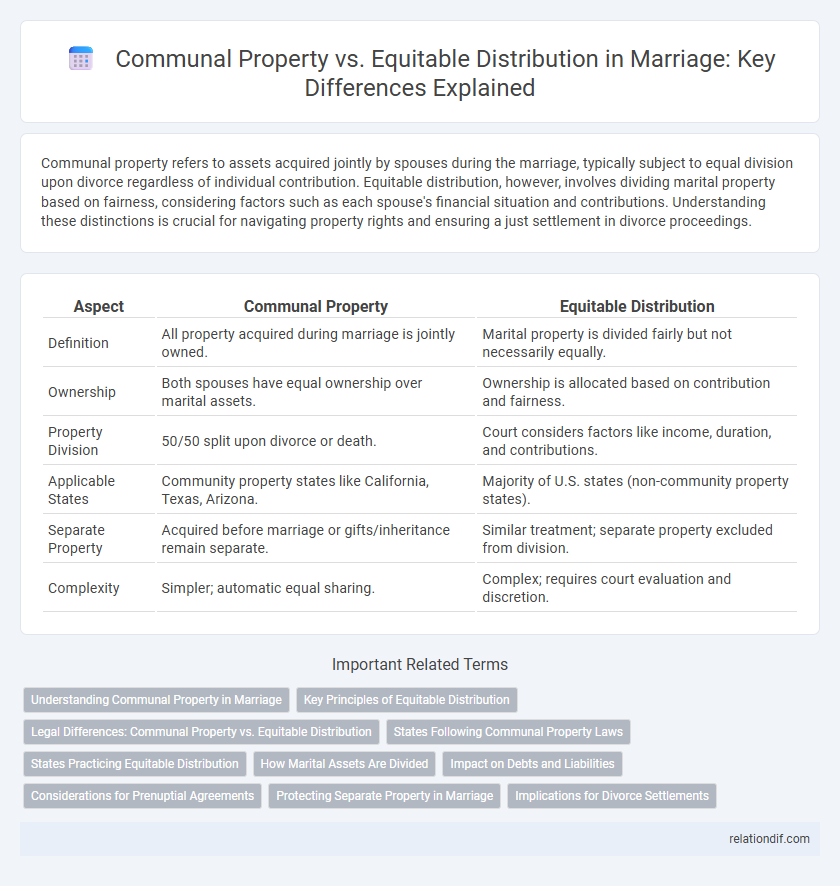

Communal property refers to assets acquired jointly by spouses during the marriage, typically subject to equal division upon divorce regardless of individual contribution. Equitable distribution, however, involves dividing marital property based on fairness, considering factors such as each spouse's financial situation and contributions. Understanding these distinctions is crucial for navigating property rights and ensuring a just settlement in divorce proceedings.

Table of Comparison

| Aspect | Communal Property | Equitable Distribution |

|---|---|---|

| Definition | All property acquired during marriage is jointly owned. | Marital property is divided fairly but not necessarily equally. |

| Ownership | Both spouses have equal ownership over marital assets. | Ownership is allocated based on contribution and fairness. |

| Property Division | 50/50 split upon divorce or death. | Court considers factors like income, duration, and contributions. |

| Applicable States | Community property states like California, Texas, Arizona. | Majority of U.S. states (non-community property states). |

| Separate Property | Acquired before marriage or gifts/inheritance remain separate. | Similar treatment; separate property excluded from division. |

| Complexity | Simpler; automatic equal sharing. | Complex; requires court evaluation and discretion. |

Understanding Communal Property in Marriage

Communal property in marriage refers to assets and debts acquired during the marriage that are jointly owned by both spouses, typically governed by community property laws in certain states. This contrasts with equitable distribution systems, where marital property is divided fairly but not necessarily equally upon divorce. Understanding communal property helps couples manage joint financial responsibilities and clarifies ownership rights in the event of separation or death.

Key Principles of Equitable Distribution

Equitable distribution in marriage refers to the fair allocation of marital assets and debts upon divorce, emphasizing fairness rather than equal division. Key principles include considering each spouse's financial contributions, the duration of the marriage, and future economic circumstances. Courts evaluate factors such as income, age, health, and earning potential to ensure a just distribution tailored to both parties' needs.

Legal Differences: Communal Property vs. Equitable Distribution

Communal property refers to a legal framework where assets acquired during marriage are owned jointly by both spouses, typically seen in community property states like California and Texas, ensuring equal 50/50 division upon divorce. Equitable distribution, used in majority of states including New York and Florida, involves dividing marital property based on fairness rather than equality, considering factors such as the length of marriage, income disparity, and contributions to the marriage. The core legal difference lies in communal property's automatic equal split, while equitable distribution allows courts discretion to allocate assets variably for just outcomes.

States Following Communal Property Laws

States following communal property laws, such as California, Texas, and Washington, recognize property acquired during marriage as jointly owned by both spouses regardless of whose name is on the title. This legal framework simplifies asset division by presuming equal ownership, contrasting with equitable distribution states that allocate assets based on fairness rather than strict equality. Understanding these distinctions is crucial for couples navigating property rights in divorce proceedings under different state laws.

States Practicing Equitable Distribution

States practicing equitable distribution allocate marital property fairly based on factors such as each spouse's financial contribution, duration of marriage, and economic circumstances rather than splitting assets equally. This method allows courts to consider non-monetary contributions like homemaking and child-rearing, promoting a balanced outcome. Equitable distribution is prevalent in most U.S. states, contrasting with community property systems used primarily in states like California and Texas.

How Marital Assets Are Divided

Marital assets in communal property states are typically divided equally between spouses, with all property acquired during the marriage considered jointly owned, regardless of who earned it. In contrast, equitable distribution states allocate marital assets based on fairness, considering factors such as each spouse's financial contribution, the length of the marriage, and economic circumstances. Understanding whether a state follows communal property or equitable distribution laws is essential for predicting how property will be divided during a divorce.

Impact on Debts and Liabilities

Communal property laws treat debts and liabilities acquired during marriage as jointly owned, meaning both spouses are equally responsible regardless of individual contribution. In contrast, equitable distribution assesses debts based on fairness, allocating liabilities according to factors like income, debt origin, and each spouse's financial situation. Understanding the distinction is crucial for managing financial obligations during divorce proceedings and ensuring balanced debt repayment.

Considerations for Prenuptial Agreements

Prenuptial agreements play a crucial role in defining the treatment of communal property and equitable distribution in marriage, allowing couples to customize asset division beyond state default laws. Key considerations include identifying which assets qualify as communal property, specifying separate versus joint ownership, and outlining procedures for equitable distribution in case of divorce. Ensuring clarity on financial responsibilities, inheritance rights, and spousal support provisions helps prevent disputes and safeguard individual interests.

Protecting Separate Property in Marriage

Protecting separate property in marriage involves clearly distinguishing assets acquired before marriage or through inheritance from communal property, which is subject to division. Legal strategies such as prenuptial agreements, postnuptial agreements, and maintaining meticulous financial records help spouses retain ownership of separate property. Understanding state-specific laws on communal property and equitable distribution is essential to safeguard individual financial interests during divorce proceedings.

Implications for Divorce Settlements

Communal property laws require that all assets and debts acquired during the marriage be divided equally in divorce settlements, often simplifying the asset division but potentially disregarding individual contributions. Equitable distribution focuses on a fair division based on various factors such as the length of the marriage, each spouse's financial situation, and contributions, which may result in an unequal but just outcome. Understanding the distinction between these systems is crucial for accurately predicting financial responsibilities and rights during divorce proceedings.

communal property vs equitable distribution Infographic

relationdif.com

relationdif.com