Managing joint finances can enhance transparency and simplify budgeting between partners, fostering trust and shared financial goals. Maintaining separate accounts allows individuals to preserve financial independence and personal spending freedom while still contributing to shared expenses. Balancing joint and separate accounts requires clear communication and agreed-upon strategies to ensure both partnership unity and individual financial autonomy.

Table of Comparison

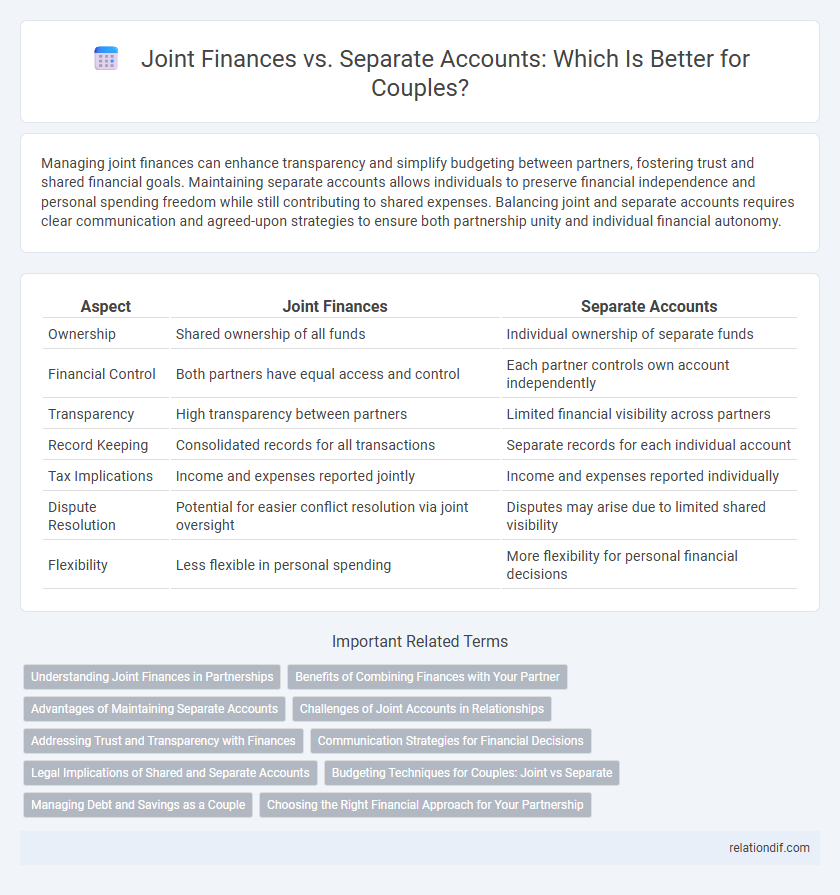

| Aspect | Joint Finances | Separate Accounts |

|---|---|---|

| Ownership | Shared ownership of all funds | Individual ownership of separate funds |

| Financial Control | Both partners have equal access and control | Each partner controls own account independently |

| Transparency | High transparency between partners | Limited financial visibility across partners |

| Record Keeping | Consolidated records for all transactions | Separate records for each individual account |

| Tax Implications | Income and expenses reported jointly | Income and expenses reported individually |

| Dispute Resolution | Potential for easier conflict resolution via joint oversight | Disputes may arise due to limited shared visibility |

| Flexibility | Less flexible in personal spending | More flexibility for personal financial decisions |

Understanding Joint Finances in Partnerships

Understanding joint finances in partnerships involves combining income, expenses, and assets into a shared account to streamline financial management and enhance transparency. This approach facilitates equal responsibility for bills, investments, and savings goals, promoting trust and collaboration between partners. Clear agreements on contributions, withdrawals, and financial decision-making are essential to prevent conflicts and ensure mutual benefit.

Benefits of Combining Finances with Your Partner

Combining finances with your partner enhances transparency and builds trust by allowing both individuals to track income, expenses, and savings collectively. Shared accounts simplify budgeting and financial planning, making it easier to set common goals like purchasing a home or saving for retirement. This financial unity can reduce conflicts by aligning spending habits and fostering a collaborative approach to managing money.

Advantages of Maintaining Separate Accounts

Maintaining separate accounts in a partnership allows each partner to retain individual financial autonomy and simplifies the tracking of personal expenses versus business-related costs. This approach minimizes the risk of disputes over fund usage and provides clear, transparent records for tax purposes and financial accountability. Separate accounts also facilitate easier exit or entry of partners by clearly delineating individual contributions and liabilities.

Challenges of Joint Accounts in Relationships

Joint accounts in partnerships often lead to challenges such as disagreements over spending habits, lack of financial privacy, and difficulty in tracking individual contributions. Conflicts can arise when one partner feels the other mismanages shared funds or makes unilateral purchases without consultation. Maintaining transparent communication and clear financial boundaries is crucial to prevent mistrust and ensure equitable money management.

Addressing Trust and Transparency with Finances

Maintaining either joint finances or separate accounts in a partnership requires clear communication to foster trust and transparency. Joint accounts promote openness by allowing both partners full access to funds and spending habits, reducing financial misunderstandings. Separate accounts can work effectively when combined with regular financial check-ins and honest disclosure, ensuring mutual confidence in financial management.

Communication Strategies for Financial Decisions

Effective communication in partnerships regarding joint finances and separate accounts enhances transparency and trust, ensuring all parties understand financial obligations and goals. Regular financial meetings and clear documentation of decisions help prevent misunderstandings and facilitate collaborative budgeting. Open dialogue about spending habits and financial priorities supports balanced decision-making and long-term fiscal stability.

Legal Implications of Shared and Separate Accounts

Shared accounts in partnerships legally establish joint ownership of funds, making all partners equally liable for withdrawals and debts, which can complicate asset protection and creditor claims. Separate accounts maintain individual financial autonomy, limiting liability exposure but requiring clear agreements to define contribution, profit distribution, and expense management to prevent disputes. Legal frameworks may dictate the transparency and reporting standards for both account types to ensure compliance with partnership agreements and regulatory obligations.

Budgeting Techniques for Couples: Joint vs Separate

Couples managing joint finances often use combined budgeting techniques like zero-based budgeting or the 50/30/20 rule to optimize transparency and shared goals. Separate accounts allow partners to maintain financial independence while contributing agreed amounts to joint expenses, fostering personal accountability alongside cooperation. Hybrid budgeting methods, which blend joint and separate accounts, help balance collective financial planning with individual spending preferences.

Managing Debt and Savings as a Couple

Managing debt and savings as a couple requires clear communication about financial goals and responsibilities when choosing between joint finances and separate accounts. Joint finances promote transparency and shared accountability for debt repayment and savings growth, while separate accounts allow individual control but need coordinated planning to avoid overlapping debt or missed savings opportunities. Couples should evaluate their financial habits, trust levels, and long-term objectives to determine the optimal balance between combined resources and personal financial autonomy.

Choosing the Right Financial Approach for Your Partnership

Choosing the right financial approach for your partnership depends on trust levels, financial goals, and operational transparency between partners. Joint finances promote unified budgeting and simplified tax filing, while separate accounts maintain individual control and can help in preserving financial independence. Evaluating factors such as cash flow management, liability risks, and ease of accounting will guide you to a structured financial strategy that supports partnership success.

Joint Finances vs Separate Accounts Infographic

relationdif.com

relationdif.com