Establishing clear boundaries between individual finances and joint finances is essential for maintaining trust and transparency in a relationship. Couples should decide which expenses are shared and which remain personal to prevent misunderstandings and financial stress. Open communication about budgeting priorities helps ensure both partners feel respected and secure in their financial arrangements.

Table of Comparison

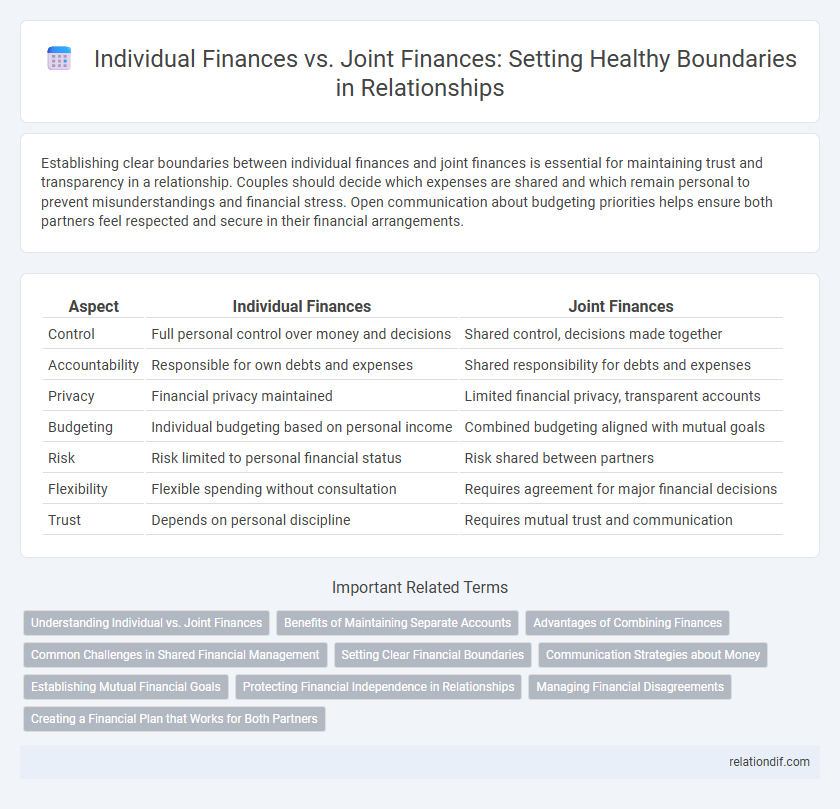

| Aspect | Individual Finances | Joint Finances |

|---|---|---|

| Control | Full personal control over money and decisions | Shared control, decisions made together |

| Accountability | Responsible for own debts and expenses | Shared responsibility for debts and expenses |

| Privacy | Financial privacy maintained | Limited financial privacy, transparent accounts |

| Budgeting | Individual budgeting based on personal income | Combined budgeting aligned with mutual goals |

| Risk | Risk limited to personal financial status | Risk shared between partners |

| Flexibility | Flexible spending without consultation | Requires agreement for major financial decisions |

| Trust | Depends on personal discipline | Requires mutual trust and communication |

Understanding Individual vs. Joint Finances

Understanding the distinction between individual and joint finances is crucial for maintaining healthy financial boundaries in relationships. Individual finances refer to assets, income, and debts managed separately by each person, while joint finances involve shared accounts, expenses, and financial goals. Clear communication and defined roles in managing both types prevent conflicts and promote transparency in financial decision-making.

Benefits of Maintaining Separate Accounts

Maintaining separate accounts allows individuals to preserve financial independence and personal budgeting control, reducing potential conflicts in money management. It provides clear boundaries that help track personal spending habits and simplify accountability, fostering transparency within the relationship. This approach also safeguards individual credit profiles and assets, offering protection in case of financial disputes or unexpected life changes.

Advantages of Combining Finances

Combining individual finances with joint accounts streamlines bill payments and budget management, enhancing transparency between partners. Shared financial resources facilitate equitable distribution of expenses and promote long-term goals such as buying a home or saving for retirement. This approach strengthens trust and collaboration by ensuring both parties have clear access to funds and financial decisions.

Common Challenges in Shared Financial Management

Managing individual finances alongside joint finances often leads to common challenges such as differing spending habits, lack of transparent communication, and conflicting financial goals. Discrepancies in budgeting priorities and unequal contributions to shared expenses frequently create tension and misunderstandings. Establishing clear boundaries and regular financial discussions can help mitigate conflicts and promote financial harmony.

Setting Clear Financial Boundaries

Setting clear financial boundaries between individual and joint finances prevents misunderstandings and promotes trust in relationships. Establish specific guidelines on money management, spending limits, and saving goals to ensure both partners maintain financial autonomy while contributing fairly to shared expenses. Transparent communication about financial priorities helps balance personal freedom with collective responsibility, reducing potential conflicts.

Communication Strategies about Money

Clear communication strategies about money involve setting specific boundaries between individual finances and joint finances to avoid misunderstandings. Couples should regularly discuss their financial goals, budgeting plans, and spending habits to establish trust and transparency. Utilizing shared financial tools while keeping some separate accounts helps maintain both autonomy and collaboration.

Establishing Mutual Financial Goals

Establishing mutual financial goals in the context of individual versus joint finances helps couples align their priorities and create a clear roadmap for saving, spending, and investing. Setting shared objectives such as purchasing a home or planning for retirement ensures transparency, reduces conflicts, and fosters cooperation in managing both personal and combined resources. Defining these goals early on promotes accountability and balances the autonomy of individual finances with the benefits of joint financial planning.

Protecting Financial Independence in Relationships

Establishing clear boundaries between individual finances and joint finances is crucial for protecting financial independence in relationships. Couples should maintain separate accounts for personal expenses while designating joint accounts for shared bills and savings, ensuring transparency and mutual respect. This approach preserves autonomy, prevents conflicts over spending habits, and promotes trust through open communication about financial goals.

Managing Financial Disagreements

Establishing clear boundaries between individual finances and joint finances helps prevent common sources of financial disputes in relationships. Couples should agree on spending limits, savings goals, and the division of financial responsibilities to minimize misunderstandings. Regular, transparent communication about budgets and expenses enhances trust and reduces the risk of conflicts over money management.

Creating a Financial Plan that Works for Both Partners

Establishing clear boundaries between individual and joint finances is essential for creating a financial plan that supports both partners' goals. Collaborative budgeting tools and transparent communication foster trust while addressing unique spending habits and saving priorities. Prioritizing shared financial goals alongside personal autonomy ensures a balanced and effective financial strategy for couples.

Individual finances vs joint finances Infographic

relationdif.com

relationdif.com