Balancing financial merging and financial autonomy is crucial in partnerships to ensure both entities benefit without compromising their core values. Financial merging can streamline resources and increase capital efficiency but may risk losing individual control and flexibility. Maintaining financial autonomy allows partners to preserve strategic independence while collaborating on shared goals, fostering innovation and resilience.

Table of Comparison

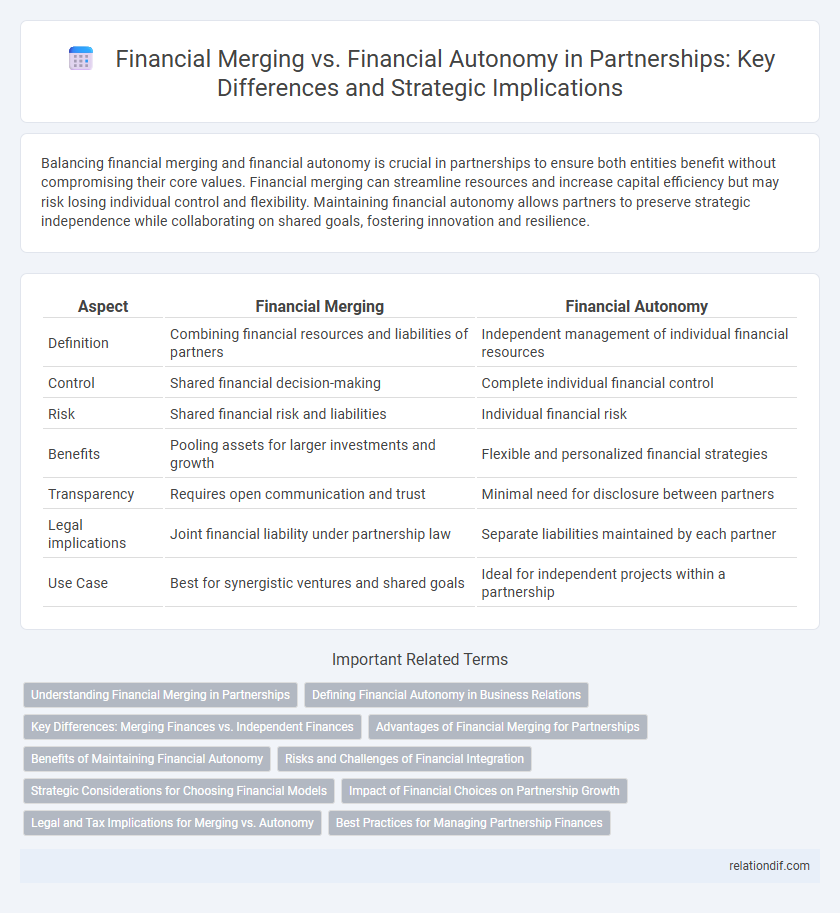

| Aspect | Financial Merging | Financial Autonomy |

|---|---|---|

| Definition | Combining financial resources and liabilities of partners | Independent management of individual financial resources |

| Control | Shared financial decision-making | Complete individual financial control |

| Risk | Shared financial risk and liabilities | Individual financial risk |

| Benefits | Pooling assets for larger investments and growth | Flexible and personalized financial strategies |

| Transparency | Requires open communication and trust | Minimal need for disclosure between partners |

| Legal implications | Joint financial liability under partnership law | Separate liabilities maintained by each partner |

| Use Case | Best for synergistic ventures and shared goals | Ideal for independent projects within a partnership |

Understanding Financial Merging in Partnerships

Financial merging in partnerships involves combining assets, liabilities, and income streams to create a unified financial structure that enhances resource allocation and risk management. This integration fosters greater transparency and streamlined decision-making, allowing partners to leverage collective capital for growth opportunities. Understanding the nuances of financial merging is crucial for optimizing tax benefits, aligning financial goals, and maintaining equitable profit distribution among stakeholders.

