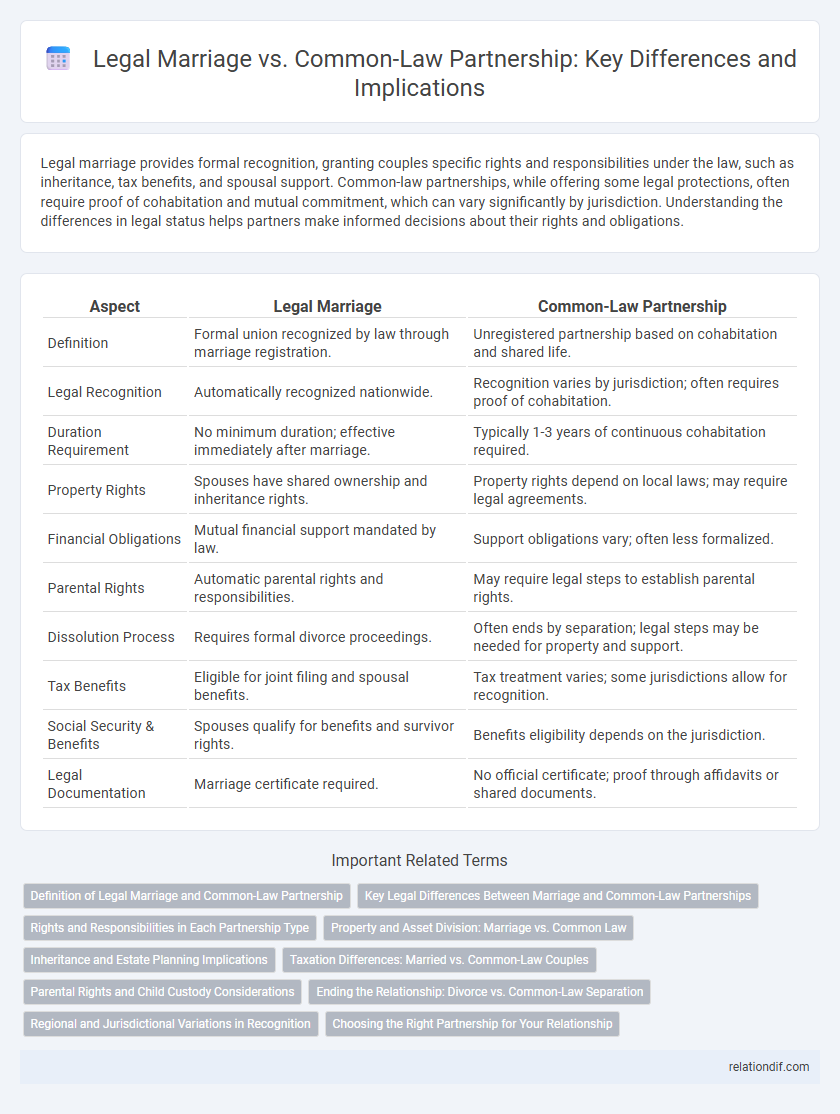

Legal marriage provides formal recognition, granting couples specific rights and responsibilities under the law, such as inheritance, tax benefits, and spousal support. Common-law partnerships, while offering some legal protections, often require proof of cohabitation and mutual commitment, which can vary significantly by jurisdiction. Understanding the differences in legal status helps partners make informed decisions about their rights and obligations.

Table of Comparison

| Aspect | Legal Marriage | Common-Law Partnership |

|---|---|---|

| Definition | Formal union recognized by law through marriage registration. | Unregistered partnership based on cohabitation and shared life. |

| Legal Recognition | Automatically recognized nationwide. | Recognition varies by jurisdiction; often requires proof of cohabitation. |

| Duration Requirement | No minimum duration; effective immediately after marriage. | Typically 1-3 years of continuous cohabitation required. |

| Property Rights | Spouses have shared ownership and inheritance rights. | Property rights depend on local laws; may require legal agreements. |

| Financial Obligations | Mutual financial support mandated by law. | Support obligations vary; often less formalized. |

| Parental Rights | Automatic parental rights and responsibilities. | May require legal steps to establish parental rights. |

| Dissolution Process | Requires formal divorce proceedings. | Often ends by separation; legal steps may be needed for property and support. |

| Tax Benefits | Eligible for joint filing and spousal benefits. | Tax treatment varies; some jurisdictions allow for recognition. |

| Social Security & Benefits | Spouses qualify for benefits and survivor rights. | Benefits eligibility depends on the jurisdiction. |

| Legal Documentation | Marriage certificate required. | No official certificate; proof through affidavits or shared documents. |

Definition of Legal Marriage and Common-Law Partnership

Legal marriage is a formally recognized union between two individuals established through a governmental or religious ceremony, complete with a marriage license and official registration. Common-law partnership is defined by cohabitation and presenting as a couple without a formal marriage license, recognized differently depending on jurisdictional laws. Legal marriage grants specific rights and obligations automatically, whereas common-law partnerships often require proof of shared life and financial interdependence for legal recognition.

