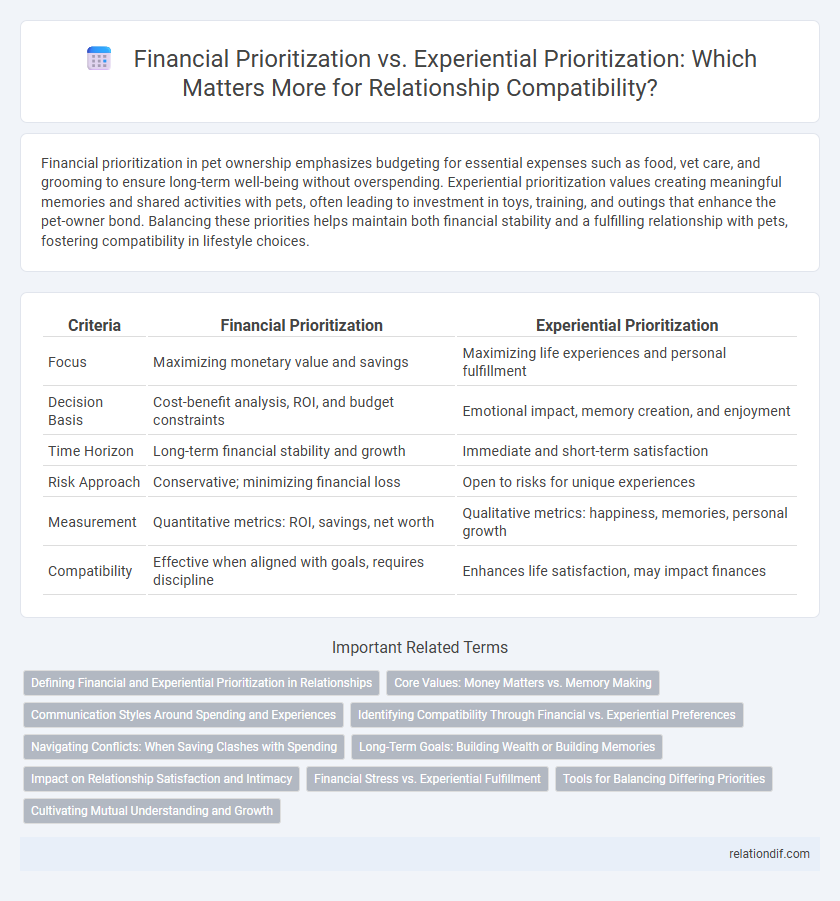

Financial prioritization in pet ownership emphasizes budgeting for essential expenses such as food, vet care, and grooming to ensure long-term well-being without overspending. Experiential prioritization values creating meaningful memories and shared activities with pets, often leading to investment in toys, training, and outings that enhance the pet-owner bond. Balancing these priorities helps maintain both financial stability and a fulfilling relationship with pets, fostering compatibility in lifestyle choices.

Table of Comparison

| Criteria | Financial Prioritization | Experiential Prioritization |

|---|---|---|

| Focus | Maximizing monetary value and savings | Maximizing life experiences and personal fulfillment |

| Decision Basis | Cost-benefit analysis, ROI, and budget constraints | Emotional impact, memory creation, and enjoyment |

| Time Horizon | Long-term financial stability and growth | Immediate and short-term satisfaction |

| Risk Approach | Conservative; minimizing financial loss | Open to risks for unique experiences |

| Measurement | Quantitative metrics: ROI, savings, net worth | Qualitative metrics: happiness, memories, personal growth |

| Compatibility | Effective when aligned with goals, requires discipline | Enhances life satisfaction, may impact finances |

Defining Financial and Experiential Prioritization in Relationships

Financial prioritization in relationships emphasizes managing budgets, savings, and future financial goals, ensuring stability and shared economic responsibilities. Experiential prioritization values shared experiences, memories, and emotional connection through activities and adventures, fostering intimacy and personal growth. Understanding these priorities helps couples align their expectations and create a balanced approach to both monetary management and emotional fulfillment.

Core Values: Money Matters vs. Memory Making

Financial prioritization emphasizes allocating resources toward stability, savings, and long-term investments, aligning closely with the core value of Money Matters. Experiential prioritization centers on creating meaningful memories through travel, events, and shared experiences, reflecting the value of Memory Making. Couples who harmonize these priorities by balancing fiscal responsibility with intentional experiences strengthen their compatibility and mutual fulfillment.

Communication Styles Around Spending and Experiences

Financial prioritization often emphasizes clear, data-driven communication styles focused on budgets, savings, and long-term goals, fostering transparency and reducing misunderstandings. Experiential prioritization encourages expressive, emotion-based communication that highlights shared moments, values, and personal fulfillment, enhancing relational connection. Aligning these communication styles around spending and experiences promotes mutual respect and compatibility in financial decision-making.

Identifying Compatibility Through Financial vs. Experiential Preferences

Compatibility assessment reveals that aligning financial priorities with experiential preferences enhances relationship satisfaction and long-term harmony. Couples who openly discuss budget constraints alongside desired experiences foster mutual understanding and reduce conflicts. Prioritizing both monetary management and shared activities creates a balanced foundation for compatibility evaluation.

Navigating Conflicts: When Saving Clashes with Spending

Balancing financial prioritization and experiential prioritization requires strategic navigation when saving goals conflict with spending desires. Effective conflict resolution involves setting clear budget boundaries that allocate funds for essential savings while allowing discretionary spending on meaningful experiences. Prioritizing transparent communication and shared financial objectives helps align individual preferences, reducing tension between long-term financial security and immediate experiential enjoyment.

Long-Term Goals: Building Wealth or Building Memories

Financial prioritization emphasizes consistent saving and investing to build long-term wealth, ensuring future financial security and opportunities for significant milestones. Experiential prioritization values creating memorable life experiences, which can enhance personal fulfillment and emotional well-being but may limit immediate wealth accumulation. Balancing these approaches requires aligning spending habits with individual long-term goals, whether focusing on asset growth or meaningful life events.

Impact on Relationship Satisfaction and Intimacy

Financial prioritization often leads to stability and security, fostering trust and reducing stress in relationships, which enhances satisfaction and intimacy. Experiential prioritization, by focusing on shared activities and memorable moments, strengthens emotional bonds and promotes deeper connection, thereby increasing relationship fulfillment. Couples balancing both financial and experiential priorities tend to experience higher overall relationship satisfaction and intimacy levels.

Financial Stress vs. Experiential Fulfillment

Financial prioritization often reduces monetary stress by ensuring bills and savings are managed effectively, creating a stable economic foundation. Experiential prioritization enhances life satisfaction through meaningful activities and memorable moments, fostering emotional well-being and personal growth. Balancing these approaches minimizes financial stress while maximizing experiential fulfillment, leading to improved overall compatibility in decision-making.

Tools for Balancing Differing Priorities

Budgeting apps equipped with customizable categories enable users to allocate funds effectively between financial goals and experiential desires. Visual planning tools like interactive calendars and spending trackers provide clarity on when to indulge in experiences without compromising savings targets. AI-driven recommendation engines suggest optimal spending adjustments by analyzing past behaviors, ensuring a balanced approach to financial and experiential priorities.

Cultivating Mutual Understanding and Growth

Financial prioritization and experiential prioritization require cultivating mutual understanding by openly discussing individual values and goals. Aligning financial goals with shared life experiences fosters growth and strengthens relationship compatibility. Balancing budget allocation for essential expenses alongside meaningful experiences promotes long-term harmony and personal development.

financial prioritization vs experiential prioritization Infographic

relationdif.com

relationdif.com