Financial compatibility in pet ownership ensures that both partners agree on budgeting for pet care, including food, vet visits, and emergencies. Spending habits reveal how each person prioritizes expenses, which can affect decisions on pet-related purchases or unexpected costs. Aligning financial expectations and spending behaviors helps maintain harmony and ensures pets receive consistent care.

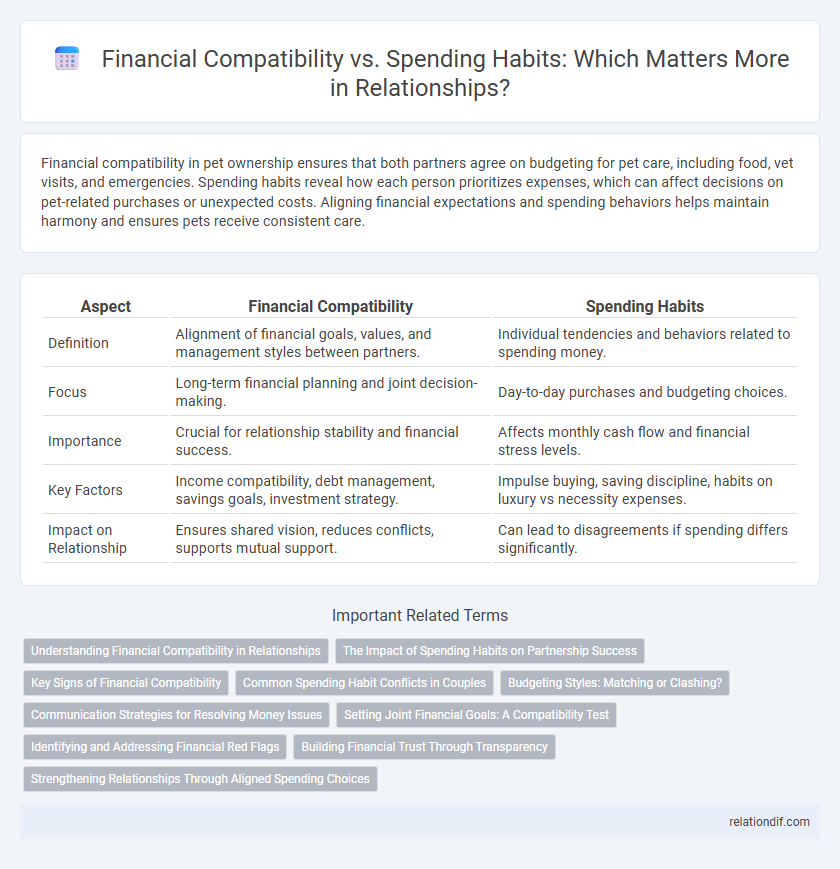

Table of Comparison

| Aspect | Financial Compatibility | Spending Habits |

|---|---|---|

| Definition | Alignment of financial goals, values, and management styles between partners. | Individual tendencies and behaviors related to spending money. |

| Focus | Long-term financial planning and joint decision-making. | Day-to-day purchases and budgeting choices. |

| Importance | Crucial for relationship stability and financial success. | Affects monthly cash flow and financial stress levels. |

| Key Factors | Income compatibility, debt management, savings goals, investment strategy. | Impulse buying, saving discipline, habits on luxury vs necessity expenses. |

| Impact on Relationship | Ensures shared vision, reduces conflicts, supports mutual support. | Can lead to disagreements if spending differs significantly. |

Understanding Financial Compatibility in Relationships

Financial compatibility in relationships hinges on aligning core values about money, long-term financial goals, and spending habits. Partners who communicate openly about budgeting, saving, and debt management tend to build stronger trust and reduce conflicts related to finances. Understanding each other's approach to financial decisions creates a foundation for shared economic stability and mutual respect.

The Impact of Spending Habits on Partnership Success

Spending habits significantly influence financial compatibility and partnership success by shaping how couples manage shared resources and financial goals. Divergent spending patterns can lead to conflicts, stress, and diminished trust, undermining long-term relationship stability. Harmonizing spending behaviors fosters mutual understanding, supports joint financial planning, and strengthens overall partnership resilience.

Key Signs of Financial Compatibility

Key signs of financial compatibility include shared financial goals, similar attitudes towards saving and investing, and mutual agreement on budgeting and debt management. Couples aligned in spending habits demonstrate consistent communication about expenses and a balanced approach to discretionary spending. Recognizing these indicators fosters long-term financial harmony and reduces conflicts related to money management.

Common Spending Habit Conflicts in Couples

Common spending habit conflicts in couples often arise from differing priorities, such as one partner preferring savings while the other favors immediate purchases. Discrepancies in budgeting, impulse buying tendencies, and attitudes toward debt frequently cause tension. Addressing these conflicts requires open communication and aligning financial goals to foster compatibility.

Budgeting Styles: Matching or Clashing?

Financial compatibility hinges on aligning budgeting styles, where matching approaches promote harmony by ensuring both partners agree on saving and spending priorities. Clashing budgeting habits, such as one prioritizing strict savings while the other prefers flexible discretionary spending, often lead to conflicts and financial stress. Couples with compatible budgeting frameworks experience improved communication, reduced financial anxiety, and a stronger foundation for long-term financial goals.

Communication Strategies for Resolving Money Issues

Effective communication strategies for resolving money issues include openly discussing individual financial goals, spending habits, and expectations to foster mutual understanding in relationships. Couples benefit from setting regular check-ins to review budgets, track expenses, and address discrepancies promptly, reducing financial stress. Employing active listening and empathy ensures both partners feel heard, enabling collaborative problem-solving that strengthens financial compatibility over time.

Setting Joint Financial Goals: A Compatibility Test

Setting joint financial goals serves as a critical compatibility test by aligning partners' spending habits and financial priorities. Couples with synchronized budgeting strategies and savings plans demonstrate stronger financial compatibility and reduced conflict. Establishing shared objectives like emergency funds, investment plans, or debt repayment schedules reveals both partners' commitment and ability to collaborate financially.

Identifying and Addressing Financial Red Flags

Identifying financial red flags in spending habits is crucial for assessing financial compatibility between partners. Excessive impulsive purchases, lack of budgeting, and hidden debts often signal potential money management conflicts. Addressing these issues early through open communication and financial planning fosters long-term stability.

Building Financial Trust Through Transparency

Building financial trust through transparency strengthens compatibility by encouraging open discussions about income, expenses, and financial goals. Clear communication around spending habits reduces misunderstandings and aligns expectations in managing joint finances. Prioritizing honesty in financial decisions fosters a solid foundation for long-term monetary partnership.

Strengthening Relationships Through Aligned Spending Choices

Financial compatibility enhances relationship stability by aligning spending habits and prioritizing shared financial goals. Couples who communicate openly about budgets and expenses reduce conflicts and build trust through transparent money management. Strengthening relationships through aligned spending choices fosters mutual respect and long-term financial harmony.

Financial Compatibility vs Spending Habits Infographic

relationdif.com

relationdif.com