Managing shared finances in a partnership involves pooling resources and expenses to achieve common financial goals, fostering transparency and mutual accountability. In contrast, keeping separate finances allows each partner to maintain individual control over their income and spending, reducing potential conflicts while preserving financial independence. Couples often find a balanced approach by combining joint accounts for shared expenses with personal accounts for individual expenditures.

Table of Comparison

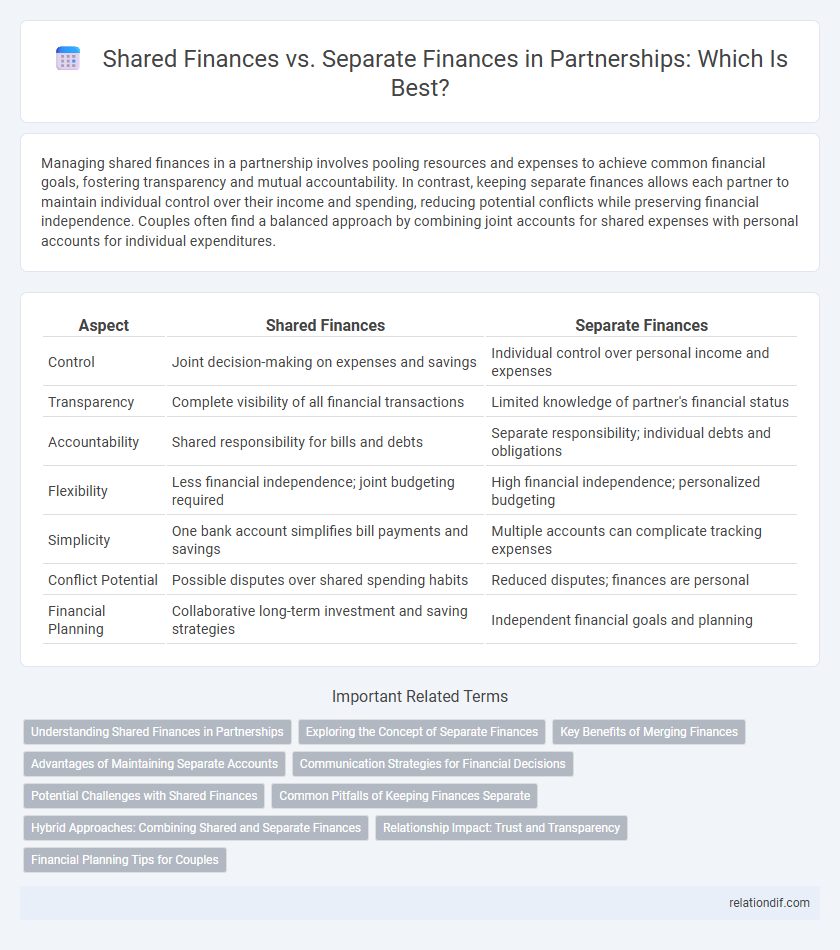

| Aspect | Shared Finances | Separate Finances |

|---|---|---|

| Control | Joint decision-making on expenses and savings | Individual control over personal income and expenses |

| Transparency | Complete visibility of all financial transactions | Limited knowledge of partner's financial status |

| Accountability | Shared responsibility for bills and debts | Separate responsibility; individual debts and obligations |

| Flexibility | Less financial independence; joint budgeting required | High financial independence; personalized budgeting |

| Simplicity | One bank account simplifies bill payments and savings | Multiple accounts can complicate tracking expenses |

| Conflict Potential | Possible disputes over shared spending habits | Reduced disputes; finances are personal |

| Financial Planning | Collaborative long-term investment and saving strategies | Independent financial goals and planning |

Understanding Shared Finances in Partnerships

Shared finances in partnerships involve jointly managing income, expenses, and financial goals to ensure transparency and mutual accountability. Establishing clear agreements on budget contributions, debt responsibilities, and savings strategies helps prevent conflicts and supports long-term financial stability. Utilizing shared accounts or financial planning tools enhances communication and aligns partners' monetary priorities effectively.

Exploring the Concept of Separate Finances

Exploring the concept of separate finances in a partnership emphasizes maintaining individual control over personal income, assets, and expenses while collaborating on common goals. Each partner manages their own financial obligations and budget, reducing conflicts related to money and fostering personal responsibility. This approach can enhance transparency and allows flexibility in decision-making without compromising the partnership's overall financial health.

Key Benefits of Merging Finances

Merging finances in a partnership fosters transparency and simplifies budgeting by consolidating income, expenses, and savings into a unified account, enhancing financial planning accuracy. Couples reporting joint accounts experience improved trust and reduced conflicts related to money management, promoting long-term financial stability. Shared finances enable streamlined bill payments and investment strategies, maximizing resource utilization and accelerating wealth growth.

Advantages of Maintaining Separate Accounts

Maintaining separate finances in a partnership offers clear advantages, including enhanced financial independence and simplified tracking of individual expenses and incomes. This approach reduces potential conflicts by allowing partners to retain control over personal spending while jointly managing shared expenses through a designated account. Separate accounts also facilitate transparent financial records, making tax preparation and legal matters more straightforward.

Communication Strategies for Financial Decisions

Effective communication strategies for financial decisions in partnerships emphasize transparency and regular discussions about both shared and separate finances. Establishing clear boundaries and expectations through open dialogue helps prevent misunderstandings and aligns financial goals. Utilizing tools such as budget meetings, joint financial planning apps, and scheduled check-ins fosters collaboration and trust in managing money together.

Potential Challenges with Shared Finances

Shared finances in a partnership often lead to potential challenges such as disagreements over spending habits, difficulty tracking expenses, and conflicts arising from unequal contributions to joint accounts. The lack of clear boundaries can result in misunderstandings regarding financial priorities and obligations, creating tension between partners. Transparent communication and establishing a detailed budget are essential to mitigate risks associated with shared financial management.

Common Pitfalls of Keeping Finances Separate

Keeping finances separate can lead to misunderstandings about spending habits and undisclosed debt, undermining trust in the partnership. Couples often face challenges coordinating bills, savings goals, and emergency funds, which may result in financial instability. Failure to communicate openly about separate accounts increases the risk of resentment and complicates long-term financial planning.

Hybrid Approaches: Combining Shared and Separate Finances

Hybrid approaches to partnership finances blend shared and separate accounts to optimize flexibility and transparency. Couples may maintain joint accounts for communal expenses while keeping personal accounts for individual spending, promoting both unity and autonomy. This method enhances financial trust and simplifies budgeting by clearly delineating collective versus personal financial responsibilities.

Relationship Impact: Trust and Transparency

Maintaining shared finances in a partnership fosters trust and transparency by encouraging open communication about income, expenses, and financial goals. Transparent handling of money reduces misunderstandings and strengthens the emotional bond, as both partners feel equally involved and accountable. In contrast, separate finances may lead to secrecy, eroding trust and potentially creating financial conflicts that impact the relationship's stability.

Financial Planning Tips for Couples

Couples should establish clear communication about shared and separate finances to align their financial goals and avoid misunderstandings. Creating a joint budget that accounts for both individual expenses and shared costs enhances transparency and accountability. Regularly reviewing financial plans together helps adapt strategies for savings, investments, and debt management, promoting long-term financial stability.

shared finances vs separate finances Infographic

relationdif.com

relationdif.com