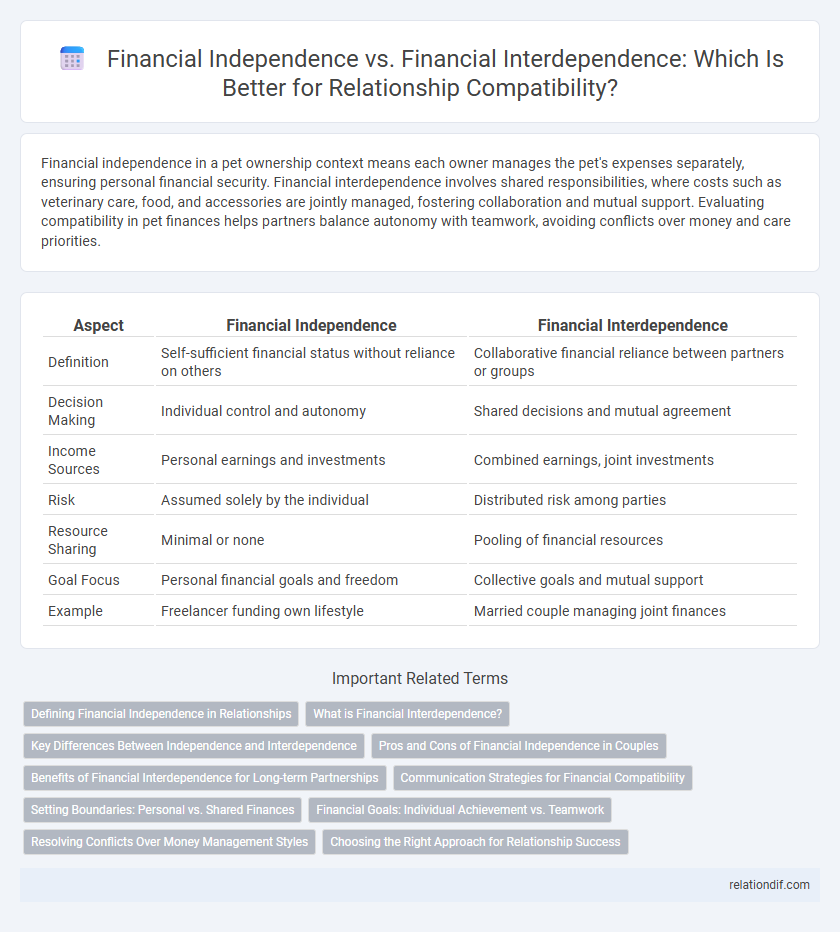

Financial independence in a pet ownership context means each owner manages the pet's expenses separately, ensuring personal financial security. Financial interdependence involves shared responsibilities, where costs such as veterinary care, food, and accessories are jointly managed, fostering collaboration and mutual support. Evaluating compatibility in pet finances helps partners balance autonomy with teamwork, avoiding conflicts over money and care priorities.

Table of Comparison

| Aspect | Financial Independence | Financial Interdependence |

|---|---|---|

| Definition | Self-sufficient financial status without reliance on others | Collaborative financial reliance between partners or groups |

| Decision Making | Individual control and autonomy | Shared decisions and mutual agreement |

| Income Sources | Personal earnings and investments | Combined earnings, joint investments |

| Risk | Assumed solely by the individual | Distributed risk among parties |

| Resource Sharing | Minimal or none | Pooling of financial resources |

| Goal Focus | Personal financial goals and freedom | Collective goals and mutual support |

| Example | Freelancer funding own lifestyle | Married couple managing joint finances |

Defining Financial Independence in Relationships

Financial independence in relationships means each partner maintains control over their own income, expenses, and financial decisions without relying on the other for support. It involves clear boundaries around individual assets, debts, and financial goals, fostering personal responsibility and self-sufficiency. Defining financial independence creates a foundation where both partners contribute equally to shared expenses while preserving their individual financial autonomy.

What is Financial Interdependence?

Financial interdependence refers to a collaborative financial dynamic where individuals or partners share income, expenses, and financial goals while maintaining some level of personal financial autonomy. This approach balances joint responsibility with individual freedom, promoting mutual support and accountability in managing resources. Recognizing financial interdependence helps enhance relationship compatibility by fostering trust and reducing conflicts over money.

Key Differences Between Independence and Interdependence

Financial independence involves individuals managing their own income, expenses, and savings without reliance on others, emphasizing personal control over finances. Financial interdependence denotes a shared financial system where partners or family members contribute to and draw from common resources, promoting mutual support and collaborative decision-making. Key differences include autonomy versus shared responsibility, individual budgeting versus joint financial planning, and self-reliance compared to cooperative resource management.

Pros and Cons of Financial Independence in Couples

Financial independence in couples promotes personal freedom and accountability, allowing each partner to manage their finances without reliance on the other, which can reduce conflict related to money. However, this independence may lead to emotional distance or a lack of shared financial goals, potentially causing misunderstandings or mistrust. Maintaining separate finances requires clear communication and mutual respect to balance individual control with relationship unity.

Benefits of Financial Interdependence for Long-term Partnerships

Financial interdependence in long-term partnerships fosters shared responsibility and mutual financial growth, enhancing stability and trust between partners. Pooling resources and aligning financial goals can lead to more effective wealth accumulation and informed decision-making. This collaboration reduces individual financial stress and builds a resilient foundation for future endeavors.

Communication Strategies for Financial Compatibility

Effective communication strategies for financial compatibility emphasize transparent discussions about individual financial goals, budgeting habits, and spending priorities to align expectations between partners. Regular financial check-ins and using collaborative tools like shared budgeting apps foster mutual understanding and trust, preventing conflicts related to money management. Establishing clear boundaries around financial responsibilities and decision-making processes supports a balanced dynamic between financial independence and interdependence.

Setting Boundaries: Personal vs. Shared Finances

Setting clear boundaries between personal and shared finances enhances compatibility by respecting individual financial independence while fostering financial interdependence in a partnership. Establishing separate accounts for personal expenses alongside joint accounts for shared responsibilities promotes transparency and mutual trust. This balance ensures both partners maintain autonomy while collaborating effectively on financial goals.

Financial Goals: Individual Achievement vs. Teamwork

Financial independence emphasizes setting and achieving personal financial goals tailored to individual needs and aspirations, prioritizing self-reliance and personal accountability. Financial interdependence highlights collaborative financial planning, where partners align their goals, share resources, and make joint decisions to achieve mutual objectives. Successful compatibility integrates clear communication and compromise, balancing individual ambitions with shared financial teamwork for sustainable wealth building.

Resolving Conflicts Over Money Management Styles

Financial independence often emphasizes personal control over budgeting and spending, while financial interdependence requires joint decision-making and shared financial goals. Couples can resolve conflicts over money management styles by establishing clear communication channels and creating mutually agreed-upon budgets that respect both partners' preferences. Utilizing tools like shared financial apps and regular money meetings enhances transparency and supports balanced autonomy within the relationship.

Choosing the Right Approach for Relationship Success

Financial independence allows individuals to maintain control over their personal finances, fostering self-reliance and reducing conflicts over money in relationships. Financial interdependence encourages shared financial goals and responsibilities, enhancing trust and long-term compatibility between partners. Selecting the right balance between independence and interdependence depends on communication styles, individual values, and mutual financial goals to ensure relationship success.

Financial independence vs financial interdependence Infographic

relationdif.com

relationdif.com