Financial compatibility in a pet ownership context ensures both partners agree on pet-related expenses, creating harmony in budgeting for food, veterinary care, and emergencies. Financial incompatibility often leads to conflicts due to differing priorities or spending habits related to pets' needs and wellness. Establishing clear financial expectations around pet care supports a stable and stress-free environment for both the pet and their owners.

Table of Comparison

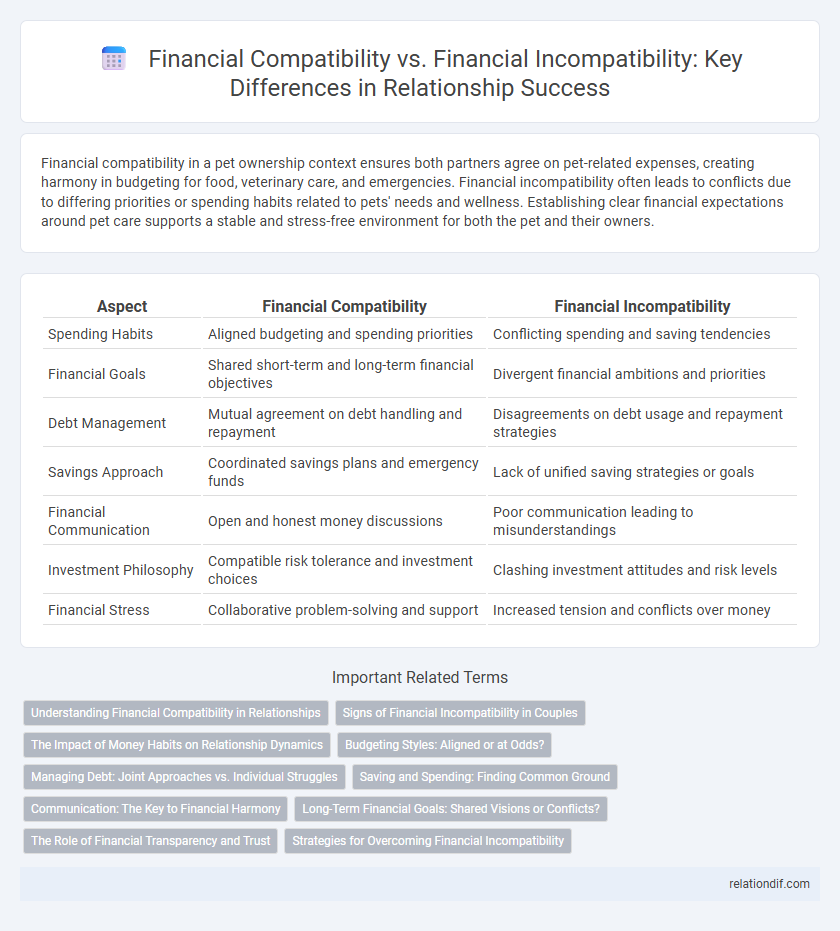

| Aspect | Financial Compatibility | Financial Incompatibility |

|---|---|---|

| Spending Habits | Aligned budgeting and spending priorities | Conflicting spending and saving tendencies |

| Financial Goals | Shared short-term and long-term financial objectives | Divergent financial ambitions and priorities |

| Debt Management | Mutual agreement on debt handling and repayment | Disagreements on debt usage and repayment strategies |

| Savings Approach | Coordinated savings plans and emergency funds | Lack of unified saving strategies or goals |

| Financial Communication | Open and honest money discussions | Poor communication leading to misunderstandings |

| Investment Philosophy | Compatible risk tolerance and investment choices | Clashing investment attitudes and risk levels |

| Financial Stress | Collaborative problem-solving and support | Increased tension and conflicts over money |

Understanding Financial Compatibility in Relationships

Financial compatibility in relationships involves aligning values, spending habits, and long-term financial goals to reduce conflicts and build trust. Couples with strong financial compatibility often experience smoother communication about budgeting, saving, and investing, fostering stability and mutual support. Misaligned financial priorities can lead to stress and disagreements, highlighting the importance of open dialogue and shared financial planning.