Defining Financial Autonomy in Business Relations

Financial autonomy in business relations refers to the ability of each partner to independently manage their financial resources, make budgeting decisions, and control expenditures without external approval. This autonomy ensures that while partnerships benefit from shared objectives, each entity retains discretion over its financial operations, promoting flexibility and accountability. Maintaining financial autonomy can prevent conflicts arising from merged financial dependencies, allowing partners to align strategically while preserving individual financial identities.

Key Differences: Merging Finances vs. Independent Finances

Financial merging combines assets, liabilities, and income streams into a shared pool, promoting transparency and joint decision-making in partnerships. Independent finances maintain separate accounts and individual control over personal expenses, allowing for autonomy and personalized budgeting strategies. Key differences include the level of trust required, complexity in managing funds, and potential impacts on tax filing and credit scores.

Advantages of Financial Merging for Partnerships

Financial merging in partnerships enhances resource allocation by consolidating capital and credit facilities, leading to increased investment capacity and operational efficiency. It simplifies financial management through unified accounting systems, reducing administrative costs and improving transparency. Shared financial responsibilities strengthen risk mitigation and foster strategic growth opportunities by leveraging combined assets and revenues.

Benefits of Maintaining Financial Autonomy

Maintaining financial autonomy in a partnership allows each entity to retain control over its budget, minimizing risks associated with shared liabilities and ensuring clearer accountability for financial decisions. This approach promotes flexibility in adapting to market changes without the constraints of joint financial obligations, supporting sustained operational efficiency. Moreover, preserving distinct financial identities enhances transparency and trust between partners, facilitating smoother conflict resolution and strategic collaboration.

Risks and Challenges of Financial Integration

Financial merging presents risks such as loss of control, cultural clashes, and complex regulatory compliance, which can lead to operational inefficiencies and increased financial liabilities. Challenges of financial integration include reconciling different accounting systems, aligning budgeting processes, and managing cash flow disruptions that may impact partner stability. In contrast, financial autonomy reduces exposure to these integration risks but can limit liquidity sharing and joint investment opportunities essential for strategic growth.

Strategic Considerations for Choosing Financial Models

Choosing between financial merging and financial autonomy hinges on strategic priorities such as resource optimization, risk management, and control over financial decisions. Financial merging facilitates unified budgeting and consolidated reporting, enhancing efficiency and attracting investors, while financial autonomy preserves independent financial governance, fostering flexibility and bespoke strategic initiatives. Evaluating factors like organizational culture, market volatility, and long-term growth objectives is crucial for selecting the optimal financial model in partnerships.

Impact of Financial Choices on Partnership Growth

Financial merging in partnerships consolidates resources, enabling larger capital investments and improved creditworthiness, which accelerates business growth and market expansion. Conversely, maintaining financial autonomy allows partners to preserve individual control, promoting flexibility and tailored risk management, but may limit access to substantial funding needed for scaling. The impact of these financial choices directly influences partnership dynamics, operational efficiency, and long-term competitive advantage.

Legal and Tax Implications for Merging vs. Autonomy

Financial merging in partnerships often triggers complex legal requirements such as consolidated tax filings and potential exposure to joint liabilities under corporate law, whereas financial autonomy allows each entity to maintain separate legal identities, limiting tax obligations and legal risks to individual partners. Merged financial structures may benefit from streamlined tax treatment but face increased scrutiny from tax authorities and regulatory compliance mandates. Maintaining financial autonomy preserves flexibility in asset management and tax planning, reducing the risk of cross-entity legal entanglements and offering each partner distinct control over fiscal responsibilities.

Best Practices for Managing Partnership Finances

Effective partnership finance management balances financial merging with maintaining financial autonomy to optimize operational efficiency and trust. Best practices include establishing clear agreements on shared expenses, transparent accounting systems, and regular financial reporting to promote accountability and align fiscal goals. Implementing joint budgeting sessions and defining individual financial responsibilities prevents conflicts and ensures sustainable collaboration.

Financial merging vs Financial autonomy Infographic

relationdif.com

relationdif.com