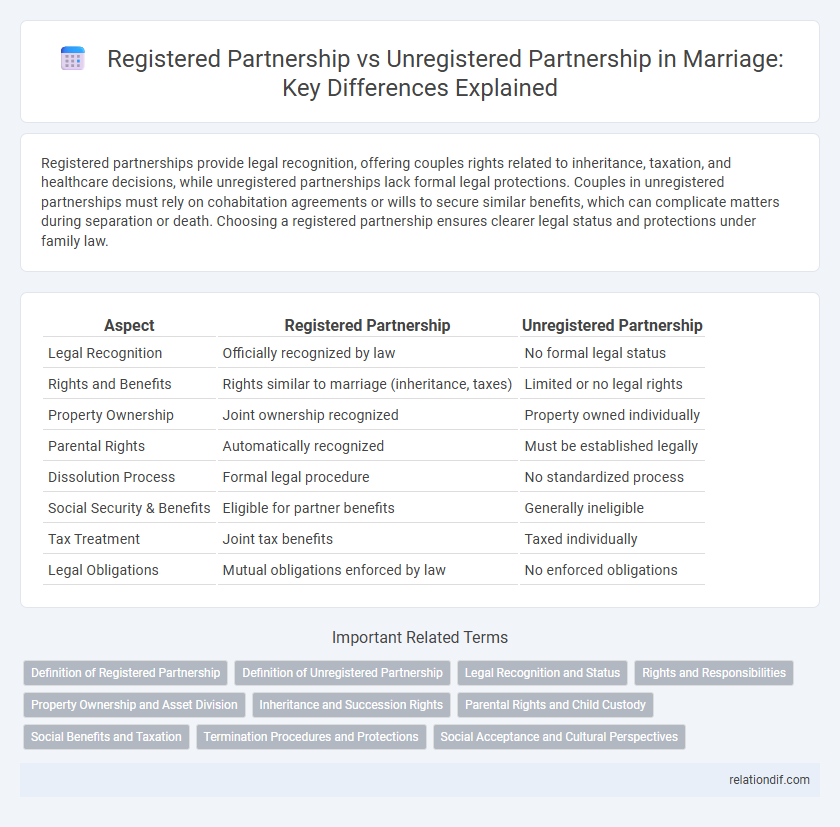

Registered partnerships provide legal recognition, offering couples rights related to inheritance, taxation, and healthcare decisions, while unregistered partnerships lack formal legal protections. Couples in unregistered partnerships must rely on cohabitation agreements or wills to secure similar benefits, which can complicate matters during separation or death. Choosing a registered partnership ensures clearer legal status and protections under family law.

Table of Comparison

| Aspect | Registered Partnership | Unregistered Partnership |

|---|---|---|

| Legal Recognition | Officially recognized by law | No formal legal status |

| Rights and Benefits | Rights similar to marriage (inheritance, taxes) | Limited or no legal rights |

| Property Ownership | Joint ownership recognized | Property owned individually |

| Parental Rights | Automatically recognized | Must be established legally |

| Dissolution Process | Formal legal procedure | No standardized process |

| Social Security & Benefits | Eligible for partner benefits | Generally ineligible |

| Tax Treatment | Joint tax benefits | Taxed individually |

| Legal Obligations | Mutual obligations enforced by law | No enforced obligations |

Definition of Registered Partnership

A registered partnership is a legally recognized union between two individuals, formally documented through government or local authority registration, granting them specific rights and responsibilities similar to marriage. This legal status provides protections in areas such as inheritance, taxation, social security, and decision-making authority in medical situations. Unlike unregistered partnerships, registered partnerships require official paperwork and registration, ensuring legal acknowledgment and enforceability of the partnership.

Definition of Unregistered Partnership

An unregistered partnership refers to a couple living together in a committed relationship without formalizing their union through legal registration, distinguishing it from a registered partnership. This arrangement lacks the official recognition and legal protections typically granted by state authorities, such as automatic rights to inheritance, taxation benefits, and spousal support. Understanding the definition and implications of an unregistered partnership is crucial for couples who choose cohabitation without formalizing their relationship through registration or marriage.

Legal Recognition and Status

Registered partnerships provide legally recognized status with explicit rights and obligations under family law, including inheritance, taxation, and social security benefits. Unregistered partnerships lack formal legal recognition, making it difficult to enforce property rights, custody, or support obligations without additional legal processes. Legal recognition in registered partnerships ensures clearer protections and obligations compared to the uncertain status of unregistered relationships.

Rights and Responsibilities

Registered partnerships grant couples legal recognition, providing rights related to inheritance, tax benefits, spousal support, and decision-making in medical emergencies. Unregistered partnerships lack formal recognition, limiting legal protections and often requiring proof of cohabitation or shared finances to establish responsibilities. Legal disputes in unregistered partnerships can be complex, as rights and obligations are less clearly defined compared to registered partnerships.

Property Ownership and Asset Division

Registered partnerships provide legal recognition that ensures clear guidelines for property ownership and asset division, often mirroring those of marriage, including joint ownership rights and equitable distribution upon dissolution. Unregistered partnerships lack formal legal status, making asset division dependent on individual ownership proofs and agreements, which can complicate property claims and lead to disputes. Legal frameworks in many jurisdictions prioritize registered partnerships for protecting partners' financial interests and securing equitable asset division.

Inheritance and Succession Rights

Registered partnerships provide clear legal recognition, ensuring automatic inheritance and succession rights similar to those of married couples, including entitlement to estate and survivor benefits. Unregistered partnerships lack formal legal status, requiring partners to establish inheritance claims through wills or legal proceedings, making succession less certain and more complicated. Legal frameworks vary by jurisdiction, but registered status significantly strengthens partners' protection in the event of death or separation.

Parental Rights and Child Custody

Registered partnerships grant legal parental rights and responsibilities automatically, including custody and decision-making authority, while unregistered partnerships often require additional legal steps to establish these rights. In unregistered partnerships, non-biological parents may need to pursue adoption or court orders to secure parental authority. Courts tend to prioritize the child's best interests when determining custody, but registered partnerships provide clearer, legally recognized protections for both parents.

Social Benefits and Taxation

Registered partnerships provide clear legal recognition, granting partners social benefits such as spousal health insurance, survivor benefits, and access to family leave, which are typically unavailable in unregistered partnerships. Taxation advantages include eligibility for joint tax filing, potential tax deductions, and inheritance tax exemptions, enhancing financial stability for registered partners. In contrast, unregistered partnerships lack these formal benefits, often facing higher tax burdens and limited access to social welfare programs.

Termination Procedures and Protections

Registered partnerships require formal termination through legal divorce or dissolution processes, ensuring clear division of assets, custody rights, and spousal support protections. Unregistered partnerships lack standardized termination procedures, often leading to complex disputes over property and financial support due to the absence of legal contracts or formal recognition. Legal recognition in registered partnerships provides stronger enforcement of rights and obligations, reducing uncertainties during separation.

Social Acceptance and Cultural Perspectives

Registered partnerships often receive greater social acceptance due to formal legal recognition, which aligns with many cultural norms valuing official commitment. Unregistered partnerships may face varied cultural perspectives, sometimes viewed as less stable or legitimate, impacting social support and communal recognition. The degree of acceptance largely depends on regional traditions, religious beliefs, and societal emphasis on institutionalized relationships.

registered partnership vs unregistered partnership Infographic

relationdif.com

relationdif.com