Balancing financial planning and financial spontaneity is essential for pet owners to ensure consistent care without neglecting unexpected expenses. Structured budgeting allows for predictable costs like food and vet visits, while flexibility accommodates emergencies or special treats. Harmonizing these approaches supports both responsible pet care and joyful moments with pets.

Table of Comparison

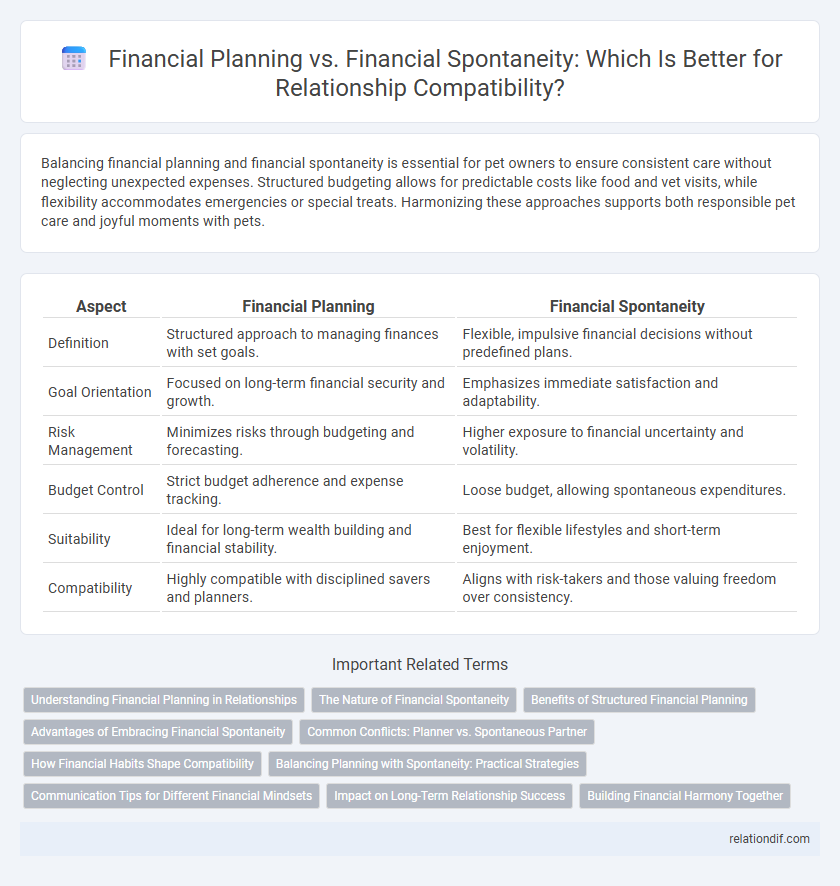

| Aspect | Financial Planning | Financial Spontaneity |

|---|---|---|

| Definition | Structured approach to managing finances with set goals. | Flexible, impulsive financial decisions without predefined plans. |

| Goal Orientation | Focused on long-term financial security and growth. | Emphasizes immediate satisfaction and adaptability. |

| Risk Management | Minimizes risks through budgeting and forecasting. | Higher exposure to financial uncertainty and volatility. |

| Budget Control | Strict budget adherence and expense tracking. | Loose budget, allowing spontaneous expenditures. |

| Suitability | Ideal for long-term wealth building and financial stability. | Best for flexible lifestyles and short-term enjoyment. |

| Compatibility | Highly compatible with disciplined savers and planners. | Aligns with risk-takers and those valuing freedom over consistency. |

Understanding Financial Planning in Relationships

Understanding financial planning in relationships requires aligning both partners' priorities and establishing clear goals for budgeting, saving, and investing. Effective communication about income, expenses, and future financial aspirations fosters trust and reduces conflicts. Couples embracing structured financial planning experience greater stability and are better equipped to navigate unexpected expenses while maintaining shared objectives.

The Nature of Financial Spontaneity

Financial spontaneity involves making impulsive monetary decisions driven by immediate desires rather than structured plans, which contrasts sharply with methodical financial planning. This approach reflects a flexible, adaptive behavior in managing finances, often characterized by unplanned purchases and impulsive investments that can disrupt long-term financial goals. Understanding the nature of financial spontaneity is crucial for recognizing the potential impacts on budget stability and overall financial health.

Benefits of Structured Financial Planning

Structured financial planning enhances long-term wealth accumulation by creating clear budgeting frameworks and investment strategies tailored to individual goals. It reduces financial stress through disciplined expense management and emergency fund allocation, ensuring stability during unforeseen events. Consistent monitoring and adjustment of financial plans optimize resource allocation, maximizing returns and minimizing debt risks.

Advantages of Embracing Financial Spontaneity

Embracing financial spontaneity allows for greater flexibility in responding to unexpected opportunities and life changes without being constrained by rigid budgets. This approach can reduce stress by promoting a more intuitive and enjoyable financial experience, encouraging creativity in managing funds. Financial spontaneity also fosters adaptability, which is crucial for navigating fluctuating markets and personal income variations effectively.

Common Conflicts: Planner vs. Spontaneous Partner

Differences between a financial planner and a spontaneous partner often lead to conflicts over budgeting priorities and spending habits. The planner prefers detailed strategies, long-term goals, and controlled expenses, whereas the spontaneous partner opts for impulsive purchases and flexible financial decisions. Addressing these conflicts requires setting clear boundaries, mutual respect for financial styles, and creating a hybrid approach blending structure with flexibility.

How Financial Habits Shape Compatibility

Financial habits significantly influence compatibility by aligning or clashing individuals' approaches to money management, impacting long-term relationship stability. Consistent financial planning fosters trust, shared goals, and reduces money-related conflicts, while financial spontaneity may introduce unpredictability and stress. Understanding each partner's financial style allows for better communication and balanced decision-making, strengthening relational harmony.

Balancing Planning with Spontaneity: Practical Strategies

Balancing financial planning with spontaneity involves setting flexible budgets that allow for unplanned expenses while maintaining overall financial goals. Integrating tools such as contingency funds and regular financial reviews supports adaptive decision-making without compromising long-term stability. Practicing mindful spending and prioritizing emergency savings enhances readiness for unexpected opportunities or challenges, ensuring a harmonious blend of structure and freedom in personal finance management.

Communication Tips for Different Financial Mindsets

Understanding the differences in financial planning versus financial spontaneity requires tailored communication strategies to foster mutual respect and clarity. For planners who prioritize budgets and long-term goals, providing clear data and structured timelines enhances cooperation, while spontaneity-driven individuals respond better to flexible discussions and emphasizing emotional value in expenditures. Encouraging open dialogue about priorities and creating compromise strategies ensures both mindsets align toward shared financial well-being.

Impact on Long-Term Relationship Success

Balancing financial planning with financial spontaneity significantly influences long-term relationship success by fostering trust and reducing conflicts over money management. Couples who align on budgeting and saving goals while allowing flexibility for spontaneous expenses are more likely to maintain a harmonious partnership. Consistent communication about financial expectations strengthens commitment and resilience against economic stressors.

Building Financial Harmony Together

Balancing financial planning with spontaneity creates a foundation for building financial harmony together by aligning long-term goals and flexible moments. Couples who integrate structured budgeting with occasional unplanned expenses foster trust and mutual respect in money management. Emphasizing open communication about spending priorities enhances compatibility and ensures shared financial well-being.

financial planning vs financial spontaneity Infographic

relationdif.com

relationdif.com