Balancing spending habits and saving habits is crucial for pet owners to ensure long-term compatibility with their pets' needs. Prioritizing essential expenses like veterinary care and quality nutrition while setting aside funds for emergencies can prevent financial strain. Consistent saving fosters responsible pet ownership and supports overall well-being.

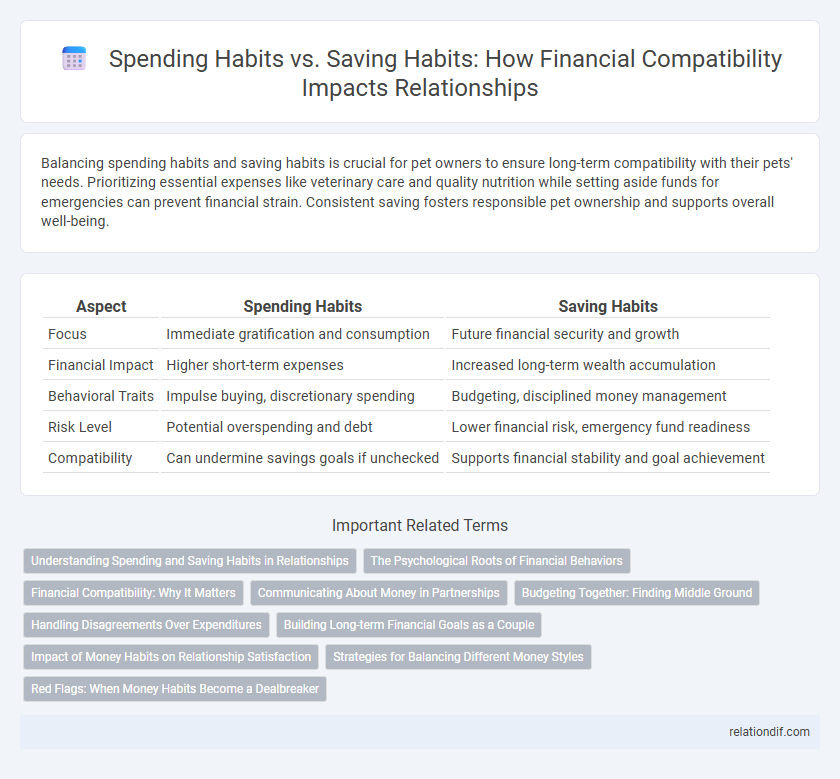

Table of Comparison

| Aspect | Spending Habits | Saving Habits |

|---|---|---|

| Focus | Immediate gratification and consumption | Future financial security and growth |

| Financial Impact | Higher short-term expenses | Increased long-term wealth accumulation |

| Behavioral Traits | Impulse buying, discretionary spending | Budgeting, disciplined money management |

| Risk Level | Potential overspending and debt | Lower financial risk, emergency fund readiness |

| Compatibility | Can undermine savings goals if unchecked | Supports financial stability and goal achievement |

Understanding Spending and Saving Habits in Relationships

Understanding spending and saving habits in relationships is vital for financial compatibility and long-term stability. Partners who openly discuss their financial goals, budget preferences, and emotional triggers behind spending or saving create a foundation of trust and mutual respect. Aligning approaches to money management reduces conflicts and supports shared growth, ensuring both individual and joint financial well-being.

The Psychological Roots of Financial Behaviors

Spending habits and saving habits stem from deep-rooted psychological factors such as personal values, upbringing, and emotional triggers. Individuals with a strong sense of financial security often exhibit more disciplined saving behaviors, while those who associate spending with reward or stress relief tend to prioritize immediate gratification. Understanding these underlying motivations is crucial for improving financial compatibility and creating balanced money management strategies.

Financial Compatibility: Why It Matters

Financial compatibility significantly influences relationship stability by aligning spending habits and saving goals, reducing conflicts and fostering mutual trust. Partners who share similar approaches to budgeting and investing build stronger foundations for long-term financial planning and wealth accumulation. Understanding each other's financial priorities ensures balanced decision-making, promoting harmony and joint success in managing money.

Communicating About Money in Partnerships

Discussing spending habits versus saving habits openly in partnerships enhances financial compatibility and fosters mutual understanding. Clear communication about individual money priorities helps establish shared goals and prevents conflicts related to budget management. Regular conversations about expenses and savings plans promote transparency and build trust within the relationship.

Budgeting Together: Finding Middle Ground

Couples who balance spending habits with saving habits create a stronger financial foundation by budgeting together and prioritizing shared goals such as emergency funds and vacation plans. Collaborative budgeting involves transparent communication about individual expenses and income, enabling compromise and mutual respect for financial boundaries. Finding middle ground helps prevent conflicts and promotes long-term financial stability by combining mindful spending with responsible saving strategies.

Handling Disagreements Over Expenditures

Spending habits and saving habits often create friction in financial compatibility, especially when partners have differing priorities. Handling disagreements over expenditures requires clear communication and establishing mutually agreed-upon budgets to balance discretionary spending with savings goals. Effective conflict resolution strategies, such as setting financial boundaries and scheduling regular money discussions, help maintain harmony and prevent resentment.

Building Long-term Financial Goals as a Couple

Spending habits and saving habits directly impact a couple's ability to build long-term financial goals, requiring clear communication and aligned priorities. Couples who balance discretionary spending with consistent saving create a foundation for investments, retirement funds, and major purchases. Establishing joint financial plans and setting measurable targets enhances compatibility and ensures mutual progress toward shared economic security.

Impact of Money Habits on Relationship Satisfaction

Differences in spending and saving habits significantly affect relationship satisfaction by influencing financial stability and emotional harmony. Couples aligned in their money management create trust and reduce conflicts, while mismatched habits often lead to stress and dissatisfaction. Understanding and respecting each partner's financial approach fosters mutual support and long-term relationship health.

Strategies for Balancing Different Money Styles

Balancing spending and saving habits requires clear communication about financial goals and priorities to ensure mutual understanding and respect. Implementing joint budgets that allocate specific amounts for discretionary spending and savings helps accommodate both money styles effectively. Regularly reviewing financial plans and adjusting contributions fosters harmony and supports shared financial stability.

Red Flags: When Money Habits Become a Dealbreaker

Spending habits that prioritize impulsive purchases over saving goals often signal underlying financial incompatibility, evidenced by recurring debt accumulation or lack of emergency funds. Red flags include persistent disagreements about budgeting, refusal to discuss financial plans, and secretive monetary behavior, which erode trust and stability in relationships. Identifying these patterns early can prevent long-term conflict and promote healthier financial compatibility between partners.

Spending habits vs saving habits Infographic

relationdif.com

relationdif.com