A Commitment pet agreement offers clear protections and expectations compared to having no pre-nup, reducing conflicts over pet custody in case of separation. Without a pre-nup, pet ownership can become a contentious legal battle, often leaving the pet's well-being uncertain. Establishing a Commitment pet agreement ensures mutual understanding and care responsibilities, prioritizing the pet's best interests above all.

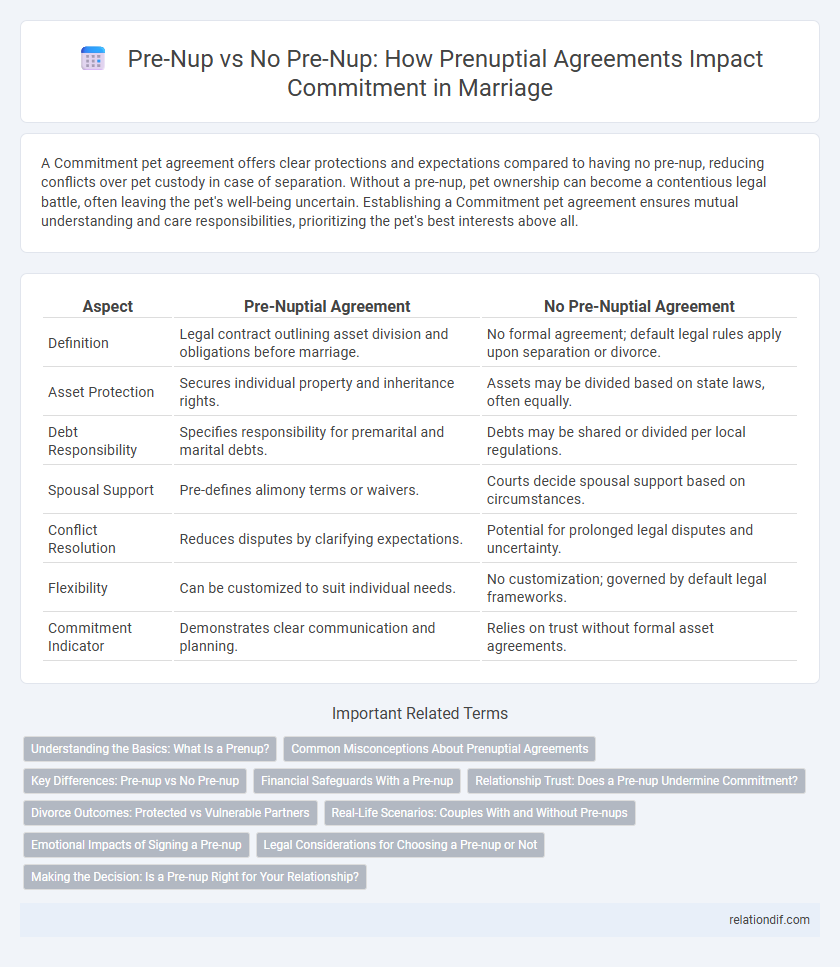

Table of Comparison

| Aspect | Pre-Nuptial Agreement | No Pre-Nuptial Agreement |

|---|---|---|

| Definition | Legal contract outlining asset division and obligations before marriage. | No formal agreement; default legal rules apply upon separation or divorce. |

| Asset Protection | Secures individual property and inheritance rights. | Assets may be divided based on state laws, often equally. |

| Debt Responsibility | Specifies responsibility for premarital and marital debts. | Debts may be shared or divided per local regulations. |

| Spousal Support | Pre-defines alimony terms or waivers. | Courts decide spousal support based on circumstances. |

| Conflict Resolution | Reduces disputes by clarifying expectations. | Potential for prolonged legal disputes and uncertainty. |

| Flexibility | Can be customized to suit individual needs. | No customization; governed by default legal frameworks. |

| Commitment Indicator | Demonstrates clear communication and planning. | Relies on trust without formal asset agreements. |

Understanding the Basics: What Is a Prenup?

