Prenuptial agreements provide clarity and protection for both parties by outlining asset division and financial responsibilities before marriage, reducing potential conflicts during divorce. Couples without a prenup risk facing state default laws that may not align with their personal wishes, potentially leading to prolonged disputes and financial uncertainty. Choosing to create a prenup can safeguard individual interests and promote transparency, fostering trust within the marriage.

Table of Comparison

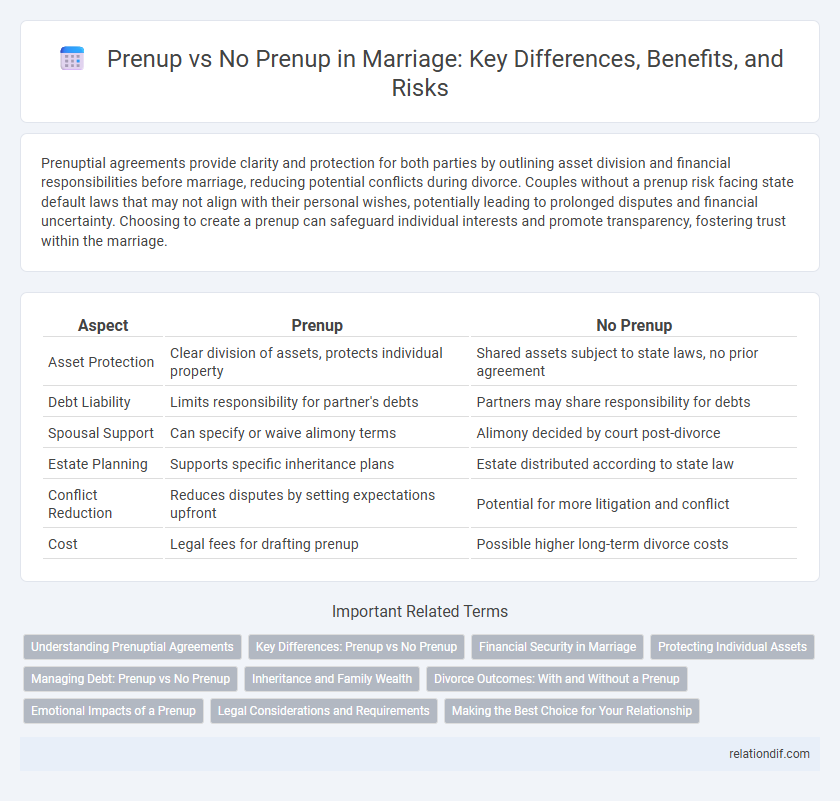

| Aspect | Prenup | No Prenup |

|---|---|---|

| Asset Protection | Clear division of assets, protects individual property | Shared assets subject to state laws, no prior agreement |

| Debt Liability | Limits responsibility for partner's debts | Partners may share responsibility for debts |

| Spousal Support | Can specify or waive alimony terms | Alimony decided by court post-divorce |

| Estate Planning | Supports specific inheritance plans | Estate distributed according to state law |

| Conflict Reduction | Reduces disputes by setting expectations upfront | Potential for more litigation and conflict |

| Cost | Legal fees for drafting prenup | Possible higher long-term divorce costs |

Understanding Prenuptial Agreements

Prenuptial agreements provide a legally binding framework that outlines asset division and financial responsibilities in the event of divorce, offering couples clarity and protection. Without a prenup, state laws typically govern asset distribution, which may not align with the couple's intentions or individual contributions during marriage. Understanding the specific terms and enforceability of a prenup is crucial for couples seeking to safeguard their financial interests and minimize future legal conflicts.

Key Differences: Prenup vs No Prenup

A prenuptial agreement clearly defines the division of assets, debt responsibilities, and spousal support terms before marriage, providing legal protection and reducing potential conflicts. Without a prenup, couples rely on state laws to govern property division and support obligations, which may not reflect personal preferences or financial arrangements. Prenups offer customized financial clarity, while no prenup scenarios often lead to default legal outcomes and increased uncertainty during divorce or separation.

Financial Security in Marriage

A prenuptial agreement provides clear guidelines for asset division, protecting individual wealth and reducing financial disputes during divorce. Without a prenup, couples may face uncertainty, increasing the risk of lengthy legal battles and financial instability. Establishing financial security through a prenup ensures transparency, safeguarding both parties' investments and future economic well-being.

Protecting Individual Assets

Protecting individual assets through a prenuptial agreement ensures clear legal boundaries and safeguards property ownership acquired before marriage. Without a prenup, state laws typically govern asset division during divorce, potentially risking personal belongings and inheritances. A prenup provides customized protection, reducing disputes and preserving financial independence for each spouse.

Managing Debt: Prenup vs No Prenup

A prenuptial agreement clearly outlines the handling of individual debts, protecting both parties from being held responsible for each other's financial obligations. Without a prenup, debts incurred by one spouse during the marriage may be considered joint liabilities, potentially affecting shared assets and credit. Managing debt through a prenup provides financial transparency and security, reducing disputes and ensuring fair responsibility in case of divorce.

Inheritance and Family Wealth

Prenuptial agreements protect family wealth by clearly defining inheritance rights and asset division, reducing the risk of disputes in marriage dissolution. Without a prenup, state laws determine inheritance and asset distribution, which may not align with individual wishes or family wealth preservation. Couples seeking to safeguard generational wealth and provide clarity for heirs often opt for a prenup to ensure financial security.

Divorce Outcomes: With and Without a Prenup

Divorce outcomes significantly differ with and without a prenup, as prenuptial agreements clearly outline asset division, reducing conflicts and legal costs during separation. Couples without prenups often face prolonged litigation and emotionally charged disputes over property, spousal support, and debt allocation. Prenups provide legal clarity, safeguarding individual financial interests and expediting divorce proceedings.

Emotional Impacts of a Prenup

Prenuptial agreements can evoke feelings of mistrust and insecurity, potentially straining emotional intimacy between partners before marriage. Couples may experience anxiety due to anticipating future conflicts or financial disagreements, which a prenup explicitly addresses. However, for some, a prenup fosters transparency and reduces stress by clearly defining financial expectations, contributing to a more secure emotional foundation.

Legal Considerations and Requirements

Prenuptial agreements provide a legally binding framework that outlines asset division, spousal support, and debt responsibilities, which can prevent lengthy disputes during divorce proceedings. Without a prenup, state laws dictate the division of property and financial obligations based on community or equitable distribution principles, which vary widely by jurisdiction. Enforceability of prenups depends on full disclosure of assets, voluntary agreement, and fairness at the time of signing, making legal counsel essential to ensure compliance with varying state-specific requirements.

Making the Best Choice for Your Relationship

Choosing whether to sign a prenuptial agreement depends on open communication and mutual trust between partners. Prenups offer financial clarity and asset protection, reducing potential conflicts in divorce or separation. Couples without prenups often rely on shared values and emotional commitment to navigate financial decisions collaboratively.

prenup vs no prenup Infographic

relationdif.com

relationdif.com