Key Legal Differences Between Marriage and Common-Law Partnerships

Legal marriage involves a formal, government-recognized contract requiring a marriage license and official ceremony, establishing spousal rights such as inheritance, tax benefits, and decision-making authority. Common-law partnerships, by contrast, are based on cohabitation for a specified period without formal registration, granting limited legal recognition and fewer automatic rights concerning property division and spousal support. The key differences impact legal protections, financial obligations, and eligibility for benefits, making the distinction critical for couples considering their long-term commitment options.

Rights and Responsibilities in Each Partnership Type

Legal marriage grants spouses comprehensive rights and responsibilities, including joint property ownership, spousal support, inheritance rights, and decision-making authority in medical emergencies. Common-law partnerships often provide limited legal recognition, with rights varying significantly by jurisdiction, typically requiring proof of cohabitation and shared finances to access benefits such as property division or spousal support. Understanding these distinctions is essential for partners to ensure proper legal protection and fulfill their obligations within each partnership type.

Property and Asset Division: Marriage vs. Common Law

Legal marriage typically involves automatic spousal rights to property and asset division upon separation or divorce, governed by statutory laws that ensure equitable distribution based on contributions and needs. Common-law partnerships often require proof of cohabitation duration and financial interdependence to establish property claims, with asset division varying significantly by jurisdiction and often lacking automatic spousal entitlements. Understanding the distinctions in legal protections and property division is crucial for partners to safeguard their financial interests in both marriage and common-law arrangements.

Inheritance and Estate Planning Implications

Legal marriage provides automatic inheritance rights and clearer estate planning directives, ensuring a surviving spouse is recognized under the law without requiring a will. Common-law partners often need explicit legal documentation, such as a will or cohabitation agreement, to secure inheritance rights and avoid disputes. Estate planning for common-law partnerships demands more proactive measures to guarantee asset distribution aligns with the partner's intentions.

Taxation Differences: Married vs. Common-Law Couples

Married couples and common-law partners face distinct taxation rules in Canada, impacting income splitting, spousal tax credits, and pension benefits. Common-law partners must meet specific cohabitation criteria, typically living together for at least 12 consecutive months, to access similar tax benefits as married spouses. Differences in the treatment of capital gains and spousal support payments also affect the tax obligations and benefits for each partnership type.

Parental Rights and Child Custody Considerations

Legal marriage provides clear parental rights and responsibilities recognized by law, offering automatic custody and decision-making authority for children born within the marriage. Common-law partnerships may require proof of cohabitation and intent to parent for parents to obtain similar rights, often necessitating legal agreements or court intervention to establish custody. Understanding these distinctions is crucial for protecting parental rights and ensuring child welfare in both marital and non-marital family structures.

Ending the Relationship: Divorce vs. Common-Law Separation

Legal marriage dissolution requires formal divorce proceedings through the court system, involving division of assets, custody arrangements, and potential alimony. Common-law separation lacks mandatory legal processes, often relying on mutual agreement to settle finances and child custody without a formal divorce. Understanding jurisdiction-specific regulations is crucial for correctly ending either type of partnership.

Regional and Jurisdictional Variations in Recognition

Legal marriage enjoys uniform recognition with standardized registration and rights across most jurisdictions, while common-law partnerships face significant regional variations in status and legal protections. In provinces like Ontario and British Columbia, common-law couples obtain certain spousal rights after cohabiting for a specified period, whereas in others, such as Quebec, common-law relationships lack equivalent legal recognition. These jurisdictional differences impact matters such as property division, inheritance rights, and access to spousal benefits, underscoring the importance of understanding local laws when considering partnership status.

Choosing the Right Partnership for Your Relationship

Legal marriage offers a formal, legally recognized union with extensive spousal rights, including property division, inheritance, and tax benefits, whereas common-law partnerships provide similar protections but often require proof of cohabitation and duration. Selecting the appropriate partnership depends on personal values, legal security, and financial implications tailored to your relationship goals. Understanding jurisdiction-specific laws ensures informed decisions about rights, responsibilities, and long-term commitments in both marriage and common-law arrangements.

Legal Marriage vs Common-Law Partnership Infographic

relationdif.com

relationdif.com