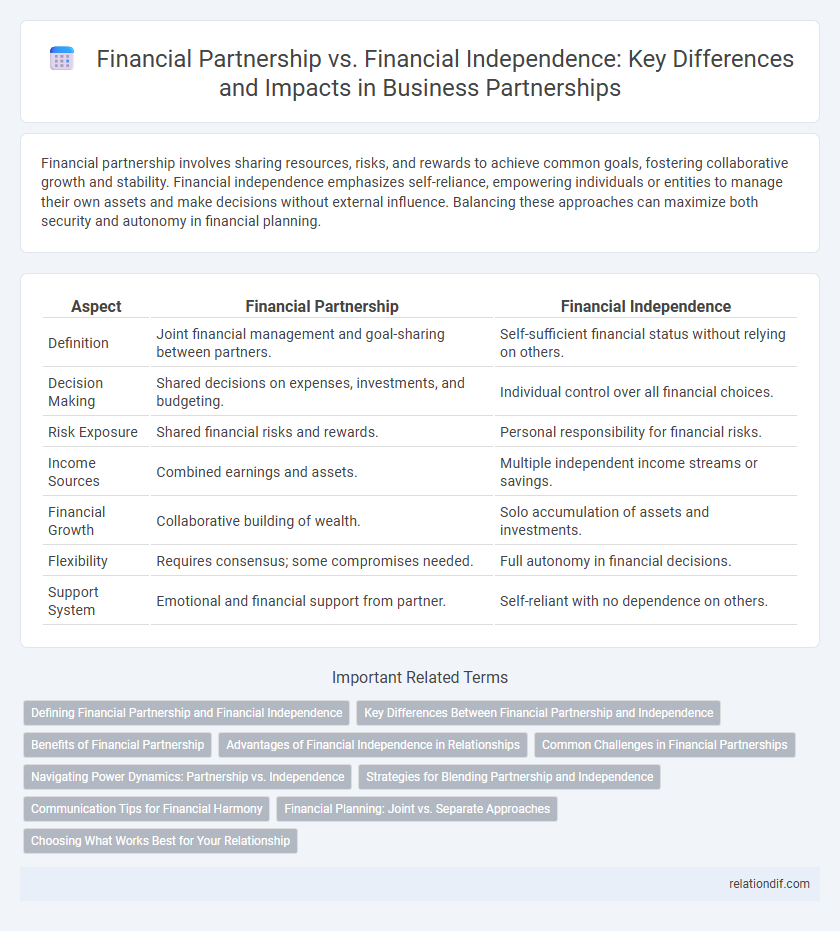

Financial partnership involves sharing resources, risks, and rewards to achieve common goals, fostering collaborative growth and stability. Financial independence emphasizes self-reliance, empowering individuals or entities to manage their own assets and make decisions without external influence. Balancing these approaches can maximize both security and autonomy in financial planning.

Table of Comparison

| Aspect | Financial Partnership | Financial Independence |

|---|---|---|

| Definition | Joint financial management and goal-sharing between partners. | Self-sufficient financial status without relying on others. |

| Decision Making | Shared decisions on expenses, investments, and budgeting. | Individual control over all financial choices. |

| Risk Exposure | Shared financial risks and rewards. | Personal responsibility for financial risks. |

| Income Sources | Combined earnings and assets. | Multiple independent income streams or savings. |

| Financial Growth | Collaborative building of wealth. | Solo accumulation of assets and investments. |

| Flexibility | Requires consensus; some compromises needed. | Full autonomy in financial decisions. |

| Support System | Emotional and financial support from partner. | Self-reliant with no dependence on others. |

Defining Financial Partnership and Financial Independence

Financial partnership involves pooling resources, sharing risks, and collaboratively managing assets to achieve common financial goals. Financial independence is defined by having sufficient personal wealth and passive income streams to cover living expenses without reliance on external support. Understanding the distinction between these concepts is crucial for strategic financial planning and long-term wealth management.

Key Differences Between Financial Partnership and Independence

Financial partnership involves shared decision-making, joint financial goals, and combined resources, fostering mutual accountability and risk distribution. Financial independence emphasizes individual control over income, expenses, and savings, prioritizing personal autonomy without reliance on others. Key differences lie in the degree of financial reliance, communication needs, and flexibility in managing money.

Benefits of Financial Partnership

Financial partnership offers combined resources, shared financial goals, and diversified risk, creating a stronger foundation for wealth building compared to financial independence. Collaborative decision-making enhances investment opportunities and provides emotional support during economic challenges. Access to dual income streams and pooled assets accelerates financial growth and stability.

Advantages of Financial Independence in Relationships

Financial independence in relationships fosters trust by reducing dependency on a partner for economic stability, leading to healthier communication and decision-making. It empowers individuals to pursue personal goals and contribute more meaningfully to the partnership without financial constraints. This autonomy also minimizes conflicts over money, promoting mutual respect and long-term relationship satisfaction.

Common Challenges in Financial Partnerships

Financial partnerships often face challenges such as misaligned goals, communication breakdowns, and unequal financial contributions, which can strain trust and decision-making. Discrepancies in risk tolerance and spending habits further complicate joint financial management, leading to conflicts or stagnation. Addressing these issues requires transparent discussions, clearly defined roles, and mutual financial planning to foster stability and growth.

Navigating Power Dynamics: Partnership vs. Independence

Navigating power dynamics in financial partnerships involves balancing shared decision-making and resource control to ensure mutual benefit and avoid conflicts. Financial independence empowers individuals to maintain autonomy and negotiate partnerships from a position of strength, fostering equitable collaboration. Understanding these dynamics helps optimize trust and transparency, essential for sustainable financial relationships.

Strategies for Blending Partnership and Independence

Effective financial partnership involves clear communication, shared goals, and transparent budgeting to align both parties' interests, while maintaining financial independence requires setting personal financial boundaries and investing in individual income streams. Strategies for blending partnership and independence include joint savings plans for common goals alongside separate accounts for personal expenses, fostering trust without compromising autonomy. Utilizing financial tools like co-managed budgets and regular check-ins ensures collaboration, accountability, and resilience in navigating financial challenges together.

Communication Tips for Financial Harmony

Open and transparent communication establishes mutual trust and clarity, essential for achieving financial harmony in a partnership. Regularly discussing budgets, financial goals, and individual spending habits helps prevent misunderstandings and aligns monetary priorities. Emphasizing active listening and empathy fosters collaboration and supports a balanced dynamic between financial partnership and independence.

Financial Planning: Joint vs. Separate Approaches

Financial planning in partnerships often involves joint approaches that combine incomes, expenses, and long-term goals to optimize resource allocation and tax benefits. Separate financial planning strategies emphasize individual autonomy, allowing partners to maintain distinct budgets, credit scores, and investment portfolios tailored to personal priorities. Balancing joint and separate financial plans enhances overall fiscal health and supports both shared responsibilities and individual financial independence.

Choosing What Works Best for Your Relationship

Financial partnership involves shared goals, transparent communication, and joint decision-making to strengthen trust and mutual support within a relationship. Financial independence allows each partner to maintain individual control over their finances, fostering personal accountability and reducing potential conflicts over money management. Evaluating priorities, spending habits, and communication styles helps couples select the approach that best supports their unique relationship dynamics and long-term financial stability.

financial partnership vs financial independence Infographic

relationdif.com

relationdif.com