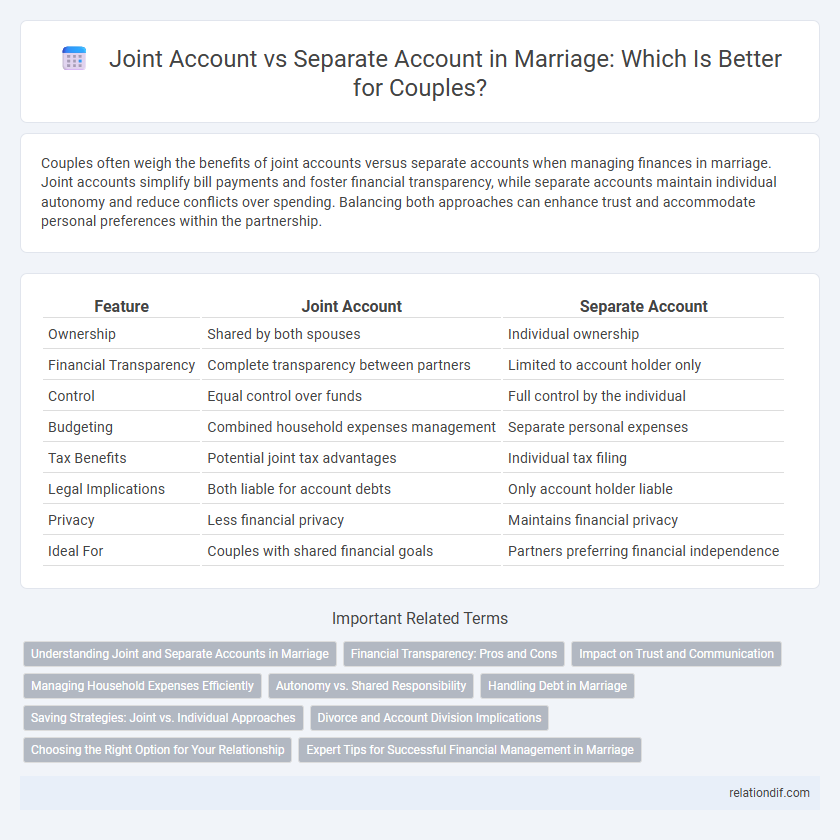

Couples often weigh the benefits of joint accounts versus separate accounts when managing finances in marriage. Joint accounts simplify bill payments and foster financial transparency, while separate accounts maintain individual autonomy and reduce conflicts over spending. Balancing both approaches can enhance trust and accommodate personal preferences within the partnership.

Table of Comparison

| Feature | Joint Account | Separate Account |

|---|---|---|

| Ownership | Shared by both spouses | Individual ownership |

| Financial Transparency | Complete transparency between partners | Limited to account holder only |

| Control | Equal control over funds | Full control by the individual |

| Budgeting | Combined household expenses management | Separate personal expenses |

| Tax Benefits | Potential joint tax advantages | Individual tax filing |

| Legal Implications | Both liable for account debts | Only account holder liable |

| Privacy | Less financial privacy | Maintains financial privacy |

| Ideal For | Couples with shared financial goals | Partners preferring financial independence |

Understanding Joint and Separate Accounts in Marriage

Couples often choose between joint accounts, which facilitate shared expenses and financial transparency, and separate accounts that maintain individual financial independence. Joint accounts simplify budgeting for household costs, while separate accounts allow partners to manage personal spending without affecting the other's finances. Understanding the benefits and drawbacks of each option helps couples tailor their financial management to their unique needs and goals.

Financial Transparency: Pros and Cons

Joint accounts in marriage enhance financial transparency by allowing both partners to track income, expenses, and savings in one place, fostering trust and communication. However, separate accounts can maintain individual privacy and prevent conflicts over spending habits while potentially reducing clarity on shared financial goals. Couples must balance transparency with independence, considering their communication style, financial habits, and long-term objectives to choose the best account structure.

Impact on Trust and Communication

Choosing a joint account often fosters greater transparency and trust in marriage by enabling shared financial oversight and open communication about spending habits. Separate accounts can maintain individual financial independence but may require deliberate efforts to discuss and align on shared expenses to prevent misunderstandings. Couples benefit from clear agreements on account management, which strengthens trust and supports ongoing dialogue about financial goals.

Managing Household Expenses Efficiently

Maintaining a joint account streamlines managing household expenses by consolidating bills, groceries, and utilities into a single, transparent financial pool, enhancing budget tracking. Couples using separate accounts can allocate personal spending while contributing fixed amounts to a shared fund, preserving individual financial autonomy yet ensuring essential costs are covered. A strategic blend of joint and separate accounts often optimizes cash flow management and reduces misunderstandings around money in marriage.

Autonomy vs. Shared Responsibility

In marriage, joint accounts promote shared responsibility by consolidating finances for household expenses and savings goals, fostering transparency and trust. Separate accounts maintain individual autonomy, allowing partners to manage personal spending and financial independence. Balancing both approaches can support mutual accountability while respecting each spouse's financial individuality.

Handling Debt in Marriage

Managing debt in marriage requires clear financial strategies, where joint accounts allow couples to share responsibility and track expenses collectively, fostering transparency and mutual support. Separate accounts provide individual control over personal debt, reducing conflicts and enabling partners to protect their credit scores independently. Couples often balance both methods to optimize financial health and address debt repayment effectively.

Saving Strategies: Joint vs. Individual Approaches

Couples often weigh joint accounts against separate accounts when developing saving strategies to maximize financial security. Joint accounts foster shared responsibility and transparency in managing household expenses, while separate accounts offer individual control and personal budgeting freedom. Combining both approaches, such as maintaining a joint account for common expenses alongside individual accounts for personal savings, can optimize financial planning and strengthen long-term wealth building.

Divorce and Account Division Implications

During divorce proceedings, joint accounts often require equitable division based on combined contributions and shared expenditures, potentially complicating asset separation. Separate accounts can simplify the financial disentanglement process by clearly delineating individual ownership, reducing disputes over fund allocation. Couples should consider legal counsel to understand jurisdiction-specific laws affecting account division and protect their financial interests.

Choosing the Right Option for Your Relationship

Couples often face the decision between a joint account and separate accounts based on trust, financial goals, and spending habits. Joint accounts promote transparency and simplify shared expenses like bills and mortgages, fostering unity in financial management. Separate accounts maintain individual autonomy and reduce conflicts over discretionary spending, making them suitable for partners valuing financial independence within a marriage.

Expert Tips for Successful Financial Management in Marriage

Experts recommend evaluating joint accounts and separate accounts based on transparency, trust, and individual spending habits to foster financial harmony in marriage. Combining resources into a joint account can simplify bill payments and savings goals, while maintaining separate accounts allows for personal financial independence and reduces conflicts. Regular communication and setting clear boundaries around money management are crucial strategies to balance shared responsibilities and individual preferences effectively.

joint account vs separate account Infographic

relationdif.com

relationdif.com