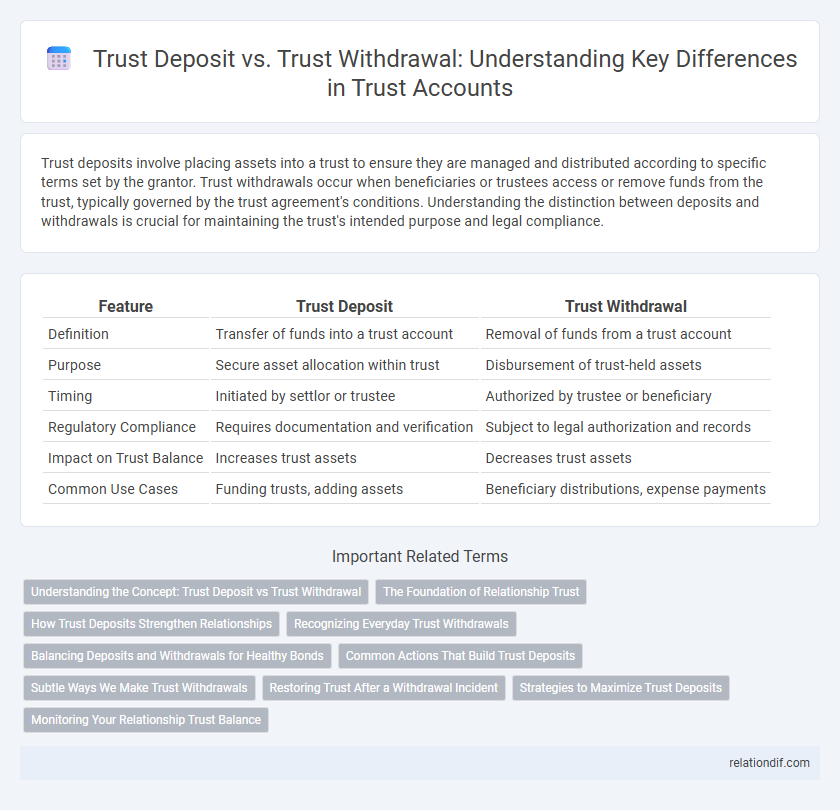

Trust deposits involve placing assets into a trust to ensure they are managed and distributed according to specific terms set by the grantor. Trust withdrawals occur when beneficiaries or trustees access or remove funds from the trust, typically governed by the trust agreement's conditions. Understanding the distinction between deposits and withdrawals is crucial for maintaining the trust's intended purpose and legal compliance.

Table of Comparison

| Feature | Trust Deposit | Trust Withdrawal |

|---|---|---|

| Definition | Transfer of funds into a trust account | Removal of funds from a trust account |

| Purpose | Secure asset allocation within trust | Disbursement of trust-held assets |

| Timing | Initiated by settlor or trustee | Authorized by trustee or beneficiary |

| Regulatory Compliance | Requires documentation and verification | Subject to legal authorization and records |

| Impact on Trust Balance | Increases trust assets | Decreases trust assets |

| Common Use Cases | Funding trusts, adding assets | Beneficiary distributions, expense payments |

Understanding the Concept: Trust Deposit vs Trust Withdrawal

Trust deposit refers to the initial or additional funds placed into a trust account, establishing or increasing the assets held under the trust's terms. Trust withdrawal involves the authorized removal of funds or assets from the trust, typically managed by the trustee according to the grantor's instructions and legal guidelines. Understanding the distinction between trust deposit and trust withdrawal is crucial for effective trust administration and ensuring compliance with fiduciary responsibilities.

The Foundation of Relationship Trust

Trust deposits strengthen the foundation of relationship trust by consistently demonstrating reliability, transparency, and integrity in interactions. Each trustworthy action serves as a deposit that enhances confidence and deepens emotional bonds between parties. Trust withdrawals occur when actions undermine these principles, risking harm to the established trust and weakening relational stability.

How Trust Deposits Strengthen Relationships

Trust deposits create a foundation of reliability and confidence that fosters long-term commitment between parties. By consistently fulfilling promises and demonstrating integrity, trust deposits enhance emotional bonds and encourage collaborative efforts. These positive interactions lead to stronger relationships, increased loyalty, and mutual support over time.

Recognizing Everyday Trust Withdrawals

Trust withdrawals occur when actions or words undermine confidence, such as breaking commitments, failing to communicate honestly, or neglecting responsibilities. Recognizing everyday trust withdrawals involves being aware of subtle behaviors like consistently missing deadlines, withholding important information, or showing lack of empathy. Identifying these patterns early helps maintain healthy relationships by addressing issues before trust significantly diminishes.

Balancing Deposits and Withdrawals for Healthy Bonds

Maintaining a healthy trust balance requires careful monitoring of trust deposits and trust withdrawals to ensure financial stability and ongoing relationship confidence. Overly frequent trust withdrawals can undermine fund availability, while consistent deposits reinforce the reliability and integrity of the trust. Strategic alignment of deposit inflows and withdrawal outflows promotes transparency, accountability, and long-term bond strength.

Common Actions That Build Trust Deposits

Consistently delivering on promises, demonstrating reliability, and actively listening to others are common actions that build trust deposits in any relationship. Showing empathy, maintaining transparency, and respecting confidentiality also enhance trust by reinforcing a sense of security and mutual respect. These positive interactions accumulate over time, creating a strong foundation for deeper trust and collaboration.

Subtle Ways We Make Trust Withdrawals

Trust withdrawals often occur through subtle actions such as withholding important information, failing to meet commitments, or showing inconsistency in communication, which gradually erode confidence. These small breaches can accumulate, making the recipient question reliability and intentions without overt confrontation. Understanding these nuanced behaviors helps in identifying and addressing trust issues before they escalate.

Restoring Trust After a Withdrawal Incident

Restoring trust after a trust withdrawal requires consistent transparency and timely communication to rebuild confidence. Demonstrating accountability through corrective actions and fulfilling commitments strengthens the foundation of trust deposits. Maintaining ongoing reliability and empathy ensures the relationship recovers and trust is replenished effectively.

Strategies to Maximize Trust Deposits

Maximizing trust deposits involves implementing consistent funding schedules, leveraging automatic contributions, and offering incentives for larger or more frequent deposits. Utilizing diversified asset allocation strategies and regularly reviewing trust performance can encourage trustees to increase deposits by demonstrating growth potential. Clear communication about the trust's goals and benefits helps build confidence, fostering greater commitment to sustained contributions.

Monitoring Your Relationship Trust Balance

Monitoring your relationship trust balance involves regularly evaluating deposit actions like honesty, reliability, and consistent communication that build trust over time. Trust withdrawals occur through behaviors such as broken promises, neglect, or dishonesty, which deplete the trust reserve between parties. Maintaining a healthy trust balance requires awareness of both positive contributions and negative impacts to ensure long-term relational stability.

Trust Deposit vs Trust Withdrawal Infographic

relationdif.com

relationdif.com