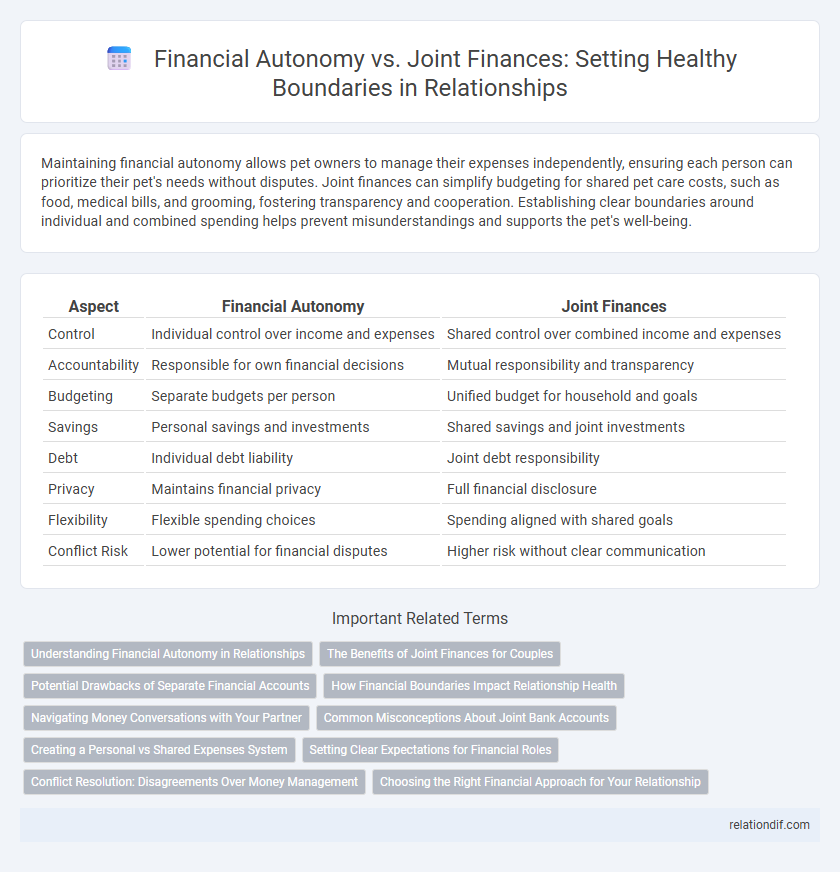

Maintaining financial autonomy allows pet owners to manage their expenses independently, ensuring each person can prioritize their pet's needs without disputes. Joint finances can simplify budgeting for shared pet care costs, such as food, medical bills, and grooming, fostering transparency and cooperation. Establishing clear boundaries around individual and combined spending helps prevent misunderstandings and supports the pet's well-being.

Table of Comparison

| Aspect | Financial Autonomy | Joint Finances |

|---|---|---|

| Control | Individual control over income and expenses | Shared control over combined income and expenses |

| Accountability | Responsible for own financial decisions | Mutual responsibility and transparency |

| Budgeting | Separate budgets per person | Unified budget for household and goals |

| Savings | Personal savings and investments | Shared savings and joint investments |

| Debt | Individual debt liability | Joint debt responsibility |

| Privacy | Maintains financial privacy | Full financial disclosure |

| Flexibility | Flexible spending choices | Spending aligned with shared goals |

| Conflict Risk | Lower potential for financial disputes | Higher risk without clear communication |

Understanding Financial Autonomy in Relationships

Financial autonomy in relationships involves maintaining individual control over personal income and expenses while fostering open communication about shared financial goals. Balancing separate finances with collaborative budgeting empowers partners to respect individual spending habits and avoid conflicts related to money management. Clear boundaries around financial decisions promote trust and prevent dependency, ensuring each person retains a sense of independence within the partnership.

The Benefits of Joint Finances for Couples

Joint finances foster transparency and trust by providing a clear overview of income, expenses, and savings between partners, reducing potential conflicts over money. Combining financial resources allows couples to plan effectively for shared goals such as buying a home, vacations, or retirement, enhancing long-term stability. Shared accounts also streamline bill payments and budgeting, making daily financial management more efficient and promoting a stronger sense of partnership.

Potential Drawbacks of Separate Financial Accounts

Separate financial accounts can create challenges such as reduced transparency, which may lead to misunderstandings or mistrust between partners. This division often hampers effective budgeting and can complicate joint financial goals, especially when expenses or financial responsibilities are unevenly distributed. Furthermore, maintaining individual accounts might result in higher overall fees or missed opportunities for better credit or investment options available through combined finances.

How Financial Boundaries Impact Relationship Health

Establishing clear financial boundaries enhances relationship health by fostering trust and preventing conflicts over money management. Couples who maintain a balance between financial autonomy and joint finances experience greater satisfaction and reduced stress, as each partner retains personal control while supporting shared goals. Transparent discussions about spending limits and financial responsibilities contribute to emotional security and long-term partnership stability.

Navigating Money Conversations with Your Partner

Establishing clear boundaries in financial autonomy versus joint finances requires open communication about budgeting, spending habits, and savings goals. Couples benefit from setting mutually agreed limits on personal and shared expenses to prevent misunderstandings and maintain trust. Transparent discussions about money management create a balanced partnership where both individuals feel respected and financially secure.

Common Misconceptions About Joint Bank Accounts

Common misconceptions about joint bank accounts include the belief that they always lead to financial loss of autonomy or inevitable conflicts. In reality, joint accounts can enhance transparency and simplify shared expenses while allowing individuals to maintain separate accounts for personal spending. Understanding the balance between financial autonomy and joint finances is crucial for healthy boundary setting in relationships.

Creating a Personal vs Shared Expenses System

Creating a clear system for managing personal versus shared expenses enhances financial autonomy while preserving partnership harmony. Designate individual accounts for personal spending and a joint account for shared costs like rent, utilities, and groceries. Consistent communication about contributions and budgeting fosters transparency and mutual respect in handling finances.

Setting Clear Expectations for Financial Roles

Setting clear expectations for financial roles is essential in maintaining boundaries within partnerships, ensuring each individual understands their responsibilities in managing personal and shared expenses. Defining specific contributions to joint accounts, budgeting processes, and decision-making authority fosters transparency and reduces conflicts related to money. Clear communication about financial autonomy and joint finances supports mutual respect and strengthens financial stability in the relationship.

Conflict Resolution: Disagreements Over Money Management

Disagreements over money management often arise when partners struggle to balance financial autonomy with joint finances, leading to conflicts rooted in differing spending habits and financial priorities. Establishing clear boundaries, such as separate accounts for personal use alongside a shared fund for joint expenses, helps mitigate misunderstandings and fosters mutual respect. Effective conflict resolution in money matters requires open communication and agreed-upon rules that honor individual autonomy while supporting collective financial goals.

Choosing the Right Financial Approach for Your Relationship

Selecting the right financial approach for your relationship involves assessing your individual preferences, financial goals, and communication styles to determine whether financial autonomy or joint finances better support your partnership. Financial autonomy allows partners to maintain control over personal spending and savings, fostering independence and reducing conflict over money. Conversely, joint finances promote transparency and shared responsibility, aligning goals and building trust through collaborative budgeting and financial planning.

financial autonomy vs joint finances Infographic

relationdif.com

relationdif.com