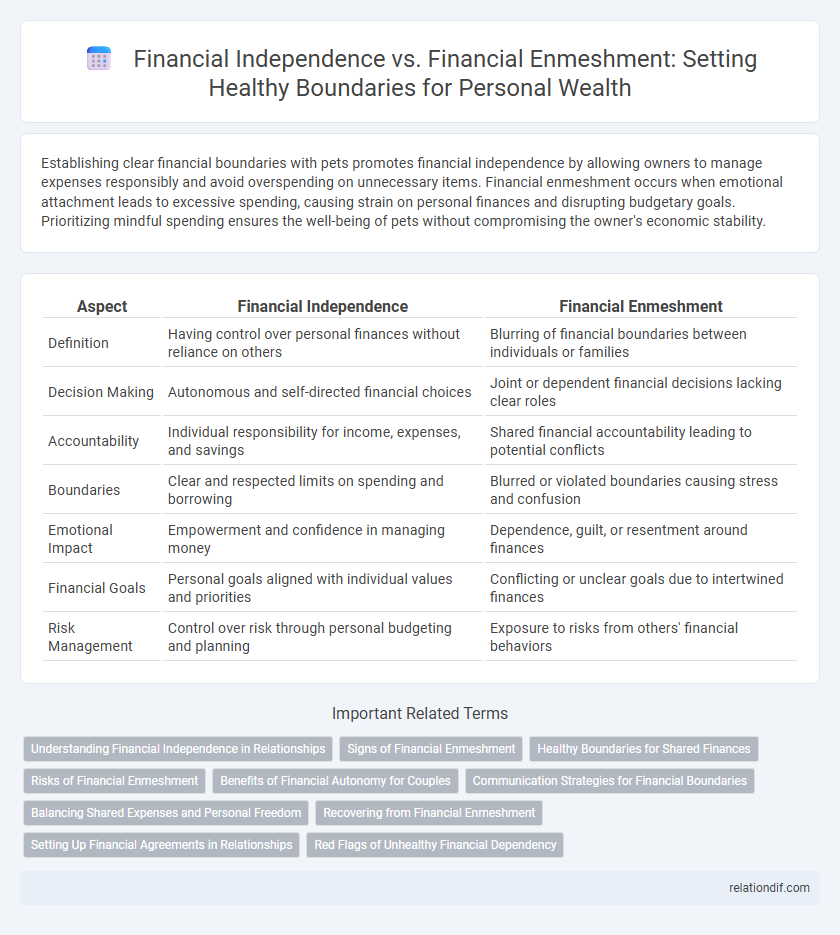

Establishing clear financial boundaries with pets promotes financial independence by allowing owners to manage expenses responsibly and avoid overspending on unnecessary items. Financial enmeshment occurs when emotional attachment leads to excessive spending, causing strain on personal finances and disrupting budgetary goals. Prioritizing mindful spending ensures the well-being of pets without compromising the owner's economic stability.

Table of Comparison

| Aspect | Financial Independence | Financial Enmeshment |

|---|---|---|

| Definition | Having control over personal finances without reliance on others | Blurring of financial boundaries between individuals or families |

| Decision Making | Autonomous and self-directed financial choices | Joint or dependent financial decisions lacking clear roles |

| Accountability | Individual responsibility for income, expenses, and savings | Shared financial accountability leading to potential conflicts |

| Boundaries | Clear and respected limits on spending and borrowing | Blurred or violated boundaries causing stress and confusion |

| Emotional Impact | Empowerment and confidence in managing money | Dependence, guilt, or resentment around finances |

| Financial Goals | Personal goals aligned with individual values and priorities | Conflicting or unclear goals due to intertwined finances |

| Risk Management | Control over risk through personal budgeting and planning | Exposure to risks from others' financial behaviors |

Understanding Financial Independence in Relationships

Financial independence in relationships involves maintaining control over personal finances while supporting joint goals, ensuring both partners contribute equitably without losing individual autonomy. Recognizing the signs of financial enmeshment helps prevent dependency, where one partner's financial decisions disproportionately affect the other's well-being. Establishing clear boundaries fosters trust and promotes balanced financial decision-making that respects each partner's economic identity.

Signs of Financial Enmeshment

Signs of financial enmeshment include a lack of clear boundaries between personal and joint finances, frequent borrowing without repayment agreements, and decision-making dominated by one partner without mutual consent. Emotional dependency on shared financial resources often leads to confusion over individual spending and saving priorities. These patterns undermine financial independence and create power imbalances that strain relationships.

Healthy Boundaries for Shared Finances

Establishing healthy boundaries in shared finances involves clear communication about individual spending limits and joint financial goals to prevent financial enmeshment. Defining separate accounts alongside shared ones allows partners to maintain financial independence while contributing fairly to household expenses. Consistent review of financial agreements supports transparency and mutual respect, fostering trust and long-term financial well-being.

Risks of Financial Enmeshment

Financial enmeshment increases the risk of blurred financial boundaries, leading to loss of autonomy and potential exploitation. Shared debts and assets can create entangled obligations, complicating personal financial goals and credit standing. This interdependence may result in emotional stress and hinder individual decision-making necessary for achieving long-term financial independence.

Benefits of Financial Autonomy for Couples

Financial autonomy in couples fosters mutual respect and reduces conflicts related to money management, promoting clearer communication and trust. By maintaining individual financial independence, partners enhance their decision-making capabilities and support personal growth, which positively impacts relationship stability. Establishing boundaries around finances also encourages transparency, accountability, and shared long-term goals, strengthening the couple's economic resilience.

Communication Strategies for Financial Boundaries

Effective communication strategies for establishing financial boundaries involve clearly articulating individual financial goals, spending limits, and expectations within relationships to prevent misunderstandings and conflicts. Utilizing regular, transparent conversations about budgets, debts, and financial responsibilities fosters mutual respect and clarity between partners or family members. Implementing structured discussions and written agreements reinforces accountability and supports sustained financial independence, reducing the risk of financial enmeshment.

Balancing Shared Expenses and Personal Freedom

Balancing shared expenses and personal freedom requires setting clear financial boundaries to prevent enmeshment and promote independence. Establishing individual budgets while agreeing on joint spending priorities ensures transparency and respect for each person's financial autonomy. Maintaining open communication about money management fosters trust and prevents conflicts in shared financial responsibilities.

Recovering from Financial Enmeshment

Recovering from financial enmeshment requires setting clear monetary boundaries to regain personal financial autonomy and prevent codependent spending habits. Establishing separate accounts and budgeting independently helps reinforce control over individual financial decisions. Gradual detachment from shared financial obligations fosters long-term financial independence and emotional well-being.

Setting Up Financial Agreements in Relationships

Setting up clear financial agreements in relationships establishes boundaries that protect individual assets and promote financial independence. Explicit agreements on budgeting, expenses, and savings reduce conflicts tied to financial enmeshment and foster trust. Well-defined financial boundaries enable partners to support each other while maintaining autonomy over personal finances.

Red Flags of Unhealthy Financial Dependency

Signs of unhealthy financial dependency include lack of transparency about income or expenses, repeated borrowing without repayment, and reluctance to discuss money matters openly. Persistent control over spending decisions or withholding financial information can indicate enmeshment rather than independence. Such red flags undermine personal autonomy and create imbalanced financial dynamics within relationships.

financial independence vs financial enmeshment Infographic

relationdif.com

relationdif.com