Choosing compatible pets can lead to significant financial savings by minimizing unexpected expenses such as vet visits and behavioral damage. Investing in thorough research and selecting a pet with care reduces long-term costs compared to impulsive purchases that often result in costly corrections or rehoming fees. Balanced spending on quality nutrition and preventive care ultimately protects your budget and ensures a healthy, happy pet.

Table of Comparison

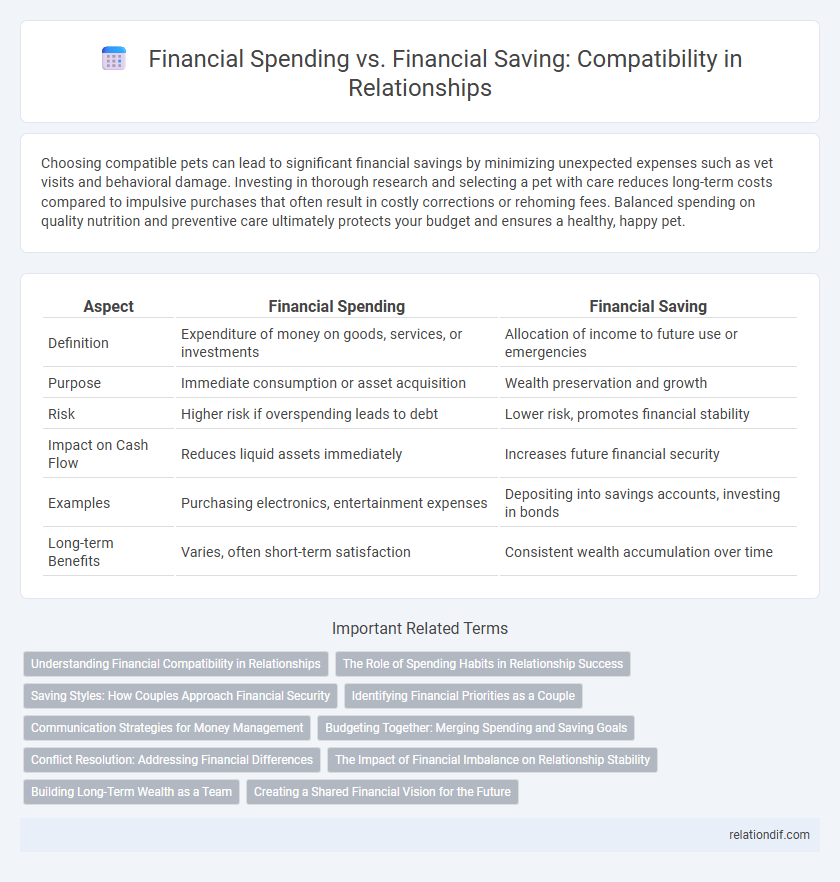

| Aspect | Financial Spending | Financial Saving |

|---|---|---|

| Definition | Expenditure of money on goods, services, or investments | Allocation of income to future use or emergencies |

| Purpose | Immediate consumption or asset acquisition | Wealth preservation and growth |

| Risk | Higher risk if overspending leads to debt | Lower risk, promotes financial stability |

| Impact on Cash Flow | Reduces liquid assets immediately | Increases future financial security |

| Examples | Purchasing electronics, entertainment expenses | Depositing into savings accounts, investing in bonds |

| Long-term Benefits | Varies, often short-term satisfaction | Consistent wealth accumulation over time |

Understanding Financial Compatibility in Relationships

Financial compatibility in relationships hinges on aligning spending and saving habits to prevent conflicts and build trust. Couples who understand each other's financial goals and priorities, such as budgeting for expenses versus prioritizing savings, tend to experience greater harmony and long-term stability. Open communication about money management styles fosters empathy and supports joint decision-making, enhancing overall relationship satisfaction.

The Role of Spending Habits in Relationship Success

Spending habits significantly impact relationship success by influencing financial compatibility and shared goals between partners. Couples who align their financial priorities and communicate openly about their spending and saving patterns tend to experience lower conflict and greater trust. Establishing a balance between responsible financial saving and mindful spending fosters mutual respect and long-term relationship stability.

Saving Styles: How Couples Approach Financial Security

Couples adopt diverse saving styles that significantly influence their approach to financial security, ranging from cautious savers prioritizing emergency funds to strategic investors focusing on long-term growth. Compatibility in saving habits often dictates overall financial harmony, as alignment in goals and risk tolerance fosters effective budget management and joint decision-making. Understanding individual saving preferences helps partners develop a tailored financial plan that balances spending desires with the imperative of building a secure future.

Identifying Financial Priorities as a Couple

Identifying financial priorities as a couple requires balancing immediate spending needs with long-term saving goals to achieve shared stability. Couples should collaboratively assess income, expenses, and future aspirations to create a budget that reflects joint values and financial objectives. Clear communication about priorities such as debt repayment, emergency fund building, and investment planning enhances compatibility and financial harmony.

Communication Strategies for Money Management

Effective communication strategies for money management enhance compatibility between financial spending and saving by fostering transparency and mutual understanding. Clear discussions about financial goals, budgeting priorities, and spending limits enable partners to align their habits and reduce conflicts. Utilizing regular check-ins and open dialogues promotes accountability and supports balanced money management decisions.

Budgeting Together: Merging Spending and Saving Goals

Balancing financial spending and saving through collaborative budgeting enhances overall money management and goal achievement. Couples who merge spending and saving goals create a unified budget that prioritizes essential expenses while allocating funds for future financial security. This approach fosters transparency, reduces financial conflicts, and optimizes resource allocation for both immediate needs and long-term savings targets.

Conflict Resolution: Addressing Financial Differences

Resolving conflicts between financial spending and saving requires open communication and mutual understanding of individual money values and goals. Establishing shared budgets and prioritizing expenses can help balance immediate needs with long-term financial security. Employing conflict resolution strategies such as compromise and empathy reduces tension and fosters cooperative financial decision-making.

The Impact of Financial Imbalance on Relationship Stability

Financial imbalance, characterized by disproportionate spending or saving habits between partners, significantly undermines relationship stability by creating ongoing tension and mistrust. Persistent disagreements over money management often lead to emotional disconnect and increased conflict, which erodes intimacy and shared goals. Addressing financial compatibility through open communication and aligned financial planning is crucial to fostering long-term relationship resilience.

Building Long-Term Wealth as a Team

Balancing financial spending and saving is essential for building long-term wealth as a team, ensuring that immediate needs are met without compromising future goals. Strategic budgeting and collaborative decision-making foster disciplined saving habits and smart investments, aligning both partners' financial priorities. Consistent communication and shared financial planning enhance compatibility, empowering couples to grow their wealth sustainably over time.

Creating a Shared Financial Vision for the Future

Aligning financial spending habits with saving goals fosters a shared vision that strengthens long-term wealth building and financial security. Prioritizing transparent communication about expenditures, budgeting, and investment strategies ensures mutual understanding and commitment toward future aspirations. Integrating both partners' values into a cohesive financial plan enhances compatibility and promotes sustainable economic well-being.

financial spending vs financial saving Infographic

relationdif.com

relationdif.com