Balancing financial priorities with spending habits is crucial for pet owners to ensure the well-being of their pets without compromising personal budgets. Understanding the long-term costs of pet care, such as veterinary visits, food, and emergency expenses, helps align spending habits with financial goals. Establishing a pet care budget promotes responsible ownership and prevents unexpected financial strain.

Table of Comparison

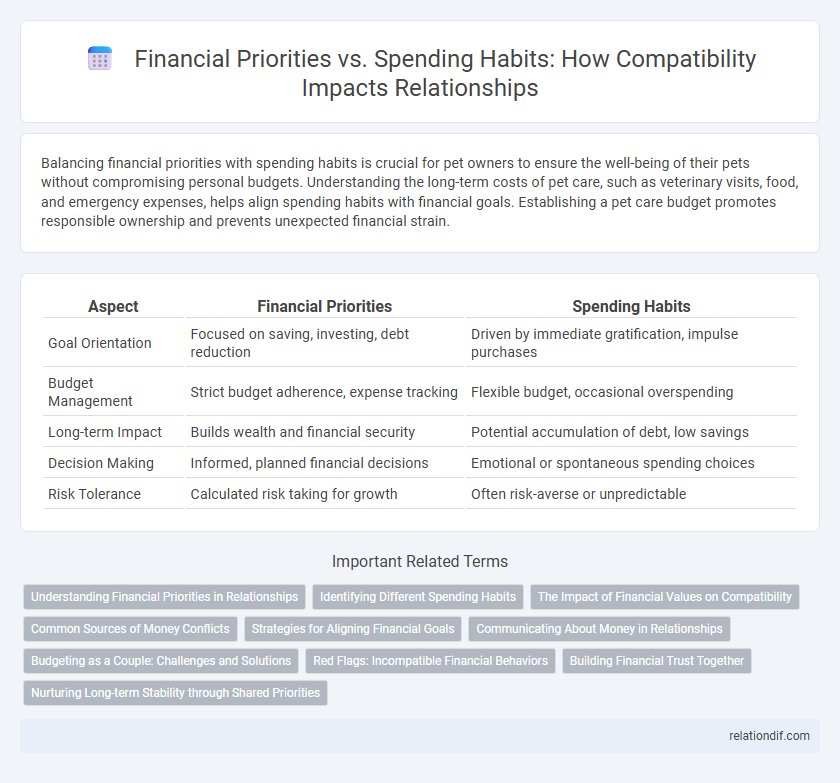

| Aspect | Financial Priorities | Spending Habits |

|---|---|---|

| Goal Orientation | Focused on saving, investing, debt reduction | Driven by immediate gratification, impulse purchases |

| Budget Management | Strict budget adherence, expense tracking | Flexible budget, occasional overspending |

| Long-term Impact | Builds wealth and financial security | Potential accumulation of debt, low savings |

| Decision Making | Informed, planned financial decisions | Emotional or spontaneous spending choices |

| Risk Tolerance | Calculated risk taking for growth | Often risk-averse or unpredictable |

Understanding Financial Priorities in Relationships

Understanding financial priorities in relationships is essential for long-term compatibility, ensuring both partners align on goals such as saving, investing, and budgeting. Clear communication about each person's spending habits and money values helps prevent conflicts and fosters mutual respect. Couples who regularly discuss financial plans tend to build stronger trust and achieve shared financial success.

Identifying Different Spending Habits

Identifying different spending habits involves analyzing patterns such as impulsive buying, budgeting discipline, and value-driven purchases. Financial priorities may clash when one partner emphasizes savings and investments while the other prefers immediate gratification through frequent discretionary spending. Understanding these divergent habits helps couples align their financial goals and foster long-term compatibility.

The Impact of Financial Values on Compatibility

Financial values significantly influence compatibility, as aligned financial priorities foster mutual understanding and reduce conflicts in relationships. Disparities in spending habits can create tension, undermining trust and long-term stability. Couples sharing similar financial goals and values tend to experience higher satisfaction and stronger emotional connections.

Common Sources of Money Conflicts

Differences in financial priorities and spending habits often lead to conflicts over discretionary versus essential expenses, with one partner favoring saving while the other prioritizes immediate gratification. Conflicts frequently arise from mismatched budgeting approaches, such as one partner tracking expenses meticulously while the other spends impulsively without consulting shared goals. Debt management and transparency about income and expenditures also serve as common flashpoints, creating tension when financial responsibilities and expectations are misaligned.

Strategies for Aligning Financial Goals

Couples can align financial goals by creating a joint budget that balances individual spending habits with shared priorities, ensuring both short-term needs and long-term plans are addressed. Regular financial check-ins foster transparency and adaptability, allowing adjustments to accommodate changing income or expenses. Setting clear, mutual goals such as saving for a home or retirement strengthens commitment and minimizes conflicts over money management.

Communicating About Money in Relationships

Open communication about financial priorities and spending habits is crucial for maintaining harmony in relationships. Couples who regularly discuss their money goals, budgets, and spending decisions build trust and prevent misunderstandings. Transparent dialogue about finances fosters mutual understanding and aligns financial behaviors with shared objectives.

Budgeting as a Couple: Challenges and Solutions

Budgeting as a couple often reveals conflicting financial priorities versus spending habits, which can lead to tension and misunderstandings. Identifying shared financial goals and establishing clear communication channels help reconcile differences and create a balanced budget. Utilizing joint budgeting tools and scheduling regular financial check-ins improve transparency and foster mutual accountability for long-term financial stability.

Red Flags: Incompatible Financial Behaviors

Incompatible financial behaviors such as chronic overspending, hidden debts, and refusal to budget often signal major red flags in compatibility. Disparities in financial priorities, like valuing savings versus impulsive purchases, can lead to chronic conflict and stress. Recognizing these divergent spending habits early helps couples address potential challenges before they escalate into long-term financial instability.

Building Financial Trust Together

Aligning financial priorities with spending habits fosters transparency and reduces conflicts, essential for building financial trust in relationships. Establishing shared goals and regularly reviewing budgets encourages accountability and mutual respect. Consistent communication about expenditures strengthens trust and supports a unified approach to financial decision-making.

Nurturing Long-term Stability through Shared Priorities

Aligning financial priorities with spending habits fosters long-term stability by promoting consistent savings and investment goals within a partnership. Establishing shared financial benchmarks enhances mutual accountability and reduces conflicts arising from impulsive expenditures. Prioritizing joint wealth building strengthens financial security and supports future planning, creating a resilient foundation for sustained economic well-being.

Financial Priorities vs Spending Habits Infographic

relationdif.com

relationdif.com