Financial merging in a partnership involves combining resources and liabilities to achieve shared economic goals, fostering collective growth and risk-sharing. Financial independence emphasizes maintaining separate accounts and individual control over finances, allowing partners to preserve personal financial autonomy and responsibility. Balancing these approaches ensures mutual trust while respecting each partner's unique financial priorities.

Table of Comparison

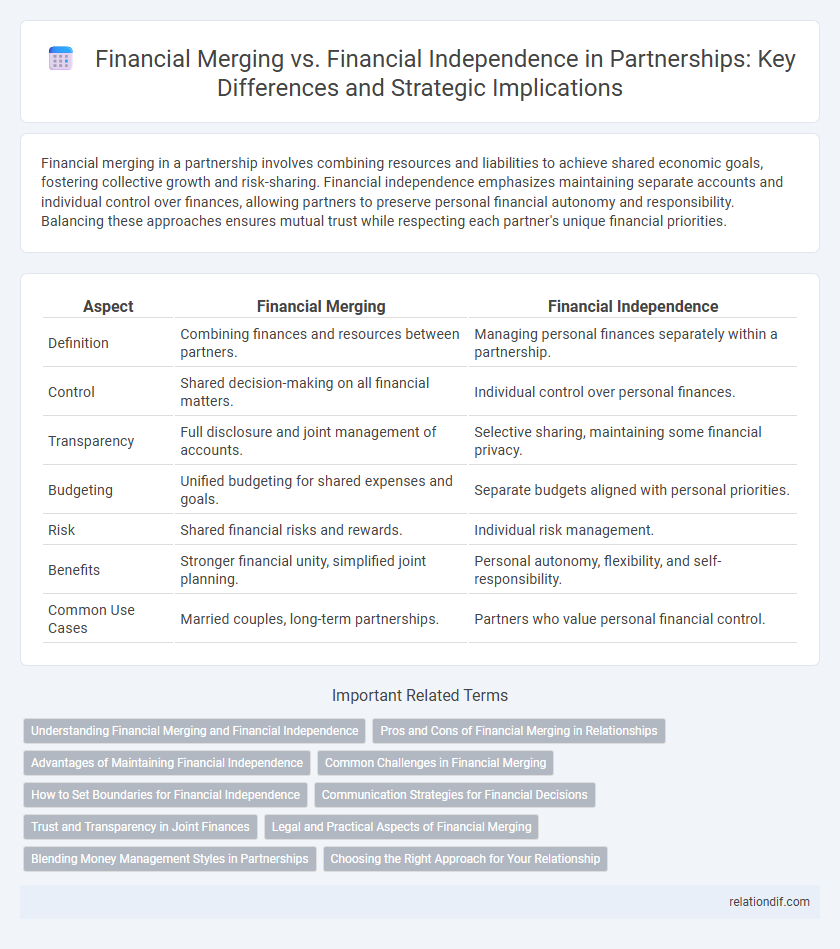

| Aspect | Financial Merging | Financial Independence |

|---|---|---|

| Definition | Combining finances and resources between partners. | Managing personal finances separately within a partnership. |

| Control | Shared decision-making on all financial matters. | Individual control over personal finances. |

| Transparency | Full disclosure and joint management of accounts. | Selective sharing, maintaining some financial privacy. |

| Budgeting | Unified budgeting for shared expenses and goals. | Separate budgets aligned with personal priorities. |

| Risk | Shared financial risks and rewards. | Individual risk management. |

| Benefits | Stronger financial unity, simplified joint planning. | Personal autonomy, flexibility, and self-responsibility. |

| Common Use Cases | Married couples, long-term partnerships. | Partners who value personal financial control. |

Understanding Financial Merging and Financial Independence

Financial merging involves combining assets, liabilities, and financial goals within a partnership to create a unified economic strategy that supports shared growth. Financial independence emphasizes maintaining separate financial identities and autonomy, allowing partners to manage personal finances individually while contributing to joint expenses as agreed. Understanding these approaches helps partners balance collaboration and individuality to build trust and avoid conflicts in their financial relationship.

Pros and Cons of Financial Merging in Relationships

Financial merging in relationships consolidates income, expenses, and financial goals, fostering transparency and teamwork while simplifying budgeting and saving for common objectives. However, it may reduce individual financial autonomy, create tensions over spending habits, and complicate personal boundaries regarding money. Couples should weigh the benefits of shared financial growth against the potential challenges of loss of independence and conflicts over money management.

Advantages of Maintaining Financial Independence

Maintaining financial independence in a partnership preserves individual credit scores and personal credit access, reducing financial risk if one partner faces debt or insolvency. It fosters clear personal accountability, enhances decision-making autonomy, and minimizes conflicts over spending habits or financial priorities. Financial independence also allows each partner to build separate savings, investments, and retirement accounts, ensuring security and flexibility independent of the partnership's overall financial health.

Common Challenges in Financial Merging

Common challenges in financial merging include aligning differing spending habits, consolidating debts, and establishing shared financial goals. Conflicts often arise from inconsistent budgeting practices and varying attitudes towards saving and investing. Effective communication and transparent financial planning are essential to navigate these hurdles and achieve a successful financial merger.

How to Set Boundaries for Financial Independence

Establishing clear financial boundaries in a partnership involves creating separate accounts for personal expenses while maintaining a joint account for shared responsibilities, ensuring transparency and mutual respect. Setting limits on shared spending and agreeing on individual financial goals promote independence, reducing potential conflicts over money. Regular discussions about budgets and long-term financial plans reinforce trust and help maintain balance between merged finances and personal fiscal autonomy.

Communication Strategies for Financial Decisions

Effective communication strategies for financial decisions in partnerships require transparent discussions about potential financial merging or maintaining financial independence. Clearly defining shared financial goals, responsibilities, and boundaries helps prevent misunderstandings and aligns expectations. Regular financial check-ins and open dialogue enable partners to adapt decisions collaboratively while respecting individual financial autonomy.

Trust and Transparency in Joint Finances

Trust and transparency form the foundation of successful financial merging in partnerships, enabling clear communication and mutual accountability. Joint finances require open disclosure of income, expenses, and debts to prevent misunderstandings and build confidence between partners. Financial independence can coexist with shared goals when partners agree on boundaries and maintain honest dialogue about money management.

Legal and Practical Aspects of Financial Merging

Financial merging in partnerships involves combining assets, liabilities, and financial responsibilities, creating shared legal obligations that require clear contractual agreements to define ownership and debt liabilities. Practically, this consolidation enhances capital access and risk-sharing but demands rigorous financial transparency and joint decision-making mechanisms. Legal frameworks often mandate compliance with fiduciary duties and tax regulations to prevent disputes and ensure equitable management of merged finances.

Blending Money Management Styles in Partnerships

Blending money management styles in partnerships requires balancing financial merging and financial independence to ensure mutual respect and shared goals. Successful partnerships integrate joint budgeting with personal spending autonomy, fostering transparency and trust. Establishing clear communication around financial boundaries and combined assets prevents conflicts and strengthens fiscal harmony.

Choosing the Right Approach for Your Relationship

Choosing between financial merging and financial independence in a partnership depends on trust levels, communication, and long-term goals. Couples who merge finances often experience streamlined budgeting and joint wealth building, while maintaining separate accounts can preserve autonomy and reduce conflict. Evaluating lifestyle preferences, risk tolerance, and financial habits ensures the selected approach supports relationship harmony and financial security.

Financial Merging vs Financial Independence Infographic

relationdif.com

relationdif.com