Establishing financial boundaries is essential for maintaining healthy spending habits and preventing impulsive purchases that can lead to debt. Clear limits on discretionary spending help pet owners allocate resources effectively, ensuring that essential expenses like food, veterinary care, and emergency funds are prioritized. Consistently respecting these financial boundaries supports long-term financial stability and responsible pet care.

Table of Comparison

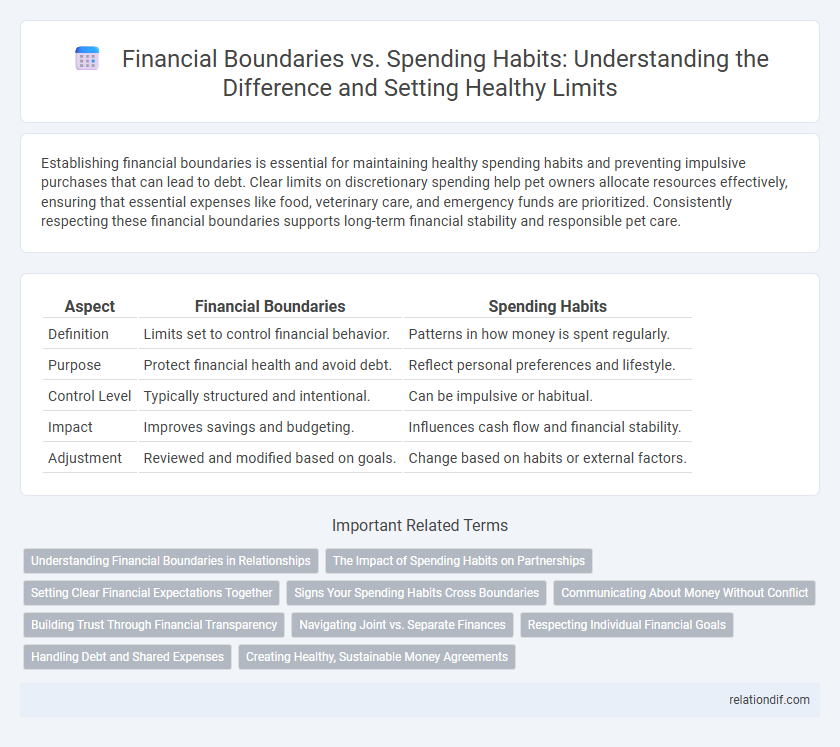

| Aspect | Financial Boundaries | Spending Habits |

|---|---|---|

| Definition | Limits set to control financial behavior. | Patterns in how money is spent regularly. |

| Purpose | Protect financial health and avoid debt. | Reflect personal preferences and lifestyle. |

| Control Level | Typically structured and intentional. | Can be impulsive or habitual. |

| Impact | Improves savings and budgeting. | Influences cash flow and financial stability. |

| Adjustment | Reviewed and modified based on goals. | Change based on habits or external factors. |

Understanding Financial Boundaries in Relationships

Understanding financial boundaries in relationships involves recognizing each partner's spending habits and aligning them with shared financial goals. Establishing clear limits on expenditures helps prevent conflicts over money and promotes mutual respect for individual financial priorities. Open communication about budgeting, saving, and discretionary spending ensures a balanced approach to managing joint and personal finances.

The Impact of Spending Habits on Partnerships

Spending habits directly influence financial boundaries within partnerships, often shaping trust and communication dynamics. Excessive or impulsive spending can lead to conflicts and financial instability, undermining mutual goals. Establishing clear financial boundaries fosters transparency and strengthens the partnership's long-term financial health.

Setting Clear Financial Expectations Together

Establishing clear financial boundaries involves openly discussing spending habits and agreeing on shared financial goals to prevent misunderstandings. Couples who set transparent financial expectations together are more likely to maintain trust and avoid conflicts related to money. Consistent communication about budgets and expenses reinforces these boundaries, promoting healthier financial management and relationship stability.

Signs Your Spending Habits Cross Boundaries

Overspending beyond your financial boundaries often results in maxed-out credit cards and mounting debt, signaling a clear sign your spending habits are problematic. Ignoring budgets and impulse purchases on non-essential items frequently indicate a lack of control over financial limits. Consistently prioritizing immediate gratification over savings growth can erode long-term financial stability and reveal crossed boundaries.

Communicating About Money Without Conflict

Establishing clear financial boundaries is essential to aligning spending habits and preventing misunderstandings in relationships. Open and honest communication about budgets, priorities, and expectations reduces the risk of conflict and fosters mutual respect. Consistently revisiting money conversations supports transparency and shared financial goals.

Building Trust Through Financial Transparency

Establishing clear financial boundaries fosters trust by promoting transparency around spending habits and budget limits. Open communication about expenses and financial goals helps partners align their money management strategies, reducing misunderstandings. Consistent honesty in sharing financial information strengthens confidence and supports long-term financial stability in relationships.

Navigating Joint vs. Separate Finances

Navigating joint versus separate finances requires clear financial boundaries to balance individual spending habits with shared monetary goals. Couples who establish defined roles for managing joint accounts and personal expenses often experience reduced conflicts and greater financial transparency. Effective boundary-setting promotes accountability while respecting each partner's unique approach to budgeting and saving.

Respecting Individual Financial Goals

Respecting individual financial goals is essential when establishing financial boundaries, as it allows for personalized spending habits that align with one's priorities and values. Clear communication about income, expenses, and saving objectives helps prevent misunderstandings and supports mutual respect for each person's financial limits. Maintaining these boundaries fosters financial well-being and reduces stress in personal and shared financial decisions.

Handling Debt and Shared Expenses

Establishing clear financial boundaries is crucial for managing debt and shared expenses effectively, preventing overspending and minimizing conflicts. Communicating spending limits and responsibilities with partners helps ensure transparency and accountability, fostering a balanced approach to debt repayment. Consistent monitoring of expenses against agreed-upon boundaries supports long-term financial stability and reduces the risk of accumulating additional debt.

Creating Healthy, Sustainable Money Agreements

Setting clear financial boundaries helps establish healthy, sustainable money agreements by differentiating between needs and discretionary spending. Consistent budgeting aligned with personal values encourages mindful spending habits and prevents impulsive purchases. Transparent communication about financial limits fosters trust and cooperation, ensuring shared financial goals are respected and maintained.

Financial boundaries vs spending habits Infographic

relationdif.com

relationdif.com