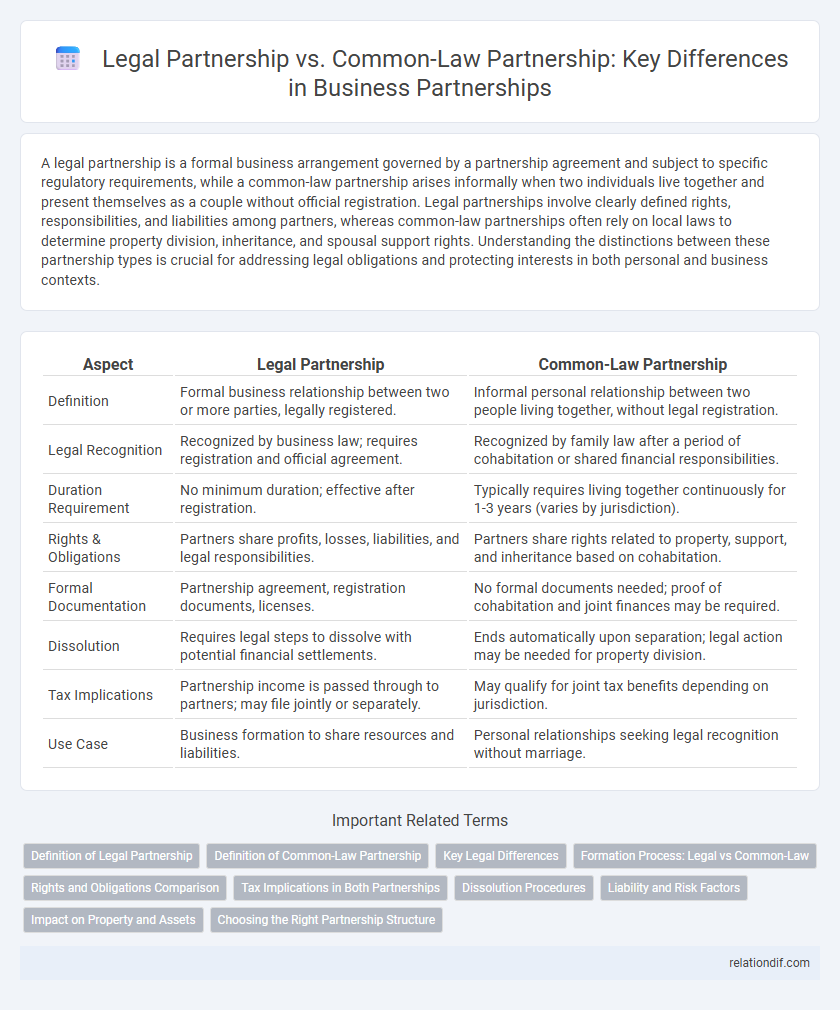

A legal partnership is a formal business arrangement governed by a partnership agreement and subject to specific regulatory requirements, while a common-law partnership arises informally when two individuals live together and present themselves as a couple without official registration. Legal partnerships involve clearly defined rights, responsibilities, and liabilities among partners, whereas common-law partnerships often rely on local laws to determine property division, inheritance, and spousal support rights. Understanding the distinctions between these partnership types is crucial for addressing legal obligations and protecting interests in both personal and business contexts.

Table of Comparison

| Aspect | Legal Partnership | Common-Law Partnership |

|---|---|---|

| Definition | Formal business relationship between two or more parties, legally registered. | Informal personal relationship between two people living together, without legal registration. |

| Legal Recognition | Recognized by business law; requires registration and official agreement. | Recognized by family law after a period of cohabitation or shared financial responsibilities. |

| Duration Requirement | No minimum duration; effective after registration. | Typically requires living together continuously for 1-3 years (varies by jurisdiction). |

| Rights & Obligations | Partners share profits, losses, liabilities, and legal responsibilities. | Partners share rights related to property, support, and inheritance based on cohabitation. |

| Formal Documentation | Partnership agreement, registration documents, licenses. | No formal documents needed; proof of cohabitation and joint finances may be required. |

| Dissolution | Requires legal steps to dissolve with potential financial settlements. | Ends automatically upon separation; legal action may be needed for property division. |

| Tax Implications | Partnership income is passed through to partners; may file jointly or separately. | May qualify for joint tax benefits depending on jurisdiction. |

| Use Case | Business formation to share resources and liabilities. | Personal relationships seeking legal recognition without marriage. |

Definition of Legal Partnership

A legal partnership is a formal business relationship governed by specific laws and contractual agreements between two or more individuals who share profits, losses, and management responsibilities. It requires registration with relevant authorities and adherence to partnership acts, distinguishing it from common-law partnerships, which are based on cohabitation and mutual understanding without formal documentation. Legal partnerships provide clear frameworks for liability, decision-making, and dispute resolution, offering partners structured rights and obligations under the law.

