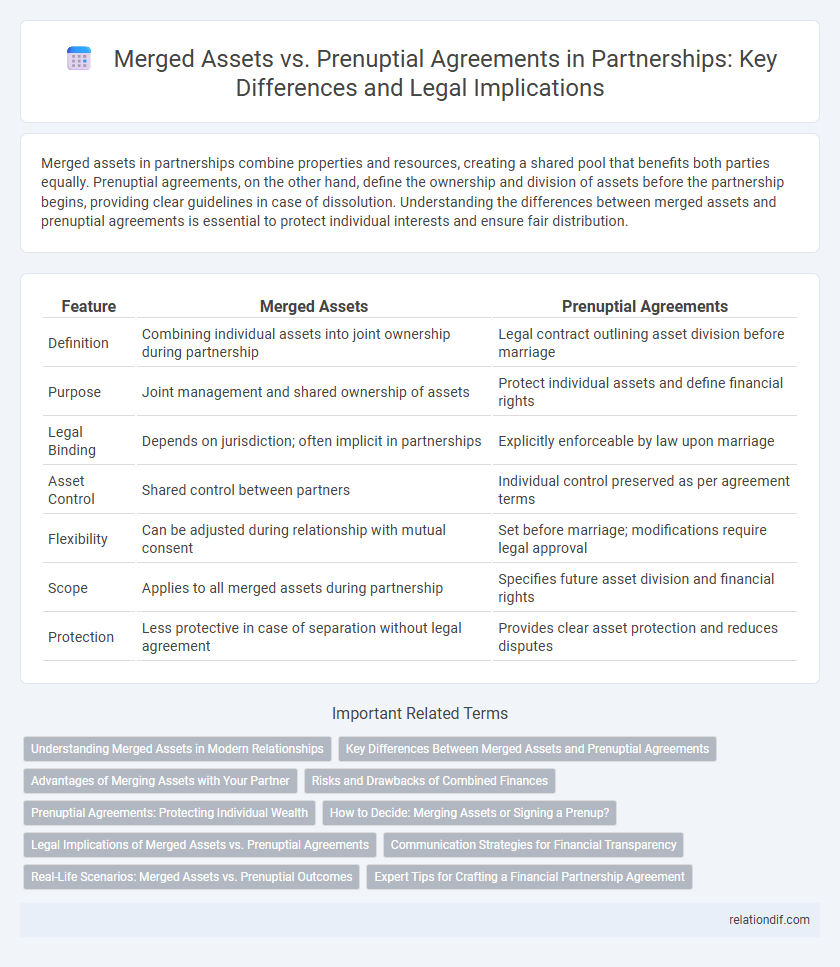

Merged assets in partnerships combine properties and resources, creating a shared pool that benefits both parties equally. Prenuptial agreements, on the other hand, define the ownership and division of assets before the partnership begins, providing clear guidelines in case of dissolution. Understanding the differences between merged assets and prenuptial agreements is essential to protect individual interests and ensure fair distribution.

Table of Comparison

| Feature | Merged Assets | Prenuptial Agreements |

|---|---|---|

| Definition | Combining individual assets into joint ownership during partnership | Legal contract outlining asset division before marriage |

| Purpose | Joint management and shared ownership of assets | Protect individual assets and define financial rights |

| Legal Binding | Depends on jurisdiction; often implicit in partnerships | Explicitly enforceable by law upon marriage |

| Asset Control | Shared control between partners | Individual control preserved as per agreement terms |

| Flexibility | Can be adjusted during relationship with mutual consent | Set before marriage; modifications require legal approval |

| Scope | Applies to all merged assets during partnership | Specifies future asset division and financial rights |

| Protection | Less protective in case of separation without legal agreement | Provides clear asset protection and reduces disputes |

Understanding Merged Assets in Modern Relationships

Merged assets in modern relationships refer to the pooling of individual finances and properties into shared ownership, reflecting a commitment to joint financial goals. Prenuptial agreements serve to clearly define the division of assets and liabilities, protecting each partner's interests before merging occurs. Understanding the distinction between merged assets and prenuptial agreements helps couples navigate financial transparency and legal security in their partnership.