A prenuptial agreement, or prenup, is a legally binding contract created before marriage that outlines the division of assets and financial responsibilities in the event of divorce or separation. Without a prenup, state laws typically govern asset distribution and spousal support, which may not align with the couple's preferences or individual circumstances. Understanding the basics of a prenup helps couples make informed decisions about protecting their financial interests and clarifying expectations for commitment.

Common Misconceptions About Prenuptial Agreements

Prenuptial agreements are often misunderstood as only benefiting the wealthier spouse, but they actually provide legal clarity and asset protection for both parties. Many believe that signing a prenup signals a lack of trust or commitment, yet it serves as a practical tool to prevent future disputes and ensure fair division of property. Misconceptions also include the idea that prenups are only for the rich or that they are signed only when expecting divorce, when in fact they can protect assets, debts, and financial responsibilities regardless of wealth or outcome.

Key Differences: Pre-nup vs No Pre-nup

A prenuptial agreement clearly defines asset division, spousal support, and debt responsibilities prior to marriage, providing legal protection and reducing conflicts in case of divorce. Without a pre-nup, state laws determine property division and financial obligations, which can lead to unpredictable outcomes and prolonged legal disputes. Couples with a pre-nup benefit from customized financial arrangements and clarity, while those without rely on default legal systems that may not align with their preferences.

Financial Safeguards With a Pre-nup

A prenuptial agreement provides clear financial safeguards by outlining asset division and debt responsibility before marriage, reducing conflicts during separation or divorce. Without a pre-nup, state laws typically determine the distribution of property, which may not align with individual financial interests. Establishing financial terms in advance promotes transparency and protects both parties' economic rights.

Relationship Trust: Does a Pre-nup Undermine Commitment?

A prenuptial agreement often raises concerns about trust, yet it can actually strengthen commitment by encouraging open communication about financial expectations and future planning. Couples who engage in transparent discussions through a pre-nup build a foundation of trust, reducing uncertainties that might otherwise cause conflict. Trust thrives not solely on the absence of legal agreements but on mutual respect and clear understanding of each partner's values and boundaries.

Divorce Outcomes: Protected vs Vulnerable Partners

Prenuptial agreements provide legally binding frameworks that protect the financial interests and assets of partners during divorce, reducing conflicts and ensuring clarity in asset division. Without a prenup, vulnerable partners often face prolonged legal battles and uncertain financial outcomes that can lead to economic hardship and emotional stress. Divorce outcomes tend to favor protected partners with prenups, minimizing risks and preserving financial stability.

Real-Life Scenarios: Couples With and Without Pre-nups

Couples with pre-nups often experience clearer financial boundaries and reduced conflict during divorce proceedings, as demonstrated by studies showing a 30% decrease in litigation costs. In contrast, couples without pre-nups face prolonged legal disputes and increased emotional stress, with courts deciding asset division based on state laws rather than personal agreements. Real-life cases illustrate how pre-nups protect individual assets and streamline the separation process, fostering a sense of security and trust.

Emotional Impacts of Signing a Pre-nup

Signing a pre-nup can create feelings of protection and security by clearly defining financial expectations, reducing anxiety about future uncertainties in the relationship. Conversely, the absence of a pre-nup may foster trust and emotional intimacy by emphasizing commitment without legal reservations. Couples often face emotional challenges balancing practical considerations of asset division with the desire for unconditional emotional connection.

Legal Considerations for Choosing a Pre-nup or Not

Choosing a prenuptial agreement involves critical legal considerations such as asset protection, debt responsibility, and clarity on spousal support obligations, which can safeguard individual financial interests in case of divorce. Without a pre-nup, state laws govern asset division and debt liability, potentially leading to unpredictable outcomes and prolonged legal disputes. Evaluating jurisdiction-specific statutes and consulting with family law experts ensure informed decisions aligning with long-term financial and emotional security goals.

Making the Decision: Is a Pre-nup Right for Your Relationship?

Deciding whether a pre-nup is right for your relationship involves assessing financial goals, asset protection, and future contingencies. Couples must consider transparency about debts, property, and income to ensure mutual understanding and reduce potential conflicts. Evaluating such factors helps create a foundation of trust and clarity, fostering a stronger commitment.

pre-nup vs no pre-nup Infographic

relationdif.com

relationdif.com