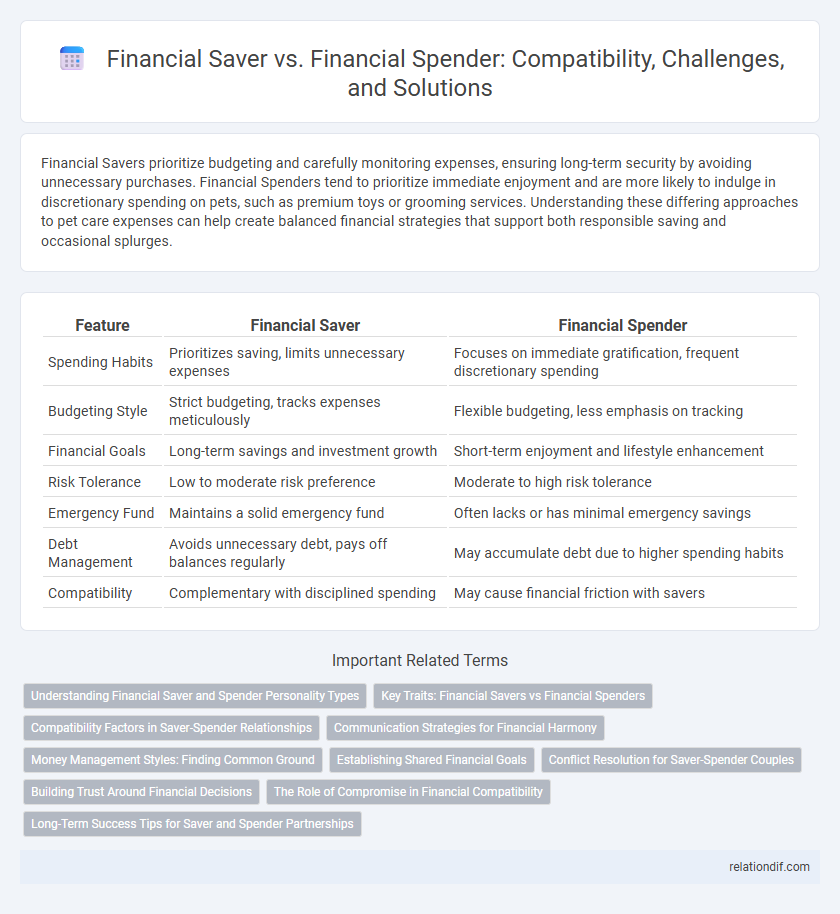

Financial Savers prioritize budgeting and carefully monitoring expenses, ensuring long-term security by avoiding unnecessary purchases. Financial Spenders tend to prioritize immediate enjoyment and are more likely to indulge in discretionary spending on pets, such as premium toys or grooming services. Understanding these differing approaches to pet care expenses can help create balanced financial strategies that support both responsible saving and occasional splurges.

Table of Comparison

| Feature | Financial Saver | Financial Spender |

|---|---|---|

| Spending Habits | Prioritizes saving, limits unnecessary expenses | Focuses on immediate gratification, frequent discretionary spending |

| Budgeting Style | Strict budgeting, tracks expenses meticulously | Flexible budgeting, less emphasis on tracking |

| Financial Goals | Long-term savings and investment growth | Short-term enjoyment and lifestyle enhancement |

| Risk Tolerance | Low to moderate risk preference | Moderate to high risk tolerance |

| Emergency Fund | Maintains a solid emergency fund | Often lacks or has minimal emergency savings |

| Debt Management | Avoids unnecessary debt, pays off balances regularly | May accumulate debt due to higher spending habits |

| Compatibility | Complementary with disciplined spending | May cause financial friction with savers |

Understanding Financial Saver and Spender Personality Types

Financial Saver personalities prioritize budgeting, long-term goals, and cautious spending to ensure financial stability, reflecting a tendency to avoid debt and build emergency funds. Financial Spenders emphasize immediate gratification, valuing experiences and purchases that enhance lifestyle, often leading to higher discretionary expenses and less focus on savings. Understanding these distinct financial behaviors helps in fostering compatibility by balancing prudent saving habits with mindful spending preferences.

Key Traits: Financial Savers vs Financial Spenders

Financial Savers prioritize budgeting, long-term goals, and risk aversion, consistently allocating funds to savings and investments. Financial Spenders emphasize immediate gratification, discretionary spending, and flexible cash flow management, often valuing experiences or luxury items over future savings. Understanding these key financial traits helps tailor compatibility strategies for managing joint finances effectively.

Compatibility Factors in Saver-Spender Relationships

Compatibility factors in saver-spender relationships include aligning financial goals, maintaining transparent communication about money habits, and respecting each other's spending values. Developing a shared budget that accommodates saving priorities while allowing discretionary spending reduces conflicts and builds trust. Mutual understanding of financial personalities enhances compromise and long-term relationship stability.

Communication Strategies for Financial Harmony

Effective communication strategies for financial harmony between a financial saver and a financial spender emphasize transparency and mutual respect. Setting clear budgeting goals and regularly discussing expenses can prevent misunderstandings and build trust. Using shared financial tools and scheduling routine money meetings ensures both parties feel heard and aligned.

Money Management Styles: Finding Common Ground

Financial savers prioritize budgeting and long-term security, carefully tracking expenses and setting aside funds for future needs. Financial spenders lean toward immediate gratification, often valuing experiences or material goods over strict saving plans. Finding common ground involves blending disciplined saving habits with occasional, mindful spending to create a balanced money management approach.

Establishing Shared Financial Goals

Financial savers and financial spenders can enhance compatibility by establishing shared financial goals that balance saving priorities with spending desires. Setting clear targets for emergency funds, debt repayment, and monthly budgets fosters mutual understanding and cooperation. Aligning these goals creates a unified approach to managing finances and prevents conflicts.

Conflict Resolution for Saver-Spender Couples

Conflict resolution for saver-spender couples involves establishing clear budgeting goals that accommodate both saving and spending priorities, fostering mutual respect for each partner's financial values. Utilizing tools such as shared expense tracking apps and scheduled financial discussions helps prevent misunderstandings and promotes transparency. Professional financial counseling can further enhance compatibility by addressing underlying attitudes toward money and improving communication strategies.

Building Trust Around Financial Decisions

Financial savers prioritize long-term stability and cautious budgeting, fostering trust through consistent, transparent money management. Financial spenders often emphasize enjoying life and immediate gratification, which can challenge trust without clear communication of spending motives. Building mutual respect requires balancing prudent saving habits with shared financial goals and open dialogue about money values.

The Role of Compromise in Financial Compatibility

Financial compatibility between a financial saver and a financial spender hinges on the ability to find balanced compromise, where budget plans integrate disciplined saving goals alongside reasonable spending allowances. Establishing mutually agreed financial priorities fosters trust and minimizes conflict, ensuring both partners feel valued in decision-making processes. Implementing transparent communication and setting joint financial objectives enhance long-term stability and harmonious money management.

Long-Term Success Tips for Saver and Spender Partnerships

Align financial goals and establish clear budgeting rules to ensure harmony between Financial Saver and Financial Spender partners. Prioritize open communication about spending habits and savings plans to build trust and avoid conflicts. Implement joint investment strategies that balance risk and security, leveraging the Saver's discipline and the Spender's optimism for long-term financial success.

Financial Saver vs Financial Spender Infographic

relationdif.com

relationdif.com