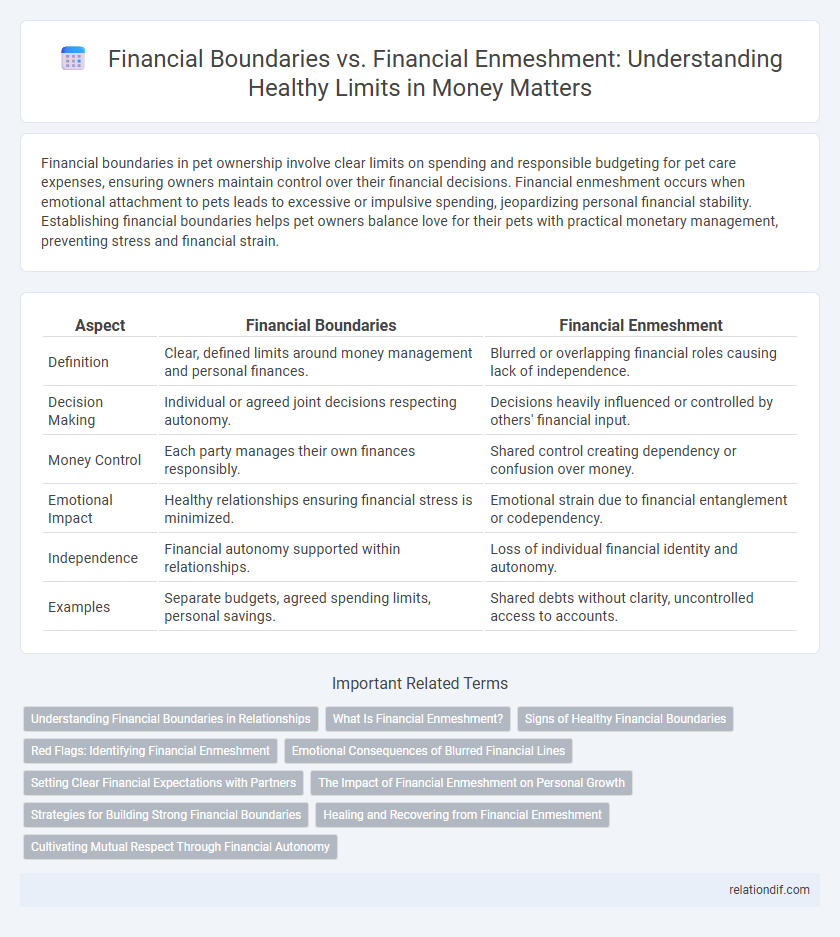

Financial boundaries in pet ownership involve clear limits on spending and responsible budgeting for pet care expenses, ensuring owners maintain control over their financial decisions. Financial enmeshment occurs when emotional attachment to pets leads to excessive or impulsive spending, jeopardizing personal financial stability. Establishing financial boundaries helps pet owners balance love for their pets with practical monetary management, preventing stress and financial strain.

Table of Comparison

| Aspect | Financial Boundaries | Financial Enmeshment |

|---|---|---|

| Definition | Clear, defined limits around money management and personal finances. | Blurred or overlapping financial roles causing lack of independence. |

| Decision Making | Individual or agreed joint decisions respecting autonomy. | Decisions heavily influenced or controlled by others' financial input. |

| Money Control | Each party manages their own finances responsibly. | Shared control creating dependency or confusion over money. |

| Emotional Impact | Healthy relationships ensuring financial stress is minimized. | Emotional strain due to financial entanglement or codependency. |

| Independence | Financial autonomy supported within relationships. | Loss of individual financial identity and autonomy. |

| Examples | Separate budgets, agreed spending limits, personal savings. | Shared debts without clarity, uncontrolled access to accounts. |

Understanding Financial Boundaries in Relationships

Understanding financial boundaries in relationships involves clearly defining individual spending limits, shared responsibilities, and transparency about income and expenses to prevent conflicts and foster trust. Financial boundaries help partners maintain autonomy and avoid financial enmeshment, where personal finances become overly intertwined, leading to stress and dependency. Establishing these boundaries promotes healthy communication and mutual respect, ensuring both parties feel secure and empowered in managing their finances together.

What Is Financial Enmeshment?

Financial enmeshment occurs when personal and financial boundaries between individuals become blurred, leading to intertwined financial responsibilities and decisions that undermine autonomy. This lack of clear separation often results in dependence, conflicts, and difficulty in managing personal finances independently. Establishing firm financial boundaries is crucial to prevent enmeshment and maintain healthy economic relationships.

Signs of Healthy Financial Boundaries

Signs of healthy financial boundaries include clear communication about spending limits, mutual respect for individual financial decisions, and consistent agreement on joint expenses without resentment. Couples or partners maintain separate accounts while transparently discussing shared financial goals, establishing trust and accountability. This balance prevents financial enmeshment, where blurred lines lead to conflict, dependency, or lack of autonomy.

Red Flags: Identifying Financial Enmeshment

Signs of financial enmeshment include unclear distinctions in money management, where partners frequently co-mingle accounts without consent or transparency. Red flags involve one party exerting control over the other's spending, leading to passive acceptance or fear of questioning financial decisions. Recognizing these patterns early helps maintain individual financial autonomy and fosters healthy monetary boundaries in relationships.

Emotional Consequences of Blurred Financial Lines

Blurred financial lines often lead to emotional consequences such as anxiety, resentment, and loss of trust within relationships. Financial enmeshment obscures individual autonomy, causing stress and conflict as partners or family members struggle to balance shared responsibilities and personal financial freedom. Establishing clear financial boundaries promotes emotional well-being by reducing uncertainty and fostering mutual respect.

Setting Clear Financial Expectations with Partners

Establishing clear financial expectations with partners prevents financial enmeshment by defining individual responsibilities and limits. Transparent communication about spending habits, savings goals, and debt management fosters mutual respect and reduces conflicts. Setting these boundaries ensures financial autonomy while promoting a balanced and healthy relationship dynamic.

The Impact of Financial Enmeshment on Personal Growth

Financial enmeshment blurs individual autonomy by intertwining personal finances with others, often leading to dependency and restricted decision-making. This lack of clear financial boundaries hampers personal growth, causing stress, reduced self-confidence, and difficulties in establishing independent financial habits. Maintaining distinct financial limits fosters self-reliance, healthier relationships, and empowers individuals to achieve their financial goals.

Strategies for Building Strong Financial Boundaries

Establishing clear financial boundaries involves setting limits on spending, sharing financial information, and defining responsibilities within relationships to prevent financial enmeshment. Effective strategies include creating individual budgets, maintaining separate accounts when appropriate, and communicating openly about monetary expectations and limits. These practices foster financial independence while protecting emotional well-being and promoting mutual respect.

Healing and Recovering from Financial Enmeshment

Healing from financial enmeshment requires establishing clear financial boundaries that promote autonomy and mutual respect. Recovering involves recognizing patterns of codependence, separating individual financial responsibilities, and cultivating transparent communication about money matters. Implementing budgeting routines and seeking professional guidance can reinforce healthier financial habits and restore personal financial empowerment.

Cultivating Mutual Respect Through Financial Autonomy

Financial boundaries foster mutual respect by allowing individuals to maintain financial autonomy, preventing dependency and imbalance in relationships. Establishing clear financial limits and transparent communication helps avoid financial enmeshment, where personal finances become overly intertwined, reducing personal accountability. Encouraging separate financial responsibilities empowers partners to support each other's independence while building trust and respect.

Financial boundaries vs financial enmeshment Infographic

relationdif.com

relationdif.com