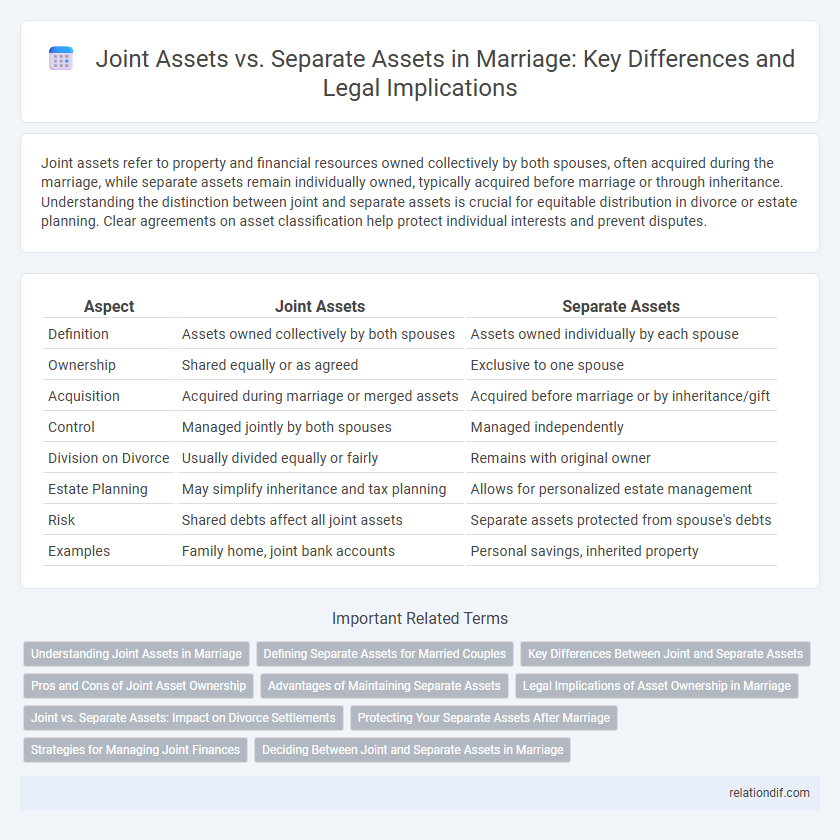

Joint assets refer to property and financial resources owned collectively by both spouses, often acquired during the marriage, while separate assets remain individually owned, typically acquired before marriage or through inheritance. Understanding the distinction between joint and separate assets is crucial for equitable distribution in divorce or estate planning. Clear agreements on asset classification help protect individual interests and prevent disputes.

Table of Comparison

| Aspect | Joint Assets | Separate Assets |

|---|---|---|

| Definition | Assets owned collectively by both spouses | Assets owned individually by each spouse |

| Ownership | Shared equally or as agreed | Exclusive to one spouse |

| Acquisition | Acquired during marriage or merged assets | Acquired before marriage or by inheritance/gift |

| Control | Managed jointly by both spouses | Managed independently |

| Division on Divorce | Usually divided equally or fairly | Remains with original owner |

| Estate Planning | May simplify inheritance and tax planning | Allows for personalized estate management |

| Risk | Shared debts affect all joint assets | Separate assets protected from spouse's debts |

| Examples | Family home, joint bank accounts | Personal savings, inherited property |

Understanding Joint Assets in Marriage

Joint assets in marriage refer to property and financial accounts acquired by either spouse during the marriage, which are legally owned together. These assets can include homes, vehicles, bank accounts, and investments, and are typically divided equally upon divorce or separation under community property or equitable distribution laws. Understanding the distinction between joint and separate assets is crucial for effective financial planning and protection of individual property rights within marriage.

Defining Separate Assets for Married Couples

Separate assets for married couples refer to property and income acquired individually before marriage, as well as gifts or inheritances received personally during the marriage. These assets remain under individual ownership and are not subject to division in case of divorce, unlike joint assets that are accumulated during the marriage. Clear documentation and legal agreements, such as prenuptial agreements, are essential to protect separate assets and define their status in marital property law.

Key Differences Between Joint and Separate Assets

Joint assets refer to property or financial resources owned collectively by both spouses, often acquired during the marriage, and typically subject to equal division in the event of divorce. Separate assets include property or finances owned individually by one spouse before marriage or received as gifts or inheritance, remaining under that spouse's sole control and not subject to division. Understanding the distinction between joint and separate assets is crucial for asset management, legal rights, and financial planning within a marriage.

Pros and Cons of Joint Asset Ownership

Joint asset ownership in marriage enables shared financial growth and simplifies estate planning by consolidating property, investments, and savings under both spouses' names. However, it presents risks such as potential disputes over asset control, exposure to each spouse's debts, and challenges in maintaining financial independence. Couples should weigh the benefits of transparency and mutual responsibility against the possibility of reduced personal financial autonomy and legal complications during divorce.

Advantages of Maintaining Separate Assets

Maintaining separate assets in marriage offers clear financial autonomy, preventing commingling of personal wealth and simplifying tax filings. It safeguards individual property rights during divorce or legal disputes, ensuring that premarital assets and inheritances remain protected. This approach facilitates tailored financial planning, allowing spouses to preserve unique investment strategies and credit profiles.

Legal Implications of Asset Ownership in Marriage

In marriage, joint assets are typically subject to equitable distribution during divorce, meaning both spouses have legal claims regardless of whose name is on the title. Separate assets, acquired before marriage or through inheritance, generally remain the sole property of the original owner unless commingled with marital property. Understanding state-specific laws is crucial, as community property states treat most assets acquired during marriage as jointly owned, while equitable distribution states assess situations case-by-case.

Joint vs. Separate Assets: Impact on Divorce Settlements

Joint assets, owned collectively by spouses, typically include property acquired during the marriage and are subject to equitable division in divorce settlements. Separate assets, held individually before marriage or obtained through inheritance or gifts, generally remain with the original owner and are excluded from division. Understanding the distinction between joint and separate assets is crucial for accurately assessing financial rights and obligations during divorce proceedings.

Protecting Your Separate Assets After Marriage

Protecting your separate assets after marriage requires clear documentation and legal safeguards such as prenuptial or postnuptial agreements to establish asset ownership boundaries. Separately acquired properties, inheritances, and individual investments must be explicitly designated to avoid unintentional commingling with joint assets. Proper asset protection strategies help prevent disputes during divorce or death, ensuring your separate assets remain distinct and secure.

Strategies for Managing Joint Finances

Establishing clear agreements on joint assets versus separate assets reduces financial conflicts and ensures transparency in marriage. Utilizing joint bank accounts for shared expenses alongside separate accounts for personal spending supports balanced financial independence. Regularly reviewing budgets and financial goals as a couple enhances cooperative management and long-term wealth building.

Deciding Between Joint and Separate Assets in Marriage

Deciding between joint and separate assets in marriage significantly impacts financial security and legal rights. Joint assets include property and income acquired during the marriage, subject to division upon divorce or death, while separate assets remain solely owned by one spouse, typically those owned before marriage or received as personal gifts or inheritance. Establishing clear agreements, such as prenuptial or postnuptial contracts, helps couples protect individual interests and manage asset ownership effectively.

joint assets vs separate assets Infographic

relationdif.com

relationdif.com