Definition of Common-Law Partnership

Common-law partnership is defined as a relationship where two individuals live together continuously for a specific period, typically ranging from one to three years, without formal marriage, and share a domestic life. Unlike a legal partnership, common-law status grants specific rights and obligations based on cohabitation and shared finances rather than a formal contractual agreement. Legal recognition of common-law partnerships varies by jurisdiction, impacting property rights, inheritance, and spousal support entitlements.

Key Legal Differences

Legal partnerships require formal registration and adherence to specific business laws, providing clear liability rules and tax obligations for partners. Common-law partnerships, recognized based on cohabitation and shared finances without formal registration, often lack explicit legal documentation and face varying legal recognition by jurisdiction. Legal partnerships offer structured governance and contractual clarity, whereas common-law partnerships rely on inferred agreements and have limited access to certain business rights and benefits.

Formation Process: Legal vs Common-Law

Legal partnerships require formal registration, including a partnership agreement filed with government authorities, to establish clear roles and liabilities, while common-law partnerships form informally through cohabitation and mutual intent without official documentation. The formation process in legal partnerships involves contractual obligations and state recognition, providing structured legal protections and tax benefits. Common-law partnerships depend on factors such as duration of cohabitation, shared finances, and public representation as a couple, often requiring evidence in disputes to prove partnership status.

Rights and Obligations Comparison

Legal partnerships are formal business arrangements governed by partnership agreements, where partners share profits, liabilities, and decision-making authority under specific statutory frameworks. Common-law partnerships, recognized based on cohabitation and relationship duration, primarily grant rights related to property division and spousal support but lack the structured obligations of formal business partnerships. Both forms establish fiduciary duties and shared responsibilities, but legal partnerships impose clearer financial and legal obligations enforceable through contract law.

Tax Implications in Both Partnerships

Legal partnerships require formal registration, impacting tax obligations through transparent income reporting and shared liability, while common-law partnerships, lacking formal registration, may face complexities in tax filings and benefits eligibility. In legal partnerships, partners are taxed individually on their share of profits, allowing clear deductions and tax credits, whereas common-law partners often must navigate ambiguous tax treatments, especially regarding property division and spousal benefits. Understanding the distinct tax implications of each partnership structure is crucial for compliance and optimizing financial outcomes under the Canada Revenue Agency guidelines.

Dissolution Procedures

Dissolution procedures for legal partnerships typically require formal documentation, such as a partnership dissolution agreement filed with relevant authorities, and may involve winding up business affairs and settling debts. Common-law partnerships often lack standardized legal processes for dissolution, relying instead on informal agreements or court intervention to resolve asset division and financial responsibilities. Understanding jurisdiction-specific regulations is crucial for both types to ensure compliance and protect individual rights during dissolution.

Liability and Risk Factors

Legal partnerships involve a formal agreement where partners share liability and financial risks according to the partnership contract, making each partner personally responsible for business debts and obligations. Common-law partnerships lack a formal agreement, which can result in unclear liability, potentially exposing partners to unexpected legal and financial risks based on jurisdictional laws. Understanding the distinct liability frameworks is crucial for managing risk effectively in both legal and common-law partnerships.

Impact on Property and Assets

In a legal partnership, property and assets acquired during the partnership are typically owned jointly and subject to formal agreements outlining division and management. Common-law partnerships often rely on equitable distribution principles or jurisdiction-specific laws to determine property rights, which can lead to varying outcomes in asset division. Understanding the distinct legal frameworks is crucial for accurately assessing property claims and protecting financial interests in each partnership type.

Choosing the Right Partnership Structure

Choosing the right partnership structure depends on legal recognition and personal circumstances, with legal partnerships offering formal agreements and clearer liability protections, while common-law partnerships rely on cohabitation duration and shared responsibilities without formal registration. Legal partnerships typically provide more defined rights regarding property, debts, and inheritance, whereas common-law partners often face challenges in proving status and securing legal benefits. Understanding jurisdiction-specific laws and the implications for taxes, asset management, and dispute resolution is crucial for selecting between these partnership types.

legal partnership vs common-law partnership Infographic

relationdif.com

relationdif.com