Couples with pets often face decisions about managing shared finances versus maintaining separate accounts, especially when budgeting for pet care expenses like food, vet visits, and insurance. Shared finances can simplify tracking and ensure both partners contribute fairly to the pet's needs, promoting a unified approach to responsibility. Separate accounts may offer individual financial autonomy but require clear communication to avoid misunderstandings about pet-related spending and commitments.

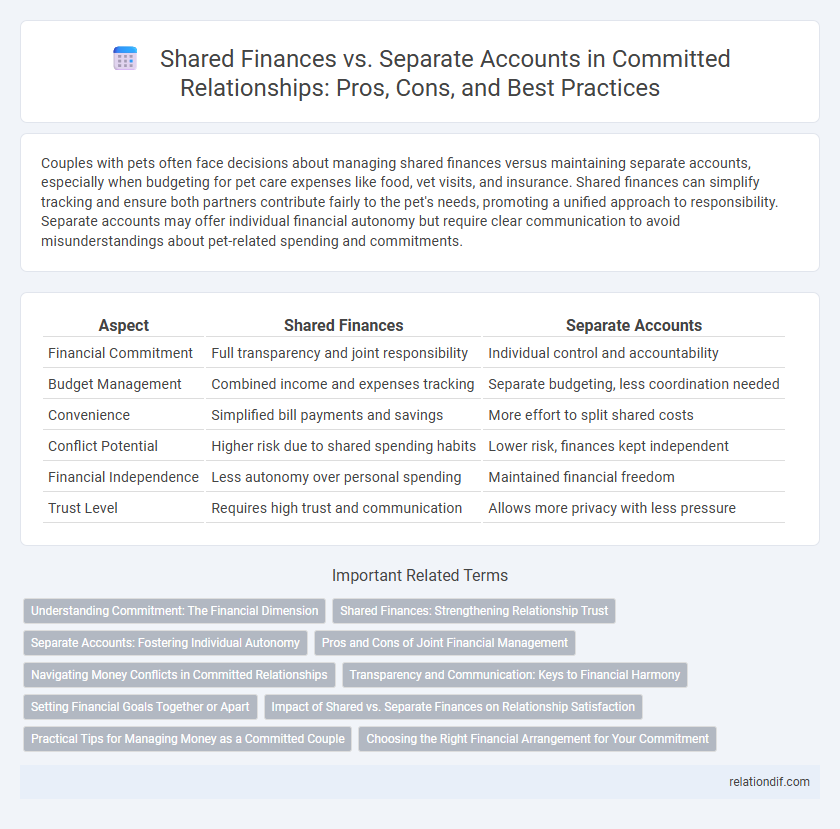

Table of Comparison

| Aspect | Shared Finances | Separate Accounts |

|---|---|---|

| Financial Commitment | Full transparency and joint responsibility | Individual control and accountability |

| Budget Management | Combined income and expenses tracking | Separate budgeting, less coordination needed |

| Convenience | Simplified bill payments and savings | More effort to split shared costs |

| Conflict Potential | Higher risk due to shared spending habits | Lower risk, finances kept independent |

| Financial Independence | Less autonomy over personal spending | Maintained financial freedom |

| Trust Level | Requires high trust and communication | Allows more privacy with less pressure |

Understanding Commitment: The Financial Dimension

Understanding commitment in relationships involves recognizing how shared finances reflect trust, communication, and long-term planning. Couples who navigate shared accounts demonstrate financial transparency and joint responsibility, reinforcing their bond through aligned goals and mutual support. Maintaining separate accounts, on the other hand, can indicate independence but requires ongoing dialogue to ensure financial harmony and commitment stability.

Shared Finances: Strengthening Relationship Trust

Shared finances foster transparency and mutual accountability, reinforcing trust between partners by aligning financial goals and responsibilities. Combining incomes into joint accounts encourages open communication about spending habits and financial priorities, reducing misunderstandings. This financial unity supports a sense of partnership and shared commitment, strengthening the emotional bond within the relationship.

Separate Accounts: Fostering Individual Autonomy

Separate accounts promote individual autonomy by allowing partners to maintain financial independence and personal control over their earnings. This approach reduces potential conflicts related to spending habits and budgeting preferences, fostering mutual respect within the commitment. By managing their own finances, each partner can pursue personal financial goals while supporting the shared objectives of the relationship.

Pros and Cons of Joint Financial Management

Joint financial management fosters transparency and ease in budgeting by consolidating incomes and expenses, which simplifies tracking shared goals like savings or debt repayment. However, it may reduce individual financial autonomy, potentially causing conflicts over spending habits and financial priorities. Clear communication and agreed-upon rules are essential to balance trust and independence within shared accounts.

Navigating Money Conflicts in Committed Relationships

Navigating money conflicts in committed relationships requires open communication about shared finances versus separate accounts to build trust and prevent misunderstandings. Couples who establish clear financial boundaries and agree on budgeting methods reduce the risk of disputes and foster financial transparency. Prioritizing mutual goals while respecting individual spending habits strengthens commitment and promotes long-term financial harmony.

Transparency and Communication: Keys to Financial Harmony

Transparency and communication are essential for maintaining financial harmony in committed relationships when managing shared finances versus separate accounts. Open discussions about income, expenses, and financial goals build trust and prevent misunderstandings. Establishing clear boundaries and regular financial check-ins promotes accountability and strengthens the partnership.

Setting Financial Goals Together or Apart

Setting financial goals together fosters transparency, strengthens trust, and aligns priorities in a committed relationship, enabling couples to build a unified path toward shared milestones like buying a home or saving for retirement. Conversely, maintaining separate accounts allows individuals to preserve financial independence, manage personal expenses discreetly, and pursue unique goals while contributing agreed-upon amounts to joint expenses. Couples should evaluate their communication styles, spending habits, and long-term objectives to determine the best approach for setting and achieving financial goals, whether collaboratively or independently.

Impact of Shared vs. Separate Finances on Relationship Satisfaction

Shared finances often enhance relationship satisfaction by fostering transparency, trust, and joint financial goals that promote emotional bonding. Couples maintaining separate accounts may experience increased autonomy but risk misunderstandings or feelings of inequality that can strain commitment. Research indicates that clear communication and agreed-upon financial management strategies are crucial for balancing individual independence with mutual financial responsibility.

Practical Tips for Managing Money as a Committed Couple

Establish clear guidelines for shared finances by setting up a joint account dedicated to common expenses such as rent, utilities, and groceries, while maintaining individual accounts for personal spending to preserve financial independence. Regularly schedule budget meetings to review income, track expenses, and adjust contributions according to changes in earnings or financial goals. Utilize budgeting apps designed for couples to enhance transparency, simplify bill payments, and foster effective communication about money management.

Choosing the Right Financial Arrangement for Your Commitment

Selecting the ideal financial arrangement hinges on aligning with your shared commitment goals and individual money management styles. Couples opting for shared finances promote transparency and unified budgeting, while maintaining separate accounts preserves financial independence and clarity. Evaluating factors such as trust, spending habits, and long-term objectives ensures a balanced approach to managing money within your commitment.

shared finances vs separate accounts Infographic

relationdif.com

relationdif.com