Financial boundaries in a pet context involve setting limits on spending for pet care to ensure budget adherence and prevent overspending on non-essential items. Material boundaries focus on restricting the types of pet products brought into the home, emphasizing a clutter-free environment and prioritizing necessary, durable items. Establishing clear financial and material boundaries helps pet owners maintain control over expenses and the household space, promoting responsible pet ownership.

Table of Comparison

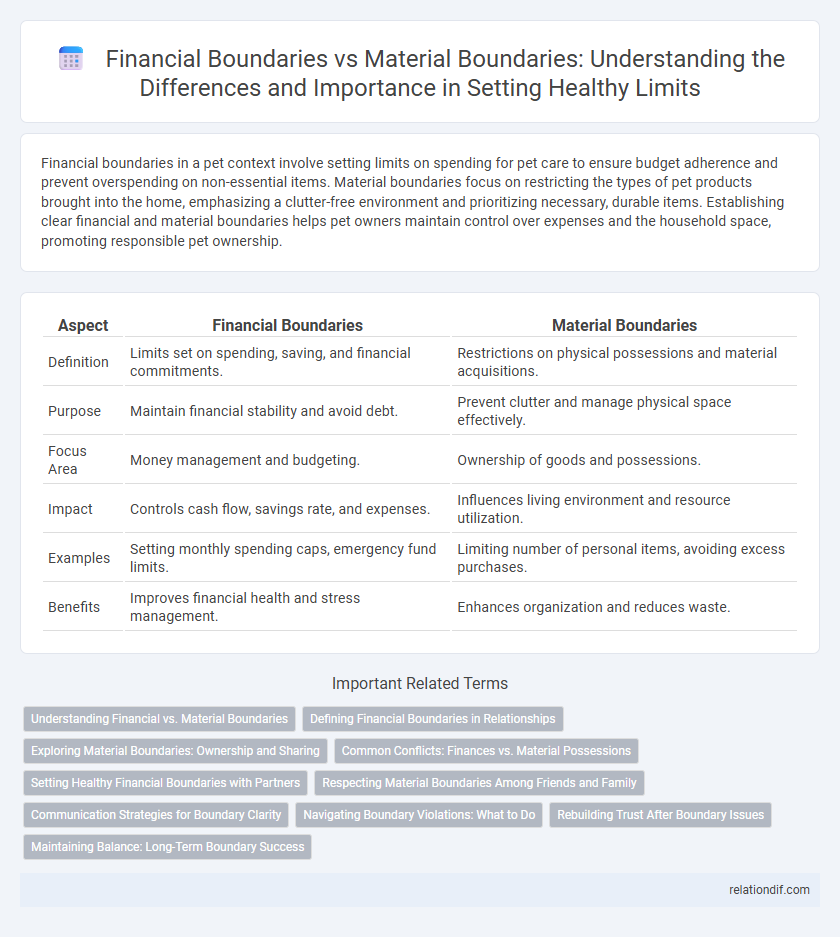

| Aspect | Financial Boundaries | Material Boundaries |

|---|---|---|

| Definition | Limits set on spending, saving, and financial commitments. | Restrictions on physical possessions and material acquisitions. |

| Purpose | Maintain financial stability and avoid debt. | Prevent clutter and manage physical space effectively. |

| Focus Area | Money management and budgeting. | Ownership of goods and possessions. |

| Impact | Controls cash flow, savings rate, and expenses. | Influences living environment and resource utilization. |

| Examples | Setting monthly spending caps, emergency fund limits. | Limiting number of personal items, avoiding excess purchases. |

| Benefits | Improves financial health and stress management. | Enhances organization and reduces waste. |

Understanding Financial vs. Material Boundaries

Financial boundaries involve setting limits on spending, saving, and investing to maintain economic stability, while material boundaries refer to controlling physical possessions and space to avoid clutter and overconsumption. Understanding financial boundaries helps in budgeting and managing debt, whereas material boundaries emphasize minimalism and organization to reduce stress and increase productivity. Both boundaries are essential for achieving overall well-being, balancing monetary discipline with physical environment management.

Defining Financial Boundaries in Relationships

Defining financial boundaries in relationships involves setting clear limits on spending, saving, and sharing money to foster transparency and prevent conflicts. Establishing agreed-upon budgets, financial responsibilities, and goals ensures both partners maintain autonomy while supporting shared objectives. These financial boundaries differ from material boundaries, which focus more on physical possessions and space rather than monetary management.

Exploring Material Boundaries: Ownership and Sharing

Material boundaries define ownership limits and establish clear distinctions between personal property and shared resources. Setting these boundaries prevents conflicts over possessions by specifying what can be used, borrowed, or shared within relationships or communities. Understanding the importance of respecting material boundaries fosters trust and cooperation in both personal and professional environments.

Common Conflicts: Finances vs. Material Possessions

Conflicts between financial boundaries and material possessions often arise when individuals prioritize spending on objects over saving or investing, leading to budget strain and unmet financial goals. Disputes emerge as material desires clash with financial discipline, causing tension in personal relationships and shared expenses. Establishing clear financial guidelines helps manage expectations and reduces conflicts related to balancing spending and accumulating possessions.

Setting Healthy Financial Boundaries with Partners

Setting healthy financial boundaries with partners involves clear communication about spending limits, saving goals, and debt management to prevent misunderstandings and conflicts. Defining responsibilities for bills, joint accounts, and personal expenses establishes mutual respect and trust. Financial transparency and agreed-upon boundaries foster long-term stability and partnership harmony.

Respecting Material Boundaries Among Friends and Family

Respecting material boundaries among friends and family involves acknowledging personal property limits and avoiding assumptions about borrowing without permission. Clearly communicating expectations about using or sharing possessions helps maintain trust and prevents conflicts. Establishing these boundaries supports healthy relationships by valuing each person's autonomy over their belongings.

Communication Strategies for Boundary Clarity

Establishing clear financial boundaries involves transparent discussions about budgeting, spending limits, and financial goals to prevent misunderstandings. Material boundaries require open communication about personal belongings and space, ensuring respect for ownership and privacy. Effective strategies include setting explicit expectations, using assertive language, and regularly revisiting agreements to maintain clarity and mutual respect in both financial and material contexts.

Navigating Boundary Violations: What to Do

When navigating financial boundary violations, clearly communicate your limits regarding spending, borrowing, and shared expenses to prevent misunderstandings and protect your financial stability. Material boundary violations require setting explicit guidelines on personal possessions, emphasizing respect for ownership, and promptly addressing any misuse or unauthorized access. Establishing firm, consistent responses to these violations reinforces respect and helps maintain healthy relationships.

Rebuilding Trust After Boundary Issues

Rebuilding trust after financial boundary issues requires clear communication and consistent accountability to restore stability in relationships. Material boundaries often involve physical possessions but financial boundaries demand transparency in spending, saving, and debt management to prevent misunderstandings. Establishing mutual respect for both types of boundaries fosters long-term trust and emotional security.

Maintaining Balance: Long-Term Boundary Success

Maintaining balance in long-term boundary success requires distinguishing between financial boundaries, which involve budgeting and spending limits, and material boundaries, centered on possessions and consumption habits. Establishing clear financial goals prevents overspending, while setting material boundaries reduces clutter and promotes sustainability. Consistent evaluation and adjustment of both boundary types ensure lasting harmony and well-being.

financial boundaries vs material boundaries Infographic

relationdif.com

relationdif.com