Signs of Financial Incompatibility in Couples

Frequent disagreements over spending habits and financial priorities often signal financial incompatibility in couples. Inability to agree on budgeting, saving, or investing strategies can create persistent tension and undermine trust. Disparate attitudes toward debt management and financial goals further highlight underlying financial incompatibility.

The Impact of Money Habits on Relationship Dynamics

Financial compatibility fosters trust and reduces conflicts by aligning spending, saving, and investing habits between partners. In contrast, financial incompatibility often leads to stress, resentment, and communication breakdowns due to mismatched priorities and money management styles. Understanding each other's financial habits and goals is crucial for maintaining harmony and long-term relationship stability.

Budgeting Styles: Aligned or at Odds?

Financial compatibility is often reflected in how partners approach budgeting, with aligned budgeting styles fostering clear communication and shared financial goals. Couples with compatible budgeting tend to set joint budgets, prioritize expenses similarly, and maintain consistent spending habits that reinforce trust and stability. Conversely, financial incompatibility emerges when conflicting budgeting methods lead to misunderstandings, stress, and divergent financial priorities that can undermine relationship harmony.

Managing Debt: Joint Approaches vs. Individual Struggles

Financial compatibility enables couples to manage debt collaboratively, ensuring transparent communication and shared responsibility for repayments, which often leads to more effective debt reduction and financial stability. In contrast, financial incompatibility frequently results in individual struggles with debt, where lack of coordination and differing financial priorities exacerbate stress and hinder progress. Joint approaches to debt management foster trust and mutual support, while incompatible strategies can create ongoing conflict and financial strain.

Saving and Spending: Finding Common Ground

Financial compatibility in relationships hinges on aligning saving and spending habits to build mutual goals and avoid conflict. Couples who agree on budgeting strategies and prioritize joint savings demonstrate stronger financial harmony and long-term stability. In contrast, financial incompatibility often arises from mismatched attitudes toward expenditure and saving, leading to tension and compromised trust.

Communication: The Key to Financial Harmony

Open and honest communication is crucial for achieving financial compatibility, allowing couples to align their budgeting goals, spending habits, and long-term financial plans effectively. Discussing income expectations, debt management, and savings priorities fosters mutual understanding and prevents misunderstandings that lead to financial incompatibility. Consistent dialogue about financial challenges and successes strengthens trust and promotes joint decision-making, ensuring a harmonious financial relationship.

Long-Term Financial Goals: Shared Visions or Conflicts?

Long-term financial goals thrive on alignment, where couples with financial compatibility share visions of savings, investments, and retirement planning, fostering mutual growth and stability. Financial incompatibility often leads to conflicts over spending habits, debt management, and risk tolerance, undermining trust and jeopardizing future security. Prioritizing transparent communication and joint financial planning can transform conflicting goals into collaborative success.

The Role of Financial Transparency and Trust

Financial compatibility hinges on open communication, where transparency in sharing income, expenses, and financial goals fosters trust and mutual understanding. Conversely, financial incompatibility often stems from secrecy or misaligned priorities, creating tension and undermining relationship stability. Establishing consistent financial transparency serves as the cornerstone for building trust, enabling couples to align their monetary values and achieve long-term harmony.

Strategies for Overcoming Financial Incompatibility

Effective strategies for overcoming financial incompatibility include open communication about money goals, creating a shared budget that respects individual spending habits, and seeking professional financial counseling to address deeper issues. Establishing joint financial priorities and regularly reviewing progress fosters mutual understanding and reduces conflict. Utilizing tools like budgeting apps or financial planning software helps maintain transparency and accountability between partners.

Financial Compatibility vs Financial Incompatibility Infographic

relationdif.com

relationdif.com