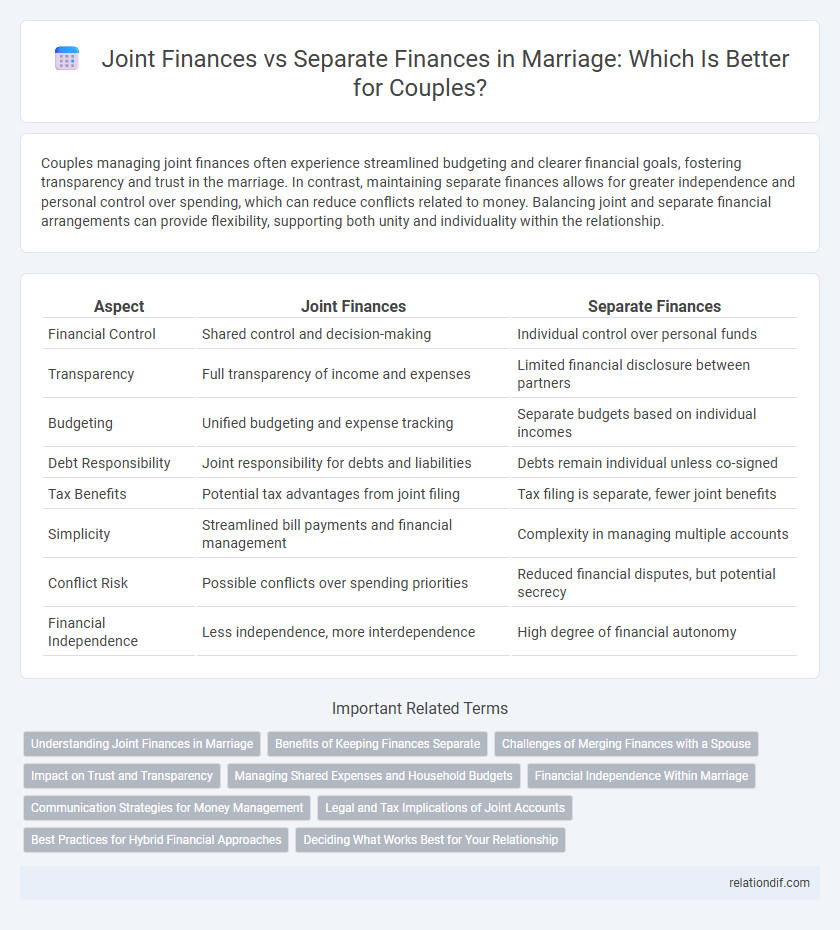

Couples managing joint finances often experience streamlined budgeting and clearer financial goals, fostering transparency and trust in the marriage. In contrast, maintaining separate finances allows for greater independence and personal control over spending, which can reduce conflicts related to money. Balancing joint and separate financial arrangements can provide flexibility, supporting both unity and individuality within the relationship.

Table of Comparison

| Aspect | Joint Finances | Separate Finances |

|---|---|---|

| Financial Control | Shared control and decision-making | Individual control over personal funds |

| Transparency | Full transparency of income and expenses | Limited financial disclosure between partners |

| Budgeting | Unified budgeting and expense tracking | Separate budgets based on individual incomes |

| Debt Responsibility | Joint responsibility for debts and liabilities | Debts remain individual unless co-signed |

| Tax Benefits | Potential tax advantages from joint filing | Tax filing is separate, fewer joint benefits |

| Simplicity | Streamlined bill payments and financial management | Complexity in managing multiple accounts |

| Conflict Risk | Possible conflicts over spending priorities | Reduced financial disputes, but potential secrecy |

| Financial Independence | Less independence, more interdependence | High degree of financial autonomy |

Understanding Joint Finances in Marriage

Understanding joint finances in marriage involves combining income, expenses, and savings into a shared account to promote transparency and simplify money management. Couples often find effective communication about budgets, debt, and financial goals crucial for preventing conflicts and fostering trust. Clear agreements on spending limits and financial responsibilities enhance cooperation and ensure long-term financial stability.

Benefits of Keeping Finances Separate

Keeping finances separate in a marriage protects individual credit scores and maintains financial independence, allowing each partner to manage personal spending habits without conflict. It simplifies accountability for debts incurred before marriage and prevents complications in case of separation or divorce. Couples who opt for separate accounts often experience less financial stress and clearer boundaries in their economic responsibilities.

Challenges of Merging Finances with a Spouse

Merging finances with a spouse often leads to challenges such as differing spending habits, conflicting financial goals, and concerns about transparency and trust. Couples may struggle to balance individual autonomy with shared responsibility, which can cause disputes over budgeting, saving, and debt management. Establishing clear communication and mutual agreements on financial priorities is essential to overcome these obstacles and achieve a harmonious financial partnership.

Impact on Trust and Transparency

Managing joint finances fosters increased trust and transparency by encouraging open communication about spending habits, financial goals, and debts, which helps prevent misunderstandings. Couples who maintain separate accounts may struggle with hidden expenditures or undisclosed debts, potentially eroding trust over time. Establishing clear financial boundaries and regularly discussing money matters strengthens mutual accountability and builds a foundation of honesty in marriage.

Managing Shared Expenses and Household Budgets

Managing shared expenses in a marriage requires establishing clear communication and agreed-upon budgeting strategies to ensure financial harmony. Couples who opt for joint finances often benefit from consolidated accounts that simplify tracking household budgets, bill payments, and savings goals. Alternatively, maintaining separate finances with a proportional contribution plan can help preserve financial independence while ensuring all shared costs are fairly covered.

Financial Independence Within Marriage

Maintaining separate finances within marriage allows each partner to preserve financial independence while contributing fairly to shared expenses. Couples who adopt joint finances often experience enhanced transparency and streamlined budgeting, but may risk losing individual control over money. Establishing clear agreements on spending, saving, and investing fosters mutual respect and balances autonomy with partnership.

Communication Strategies for Money Management

Effective communication strategies for managing joint versus separate finances in marriage include regularly scheduled financial check-ins to discuss budgets, expenses, and financial goals. Couples should establish clear agreements on shared and individual spending limits to prevent misunderstandings and promote transparency. Using tools like shared apps or spreadsheets enhances accountability and fosters open dialogue about money management priorities.

Legal and Tax Implications of Joint Accounts

Joint bank accounts in marriage carry specific legal responsibilities, as both spouses are equally liable for debts and withdrawals, potentially impacting credit scores and asset protection. From a tax perspective, joint accounts simplify the reporting of shared income and deductions but may also trigger gift tax considerations if one spouse deposits substantial funds from separate income. Couples should evaluate state laws on marital property, as community property and common law states differ significantly in how jointly held finances are treated legally and for tax benefits.

Best Practices for Hybrid Financial Approaches

Couples adopting hybrid financial approaches benefit from establishing clear agreements on shared expenses while maintaining individual accounts for personal spending to balance transparency and autonomy. Implementing joint budgeting tools alongside separate savings accounts enhances financial accountability and flexibility within the marriage. Regular financial check-ins promote trust and adaptability, ensuring both partners align their monetary goals and responsibilities effectively.

Deciding What Works Best for Your Relationship

Couples deciding between joint finances and separate finances should evaluate their communication styles, financial goals, and levels of trust to determine the most effective approach for their relationship. Joint accounts can foster transparency and simplify budget management, while maintaining separate accounts may preserve individual financial independence and reduce conflicts over spending. Prioritizing clear agreements and ongoing discussions about money helps ensure that the chosen financial structure supports both partners' needs and strengthens their partnership.

joint finances vs separate finances Infographic

relationdif.com

relationdif.com