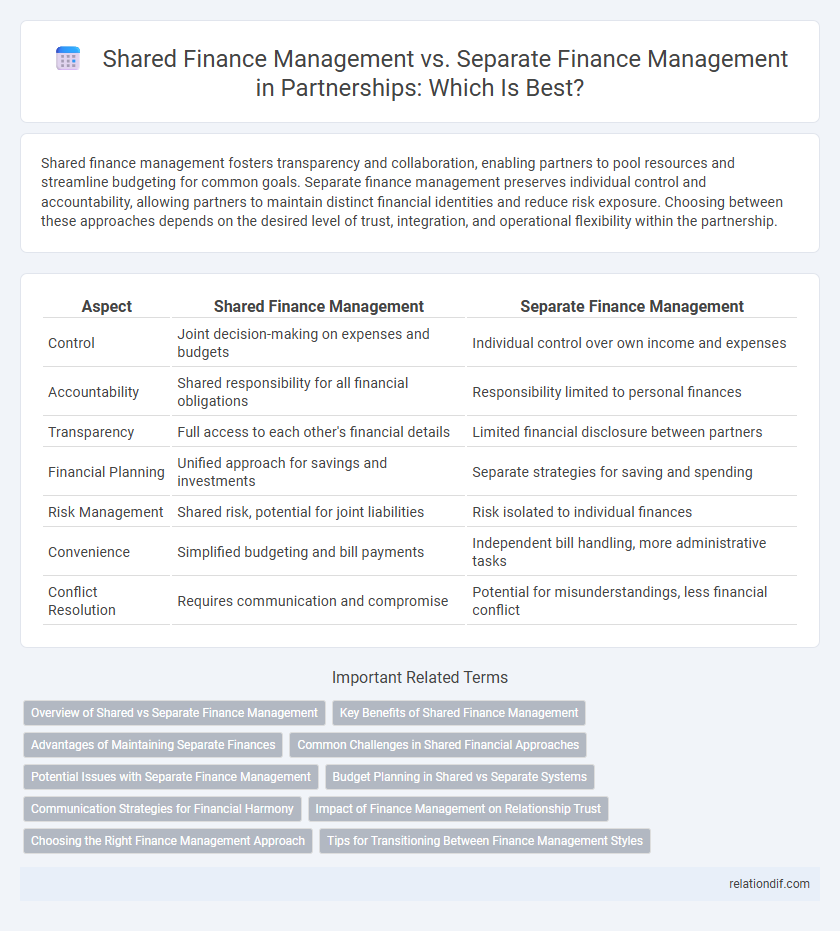

Shared finance management fosters transparency and collaboration, enabling partners to pool resources and streamline budgeting for common goals. Separate finance management preserves individual control and accountability, allowing partners to maintain distinct financial identities and reduce risk exposure. Choosing between these approaches depends on the desired level of trust, integration, and operational flexibility within the partnership.

Table of Comparison

| Aspect | Shared Finance Management | Separate Finance Management |

|---|---|---|

| Control | Joint decision-making on expenses and budgets | Individual control over own income and expenses |

| Accountability | Shared responsibility for all financial obligations | Responsibility limited to personal finances |

| Transparency | Full access to each other's financial details | Limited financial disclosure between partners |

| Financial Planning | Unified approach for savings and investments | Separate strategies for saving and spending |

| Risk Management | Shared risk, potential for joint liabilities | Risk isolated to individual finances |

| Convenience | Simplified budgeting and bill payments | Independent bill handling, more administrative tasks |

| Conflict Resolution | Requires communication and compromise | Potential for misunderstandings, less financial conflict |

Overview of Shared vs Separate Finance Management

Shared finance management in partnerships centralizes income, expenses, and budgeting, promoting transparency and collective decision-making, often resulting in streamlined financial operations and aligned goals. Separate finance management maintains individual accounts and responsibilities, offering autonomy but potentially complicating coordination and increasing risk of miscommunication. Understanding the trade-offs between shared and separate financial management helps partners choose the structure that best supports trust, control, and financial clarity.

Key Benefits of Shared Finance Management

Shared finance management in partnerships streamlines budgeting and expense tracking by consolidating resources, leading to improved financial transparency and accountability among partners. Pooling funds reduces administrative costs and enhances cash flow efficiency, enabling better strategic investment opportunities and risk mitigation. This integrated approach fosters stronger collaboration and trust, ultimately supporting sustainable business growth.

Advantages of Maintaining Separate Finances

Maintaining separate finances in a partnership enhances individual financial autonomy and simplifies personal budgeting, reducing conflicts over spending habits and financial priorities. It also facilitates clearer accountability by distinguishing personal liabilities from business expenses, which helps protect individual credit scores and assets. Separate finance management streamlines tax reporting and legal compliance by keeping business and personal transactions distinct, improving overall financial clarity.

Common Challenges in Shared Financial Approaches

Shared finance management in partnerships often faces common challenges such as lack of transparent communication, difficulty in agreeing on budget allocations, and conflicts over spending priorities. Disparities in financial literacy and accountability can lead to mistrust and inefficient resource utilization. Establishing clear guidelines and regular financial reviews helps mitigate risks associated with combined financial approaches.

Potential Issues with Separate Finance Management

Separate finance management within partnerships can lead to misaligned financial goals, increased administrative burdens, and reduced transparency between partners. Discrepancies in expense tracking and income reporting often cause conflicts and hinder effective decision-making. Lack of a unified financial strategy may result in missed opportunities for tax efficiency and resource optimization.

Budget Planning in Shared vs Separate Systems

Shared finance management in partnerships allows for collaborative budget planning, enhancing transparency and aligning financial goals among partners. Separate finance management often results in fragmented budget allocations, creating challenges in coordinating expenses and optimizing cash flow. Integrating budgets in shared systems streamlines decision-making and improves resource allocation efficiency.

Communication Strategies for Financial Harmony

Effective communication strategies are crucial for shared finance management in partnerships, ensuring transparency and aligning financial goals to prevent misunderstandings. In contrast, separate finance management requires clear agreements and regular updates to maintain trust and coordinate financial decisions without interfering in individual autonomy. Prioritizing open dialogue and scheduled financial reviews fosters financial harmony and strengthens partnership resilience.

Impact of Finance Management on Relationship Trust

Shared finance management in partnerships fosters transparency and mutual accountability, significantly enhancing relationship trust by aligning financial goals and reducing misunderstandings. Separate finance management may preserve individual autonomy but often leads to mistrust due to perceived secrecy or unequal contributions. Effective communication and agreed-upon financial boundaries are critical to maintaining trust regardless of the chosen management style.

Choosing the Right Finance Management Approach

Choosing the right finance management approach in a partnership hinges on evaluating trust levels, financial transparency, and control preferences. Shared finance management promotes unified budgeting and streamlined decision-making, enhancing accountability and reducing conflicts. Separate finance management allows partners to maintain individual financial autonomy, which can minimize disputes but may complicate joint expense tracking and tax reporting.

Tips for Transitioning Between Finance Management Styles

Transitioning from separate to shared finance management requires clear communication and setting mutual financial goals to ensure alignment. Establishing a joint budget and regularly reviewing expenses fosters transparency and trust between partners. Utilizing shared financial tools or apps can streamline tracking and reduce misunderstandings during the adjustment period.

Shared finance management vs Separate finance management Infographic

relationdif.com

relationdif.com