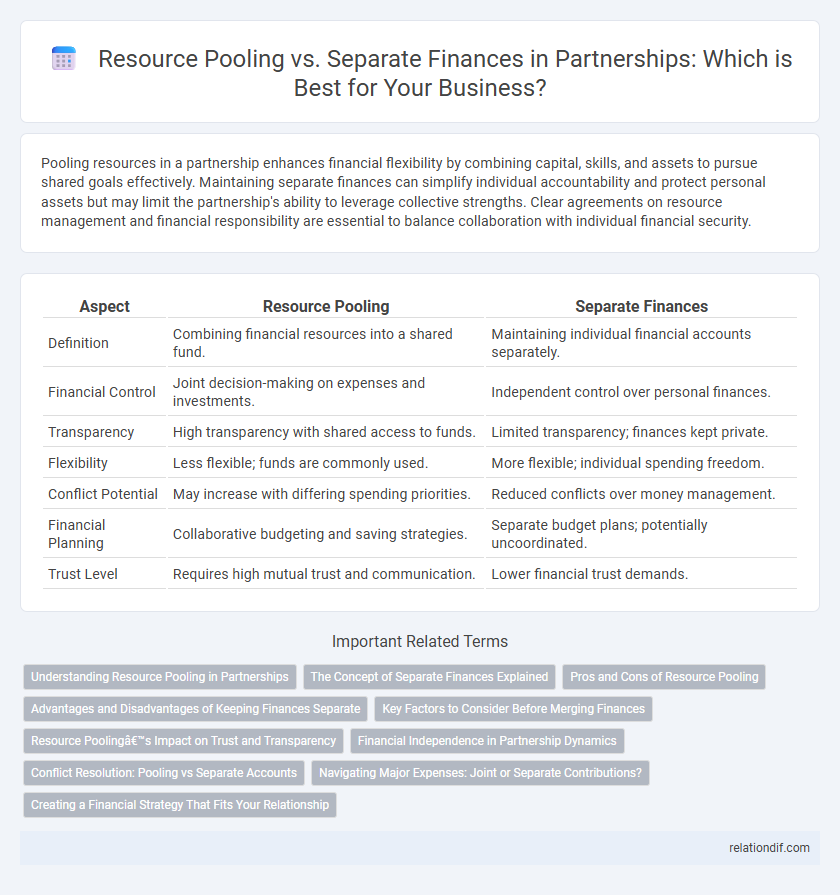

Pooling resources in a partnership enhances financial flexibility by combining capital, skills, and assets to pursue shared goals effectively. Maintaining separate finances can simplify individual accountability and protect personal assets but may limit the partnership's ability to leverage collective strengths. Clear agreements on resource management and financial responsibility are essential to balance collaboration with individual financial security.

Table of Comparison

| Aspect | Resource Pooling | Separate Finances |

|---|---|---|

| Definition | Combining financial resources into a shared fund. | Maintaining individual financial accounts separately. |

| Financial Control | Joint decision-making on expenses and investments. | Independent control over personal finances. |

| Transparency | High transparency with shared access to funds. | Limited transparency; finances kept private. |

| Flexibility | Less flexible; funds are commonly used. | More flexible; individual spending freedom. |

| Conflict Potential | May increase with differing spending priorities. | Reduced conflicts over money management. |

| Financial Planning | Collaborative budgeting and saving strategies. | Separate budget plans; potentially uncoordinated. |

| Trust Level | Requires high mutual trust and communication. | Lower financial trust demands. |

Understanding Resource Pooling in Partnerships

Resource pooling in partnerships involves combining financial resources, skills, and assets to enhance operational efficiency and strengthen business capacity. By sharing resources such as capital, equipment, and expertise, partners can reduce costs and leverage collective strengths for growth and risk management. Understanding resource pooling enables partners to optimize contributions, ensure equitable distribution of returns, and foster collaborative decision-making.

The Concept of Separate Finances Explained

Separate finances in a partnership mean each partner maintains individual financial accounts and liabilities, distinct from the joint business funds. This approach ensures clarity in income distribution, tax obligations, and personal asset protection, minimizing disputes over resource allocation. Understanding separate finances helps partners manage risks effectively while preserving financial autonomy.

Pros and Cons of Resource Pooling

Resource pooling in partnerships consolidates finances, enhancing capital availability and simplifying expense management, which supports unified decision-making and risk sharing. However, this approach can reduce individual control over funds and create potential conflicts when partners have different spending priorities or financial commitments. Transparent communication and clear agreements are essential to mitigate disputes and maintain trust within the partnership.

Advantages and Disadvantages of Keeping Finances Separate

Keeping finances separate in a partnership allows each partner to maintain individual financial control and limit liability, promoting transparency and reducing conflicts related to spending and debt. However, separate finances may complicate tax reporting, reduce the ease of funding joint ventures, and hinder the pooling of resources for business growth. Balancing independence with collaboration is essential to ensure efficient financial management without compromising partnership goals.

Key Factors to Consider Before Merging Finances

Evaluating compatibility in financial goals and spending habits is crucial when deciding between resource pooling and maintaining separate finances in a partnership. Assessing trust levels and communication strategies ensures transparency and reduces potential conflicts over shared money management. Legal implications and tax considerations must also be reviewed to protect both parties' interests before merging financial resources.

Resource Pooling’s Impact on Trust and Transparency

Resource pooling in partnerships fosters greater trust by ensuring all partners have visibility into shared financial resources, promoting transparency in decision-making and accountability. Combining finances eliminates ambiguities about individual contributions, leading to stronger collaboration and reduced conflicts over resource allocation. Enhanced transparency through pooled resources encourages open communication, which solidifies trust and supports long-term partnership success.

Financial Independence in Partnership Dynamics

Resource pooling in partnerships enhances collective financial strength, enabling shared investments and risk mitigation, whereas maintaining separate finances preserves individual financial independence and personal asset control. Financial independence within partnership dynamics supports clear accountability and fosters trust by allowing partners to manage their contributions and withdrawals transparently. Balancing pooled resources with separate finances can optimize both collaborative growth and personal economic security.

Conflict Resolution: Pooling vs Separate Accounts

Pooling resources in a partnership centralizes finances, enhancing transparency and simplifying conflict resolution by providing a clear overview of income and expenses. Separate accounts, while promoting individual financial autonomy, can lead to misunderstandings and disputes due to lack of visibility and unequal contribution perceptions. Effective conflict resolution is more achievable with pooled finances, as shared access reduces ambiguity and fosters collaborative decision-making.

Navigating Major Expenses: Joint or Separate Contributions?

Navigating major expenses in partnerships requires balancing resource pooling and separate finances to optimize cash flow and risk management. Joint contributions enable streamlined budgeting and shared accountability for significant investments, while separate finances maintain individual control and protect personal assets. Deciding between these approaches depends on trust levels, financial transparency, and the partnership's long-term goals.

Creating a Financial Strategy That Fits Your Relationship

Creating a financial strategy in a partnership involves choosing between resource pooling and maintaining separate finances, each offering distinct benefits tailored to the couple's goals and trust levels. Resource pooling maximizes shared assets, simplifies budgeting, and promotes joint financial responsibility, while separate finances support individual autonomy and personal spending freedom. Effective communication and aligning financial priorities are crucial to establish a strategy that strengthens your relationship and enhances long-term financial stability.

Resource Pooling vs Separate Finances Infographic

relationdif.com

relationdif.com