Key Differences Between Merged Assets and Prenuptial Agreements

Merged assets refer to property and financial resources combined by partners during a relationship, often governed by state laws in the absence of a prenuptial agreement. Prenuptial agreements are legal contracts established before marriage that specify the division and ownership of assets, protecting individual property rights and outlining financial responsibilities. Key differences include the timing of agreement, legal enforceability, and the ability to customize asset division compared to automatic merging of assets under marital property laws.

Advantages of Merging Assets with Your Partner

Merging assets with your partner enhances financial transparency and simplifies wealth management by combining resources into a unified portfolio. This approach fosters trust and strengthens the partnership by aligning financial goals and reducing conflicts over individual property. Shared assets also allow for more effective tax planning and increased borrowing power, benefiting long-term financial stability.

Risks and Drawbacks of Combined Finances

Merged assets in partnerships can expose both parties to increased financial risks, such as shared debt liability and loss of individual control over funds. Prenuptial agreements help mitigate these risks by clearly defining asset ownership and financial responsibilities before merging occurs. Without such agreements, combined finances may lead to disputes, reduced financial autonomy, and complicated asset division during dissolution.

Prenuptial Agreements: Protecting Individual Wealth

Prenuptial agreements serve as a crucial legal tool for protecting individual wealth by clearly defining asset ownership and financial responsibilities before marriage. These agreements help prevent disputes over merged assets by specifying what remains separate property, ensuring that personal finances are safeguarded in the event of divorce or separation. By establishing clear terms, prenuptial agreements provide financial security and peace of mind, preserving both parties' economic interests within a partnership.

How to Decide: Merging Assets or Signing a Prenup?

Deciding between merging assets or signing a prenuptial agreement requires assessing financial goals, asset protection, and long-term planning within the partnership. Merging assets fosters joint ownership and simplifies financial management but may expose each partner to shared liabilities. Prenuptial agreements offer tailored protection by defining asset division and debt responsibilities, ensuring clarity in case of separation or unforeseen events.

Legal Implications of Merged Assets vs. Prenuptial Agreements

Merged assets typically become joint property under partnership laws, exposing both parties to shared liabilities and complicating division in case of dissolution. Prenuptial agreements provide a pre-established legal framework that clearly delineates ownership, protecting individual assets from joint claims and minimizing disputes. Courts often uphold prenuptial terms, ensuring that separated assets remain distinct, whereas merged assets require complex legal intervention to untangle ownership issues.

Communication Strategies for Financial Transparency

Effective communication strategies for financial transparency emphasize detailed discussions of merged assets and prenuptial agreements to prevent misunderstandings in partnerships. Clear disclosure of individual and combined financial holdings fosters trust and ensures both parties are aware of their rights and obligations. Implementing regular financial check-ins and using neutral third-party advisors can enhance openness and facilitate conflict resolution.

Real-Life Scenarios: Merged Assets vs. Prenuptial Outcomes

Merged assets in partnerships often lead to shared financial responsibilities and benefits, complicating asset division during separation. Prenuptial agreements provide clear terms on asset ownership and distribution, minimizing disputes and protecting individual investments. Real-life scenarios show prenuptial agreements offer predictability, whereas merged assets require negotiation and legal intervention to resolve conflicts effectively.

Expert Tips for Crafting a Financial Partnership Agreement

Crafting a financial partnership agreement requires clarity between merged assets and prenuptial agreements to protect individual contributions while defining joint liabilities. Experts recommend detailed asset listing, explicit terms for asset management, and contingency plans for asset division to prevent disputes. Legal consultation ensures the agreement aligns with jurisdictional requirements and addresses potential financial scenarios effectively.

Merged assets vs Prenuptial agreements Infographic

relationdif.com

relationdif.com